Scuola di Ingegneria Industriale e dell’Informazione

Master Degree in Computer Science, and Engineering Department of Electronics, Informatics, and Bioengineering

A METHODOLOGY FOR THE CLASSIFICATION OF MOBILE ADVERTISING PLATFORMS

Supervisor: Prof. Davide Martinenghi

Mustafa Ugur EREN, matricola 850350 Beyza TOPCU, matricola 834395

This dissertation is submitted for the degree of Master of Science

ii “Doing business without advertising is like winking at a girl in the dark.

You know what you are doing, but nobody else does.”

iii

Acknowledgment

First of all, we would like to thank our supervisor Prof. Davide Martinenghi for his tremendous support and guidance throughout every step of this work, and for the vision that we gained from his course Mobile Applications. He always gave us invaluable insights while shaping this work, and it was a great honor to work with him. Also, he let us work independently. Therefore, we had a chance to research all the dimensions related to this work.

We also would like to thank all the great mentors and professors who motivated and encouraged us over our entire education career. Besides, we would like to thank our families, colleagues, and friends for their support and friendship.

iv

TABLE OF CONTENTS

Chapter 1 1

INTRODUCTION 1

1.1. Motivation 1

1.2. The aim of the thesis 7

1.3. Contribution 8

1.4. Structure of the Thesis 10

Chapter 2 12

Mobile Advertising Ecosystem 12 2.1. The journey of Mobile Ad: From Advertisers to Users 12

2.1.1 Actors of Mobile Advertising 15

2.2. Intermediaries 17

2.2.1 DSP 18

2.2.2 SSP 19

2.2.3 Ad Exchange 19

2.2.4 Ad Networks 21

2.3 Essential Characteristics and Differences of Monetization Platforms 21

Chapter 3 26

Platform Selection 26

3.1 Existing Ranking of Mobile Advertising Networks 26

3.1.1 Appsflyer Performance Index 27

v

3.1.3 TUNE Ranking 33

3.2 Metric for Selection of the Platforms 35

Chapter 4 40

Approaches to Integration of Platforms 40

4.1 Mediation 42

4.2.1. Characteristics of Mediation 44

4.2. Standalone Approach 45 4.3. Applications for Comparing Ad Networks 47

4.3.1. Fortune Witch 47

4.3.2. The Freak Cup 49

Chapter 5 52

Mediation 52

5.1 Mediation with AdMob 52

5.1.1 Testing platforms with AdMob Mediation 53

Chapter 6 62 Standalone Integration 62 6.1. Facebook 62 6.2. AdMob 63 6.3. AppLovin 64 6.4. AdColony 65 6.5. Vungle 65 6.6. Unity Ads 66 6.7. Chartboost 67

6.8. AdAction Interactive and Taptica 67

Chapter 7 70

Comparison of Platforms 70

vi 7.2. Network Usage 78 7.3. Power Consumption 81 7.4. Documentation 83 7.5. Dashboard 84 7.6. Financial Benefits 90 7.7. Platform-Based Summary 94 Chapter 8 101 Conclusion 101 8.1. Obtained Results 101 8.2. Discussion 102 8.3. Future Work 107 Glossary 110 Bibliography 114

vii

LIST OF FIGURES

Figure 1. The most installed SDK categories [1]. ... 2

Figure 2. Most installed SDKs in mobile games [1]. ... 3

Figure 3. Figures showing the app downloads in 2016, 2017 and 2021 [6]. ... 4

Figure 4. Global mobile app revenues in 2015, 2016 and 2020 [8]. ... 5

Figure 5. Things that users of mobile apps complain about [10]... 6

Figure 6. Global ad spending to ad mediums between 2015 and 2018 [14]... 13

Figure 7. The ecosystem of Mobile Ad Platforms ... 14

Figure 8. Interactions between the actors of mobile advertising ecosystem ... 16

Figure 9. The relationship between of DSP, SSP and Ad Exchange in detail [19] ... 19

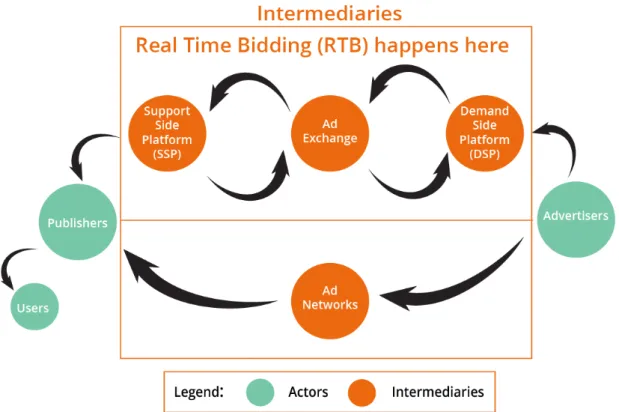

Figure 10. The Process of Real-Time Bidding [23] ... 20

Figure 11. DSP, Ad Exchange and SSP Ecosystem [26]. ... 22

Figure 12. Usage of Mobile Advertising in Top Grossing 150 Apps in Europe ... 41

Figure 13. Used Integration Methods by Top Free and Top Grossing 150 Apps in Europe ... 41

Figure 14. An overview about how mediation works [36] ... 44

Figure 15. Intro Screens of Fortune Witch's Intro Activity... 48

Figure 16. Main, Answer and Result Screens of Fortune Witch ... 49

Figure 17. Scenes from the game: "The Freak Cup." ... 50

Figure 18. The app view of AdMob displaying the ad units in the app ... 56

Figure 19. Mediated ad networks ... 56

Figure 20. Ad network optimization option in AdMob ... 57

Figure 21. Ad Mediation Report for All of the Ad Units ... 58

Figure 22. Analytics of AppLovin ... 59

viii Figure 24. Mostly Used Mobile Ad Platforms by the Top Grossing 150 Free Apps in Europe ... 94 Figure 25. Mostly Used Mobile Ad Platforms by the Top 150 Free Apps in Europe ... 94

ix

LİST OF TABLES

Table 1. Differences between Ad Exchanges and Ad Networks [27] ... 23

Table 2. Some Agents of DSP, Ad Exchange, Ad Network, SSP ... 24

Table 3. Volume Rating of Gaming and Non-Gaming Categories [26]. ... 28

Table 4. Power Rating for Gaming and Non-Gaming Categories ... 30

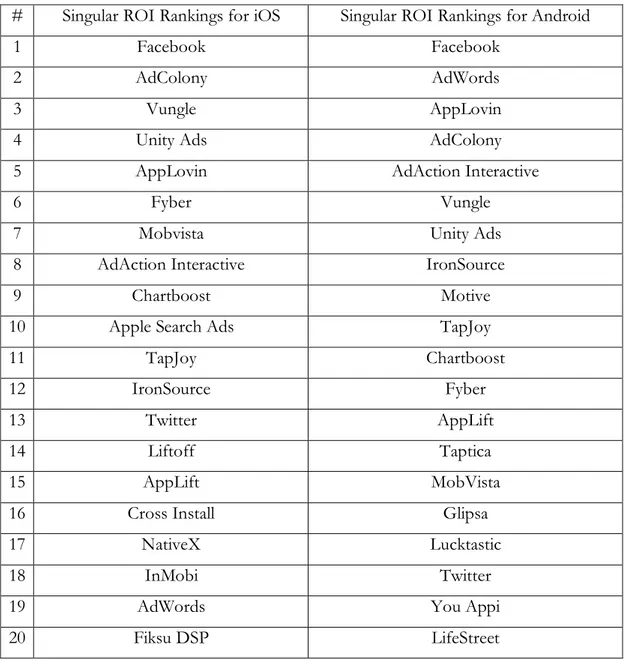

Table 5. ROI Indexes for Android and iOS ... 31

Table 6. Singular ROI Index for iOS and Android... 32

Table 7. Tune Top 25 Mobile Mobile Advertising Platforms Ranking ... 34

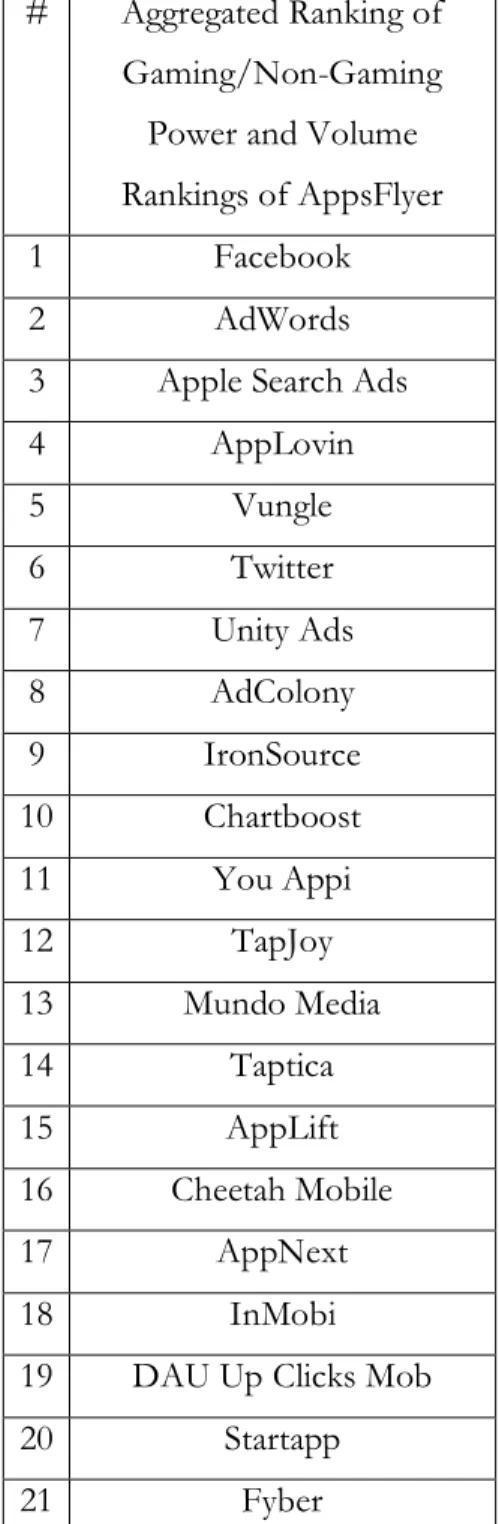

Table 8. Aggregation of AppsFlyer's Gaming/Non-Gaming Power and Volume Rankings ... 36

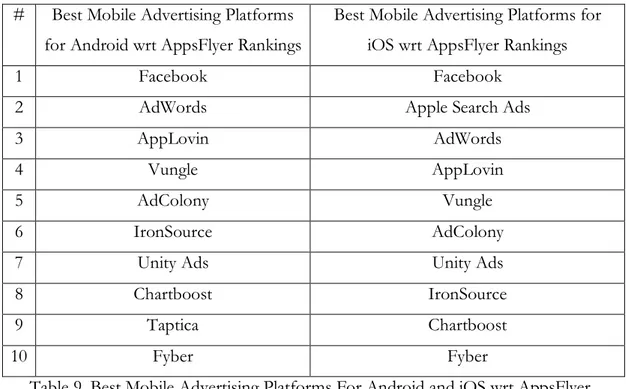

Table 9. Best Mobile Advertising Platforms For Android and iOS wrt AppsFlyer Rankings ... 37

Table 10. Aggregation of AppsFlyer Singular ROI Index and Tune Rankings for iOS and Android... 38

Table 11. Selected Mobile Advertising Platforms ... 38

Table 12. Supported Mobile Ad Platforms for Mediation By Selected Mobile Ad Platforms ... 43

Table 13. Ad networks supported by AdMob for mediation according to the ad units . 54 Table 14. Tested SDKs of mobile ad platforms in the scope of this work ... 70

Table 15. Permissions required to integrate platforms into application ... 75

Table 16. Targeting capabilities of mobile ad platform ... 75

Table 17. General Information about the Data Collected by Mobile Ad Platforms for Targeting and Tracking of Advertisement ... 76

Table 18. Collected Data about Mobile Device Displaying Ad ... 77

x Table 20. Network usage of the platform via WIFI/Cellular Networks Measured by Ad

Units ... 80

Table 21. Battery usage of the platform via WIFI/Cellular Networks Measured by Ad Units ... 82

Table 22. Types of Documentation ... 84

Table 23. Features of Setting Configurable via Dashboards of Platforms ... 85

Table 24. Explanations of Metrics ... 87

Table 25. Common Metrics Used In Visualization of the Revenue in Dashboard's of Platforms ... 88

Table 26. Dashboard Features ... 88

Table 27. Filters for Exporting Report ... 90

Table 28. Payment Features of Selected Mobile Ad Platforms ... 91

Table 29. Values of the day when the max eCPM value is observed for each platform during the test phase ... 92

Table 30. Overall values obtained as result of the whole of the testing period per platform ... 93

xi

Abstract

There are millions of mobile apps ready to download in mobile app stores. Just in Android, there are more than 3 500 000 apps, and almost 90% of them are free. These mobile apps have costs for their developers, due to both development and maintenance. At this point, mobile advertising comes into play. Almost 65% of the live apps on the market use mobile advertising, which makes mobile advertising the first source of profit for developers. When we look at mobile advertising, there is a complex and dynamic ecosystem involving several different actors that regulates the shipment of ads from advertisers to users. Since advertisers do not have any direct connection with users, intermediaries are then needed to provide a link between advertisers and publishers (e.g., developers or owners of ad space in mobile apps). Therefore, reaching users means accessing publishers via their mobile apps. While mobile advertising has positive effects on developers by providing revenue to them, it also has hidden costs corresponding to the main complaints expressed by mobile app users. Users mostly complain about network usage, battery consumption, and privacy issues. In this respect, as a major contribution of this work, we study the impact of mobile advertising on these hidden costs of mobile apps.

This thesis aims to provide a methodology to compare and to analyze mobile advertising platforms in order classify them in terms of both technical and financial aspects. In this work, we define the mobile ecosystem in detail, and illustrate the main actors and intermediaries, along with their roles. Afterward, based on rankings of mobile ad platforms available in the current literature, we aggregate such rankings in order to obtain a selection of the potentially best platforms, which we then use and analyze throughout this work. Afterward, we explain two techniques for integration of mobile ad platforms into mobile apps: mediation and standalone integration. We test the mediation approach in detail, mostly from a financial point of view. As for the platforms that we use with the standalone approach, we carefully check their claims about both technical and financial characteristics of their services. Subsequently, we compare each platform by taking into account all of the following aspects: privacy, network usage, power consumption, documentation, dashboards and financial benefits. Lastly, we provide platform-based comparison and we exemplify some of the main scenarios occurring in mobile apps in practice, and, for each such scenario, we give our recommendation on the platform to use based on our analysis.

xii

Sommario

Sono milioni le app che oggi possiamo scaricare tramite i nostri smartphone negli store, solo per Android sono disponibili più di 3.5m di applicazioni, di cui il 90% sono gratuite. Dietro ogni applicazioni mobile ci sono pero dei costi che gli sviluppatori devono sostenere, relativi allo sviluppo e alla sua gestione tecnica. Entra per questo in gioco il mobile advertising. Quasi il 65% delle app disponibili sul mercato utilizza il mobile advertising, rendendo quest'ultimo la prima fonte di profitto per gli sviluppatori.

Quando ci affacciamo al mondo del mobile advertising, scopriamo un complesso e dinamico ecosistema, in cui vengono coinvolti differenti attori, i quali regolano l'invio di Ads da parte degli inserzionisti agli utenti. Poiché gli inserzionisti non hanno una connessione diretta con gli utenti, sono gli intermediari a rendersi necessari nel creare un collegamento tra inserzionisti e publishers (es. sviluppatori o proprietari di spazi pubblicitari all'interno delle app). Pertanto, raggiungere gli utenti significa accedere all'interno delle app tramite i publishers che sviluppano o gestiscono le app.

Se il mobile advertising ha effetti positivi per gli sviluppatori, fornendo loro dei guadagni, allo stesso tempo vi sono dei costi nascosti, relativi ai reclami degli utenti. La maggior parte degli utenti lamenta infatti un consumo eccessivo di dati durante la connessione e di batteria, oltre a problematiche relative alla propria privacy. Partendo da queste considerazioni, come contributo principale di questo lavoro, abbiamo studiato l'impatto del mobile advertising sui costi nascosti delle applicazioni mobile.

Questa tesi mira a fornire una metodologia tramite cui comparare ed analizzare diverse piattaforme di mobile advertising, in modo da classificarle sotto l'aspetto tecnico e finanziario. Nel nostro lavoro abbiamo definito l'ecosistema mobile nel dettaglio, illustrando i suoi principali attori ed intermediari, insieme ai loro ruoli. Successivamente, sulla base dei rankings di mobile advertising disponibili nella letteratura corrente, abbiamo aggregato tali classifiche al fine di ottenere una selezione delle migliori piattaforme, le quali sono state prese in considerazione per essere analizzate nel nostro lavoro.

In seguito abbiamo spiegato due teniche per l'integrazione di piattaforme di mobile Ad in applicazioni mobile: mediation e standalone integration. Abbiamo quindi testato la tecnica di mediation nel dettaglio, soffermandoci principalmente dal punto di vista finanziario.

xiii

Per quanto riguarda le piattaforme che usano un approccio standalone abbiamo attentamente controllato quelle che reclamano come le principali caratteristiche tecniche e finanziarie dei loro servizi. Successivamente abbiamo comparato ogni piattaforma prendendo in considerazione i seguenti aspetti: privacy, utilizzo della rete, consumo energetico, documentazione, dashboards e vantaggi finanziari.

Infine, abbiamo confrontato le diverse piattaforme esemplificando alcuni dei principali scenari che si verificano nell'utilizzo di applicazioni mobile, fornendo per ognuno di questi scenari le nostre indicazioni sulla piattaforma da utilizzare sulla base della nostra analisi.

1

Chapter 1

INTRODUCTION

In this chapter, we first discuss the reasons pushing us to do this work and to provide an overall idea of the economic magnitude of the mobile application industry. Afterward, we discuss the aims we would like to reach and the contributions of this work. Finally, we provide an outline of this thesis and give a roadmap of the next chapters.

1.1. Motivation

It is an undeniable fact that mobile devices play an essential role for each individual. Mobile applications form the core of these devices making them indispensable, thus enabling individuals to perform their tasks in a more comfortable and fun way than computers or other devices. These tasks include either straightforward or complicated tasks like playing games, reading books, sending emails, controlling domestic appliances or the assembly lines in a factory compatible with Industry 4.0. Thus, mobile devices revolutionized the way people interact with technology.

There are a vast variety and number of applications about almost everything in app stores. Every day more than 1.000 new apps are being published into Google Play Store [1]. At the end of 2017, there were 3.500.000 applications in Google Play. In 2016, this number was 2.600.000 which makes almost one million new applications published in Google Play Store over the last year [2].

2 Another interesting point is that more than 90% of the available applications are free [3]. Since applications also have various costs to their developers (such as development, maintenance, employment), this question comes to mind “How do developers of these apps finance themselves?”. At this point, developers use several ways (such as such as in-app purchases, paid in-apps or mobile advertising) to earn revenues [4].

Figure 1. The most installed SDK categories [1].

Mobile advertising is the first source that developers resort to financing themselves, as we can see from Figure 1. Secondly, SDKs of mobile marketing and analytics companies track mobile advertising SDKs to help developers manage their user profiles and campaigns in a better way. Eight mostly installed SDKs in mobile games out of ten are again mobile advertising platforms SDKs, and the remaining two are analysis tools that we can see in Figure 2. In the scope of this work, we analyze seven of these eight most installed mobile advertising SDKs.

3 Figure 2. Most installed SDKs in mobile games [1].

In the scope of this work, we selected the Android platform to analyze mobile advertising platforms, since Google Play Store surpasses other app stores in the market regarding some applications, developers and users [4].

Today, people interact with their mobile phones more than any other electronic device that they have. In the USA, people spend 2.3 hours on average in digital contents [5]. This information is crucial since they leave their data, each time they interact with these digital contents. Each mobile phone can collect data via its sensors such as location, speed.

Moreover, users could also share more personalized information about them (such as their gender, age) via applications. All this information is precious for displaying a well-targeted advertisement or for selecting a target group.

4 In the last two decades, the development of mobile technologies has increased significantly. These devices have become so popular and have gained an unalterable place in people’s lives. Therefore, the meaning of advertisement has changed and shifted into the digital area. Today, internet and mobile application ads are competing for head-on.

Figure 3. Figures showing the app downloads in 2016, 2017 and 2021 [6].

Today, the market for mobile applications is estimated to reach $150 billion in total in 2017 [7]. However, according to Gardner’s research, global revenue from mobile applications is estimated at $77 billion in 2017 over 268 billion application downloads [6]. Statista claims 149.3 billion apps are downloaded in 2016, and they foresee 197 billion downloads in 2017, 71 billion less than Gardner’s prediction. Statista also anticipates a rise in 2021 as 352 billion downloads worldwide [8].

5 Figure 4. Global mobile app revenues in 2015, 2016 and 2020 [8].

The revenue coming from mobile advertising has increased significantly in parallel to the developments in mobile technologies. Thus, too many mobile ad platforms are established to get a share of this revenue. Today, developers gain their income via more than thousands of mobile advertising platforms enabling mobile apps displaying ads to users. Each of them has different properties for payment, support, advertisement types, and targeting.

Developers need to integrate SDKs (Software Development Kits) of the mobile ad platforms to gain profit from mobile advertising. However, in this regard, integration of SDKs is not enough. Mobile applications in which these SDKs are integrated should be successful in app stores. It is possible to measure an application’s success using its interaction with users such as ratings, number of downloads and number of users using the application regularly. There are some criteria to consider a mobile app as successful in app stores. Firstly, this app should have a regular number of users using it on a daily basis and

6 secondly and more importantly, each day; this app should be downloaded by the new users.

In this regard, some downloads and user ratings are somehow correlated [9]. Negative user ratings have some effects on developers and lead developers to have adverse effects. The most critical reasons causing negative ratings are related with privacy and ethics, hidden costs, feature removal, app crashing, compatibility, network problems, massive resources, uninteresting content, Interface Design, Unresponsiveness, Feature request [10].

Figure 5. Things that users of mobile apps complain about [10]

Mobile phones store some sensitive information about their users, and they have limited sources such as memory, battery, internet. While developing an application, developers must consider these limited sources. However, in the case of mobile advertising, developers must use SDKs of the respective platforms, which are a third-party product. Therefore, they cannot have any control over it.

During the implementation phase, developers could have a control over the test ads to understand how the integration of mobile ad platform works whether it has a problem.

7 If this platform’s SDK caused complaints from users of the app, application’s success and the revenue, its developer could gain, would decrease. Thus, in this work, we will provide insights by comparing technical properties that might cause user dissatisfaction because of using third-party SDKs of mobile ad platforms to display mobile ads.

1.2. The aim of the thesis

We propose a methodology aiming to provide a way to survey, to compare and to test mobile ad platforms comprehensively. Besides, we also discuss the effectiveness of each platform. Mobile ad platforms also affect the performance of the applications and mobile devices that contain mobile ad platforms.

Therefore, our approach also compares the mobile ad platforms from a technical standpoint, including their SDKs, maintenance, network usage and power consumption. Privacy is another issue covered by our methodology and regards permissions that mobile ad platforms required, sensitive user information that mobile ad platforms obtain such as mobile apps.

Mediation is the crucial second concept analyzed in the scope of this work. It is possible to use more than one mobile ad platform under one mediation platform rather than integrating each platform separately. We also analyzed one mediation platform regarding financial aspects: “AdMob.”

Another critical aspect of the scope of this work is the cost of mobile advertising to developers. These costs we have investigated and compared by analyzing each of the selected mobile advertising platforms concerning privacy, maintenance, power consumption, network usage since they have an impact on applications’ ratings and their performance. SDKs of mobile ad platforms may also cause privacy issues causing user complaints.

8

1.3. Contribution

In the transitive world of mobile advertising platforms, our work contributes to give precise definitions of the components of this complex ecosystem. We define the various actors and intermediaries and discuss their role and place. Afterward, we present what makes a mobile ad platform, (DSP, SSP, Ad Network or Ad Exchange) and will also introduce the leading platforms in each of these categories and differences between them.

Today, there are thousands of mobile advertising platforms in the market, and it is not possible to use all of them for creating a classification method to compare them and analyzing their technical features. Therefore, we considered three crucial mobile advertising platform rankings and, according to their classification, we built our own top ten mobile advertising platform ranking for iOS and Android platforms by using MedRank algorithm, which is a well-known algorithm for aggregating different rankings. Afterward, we analyzed these top ten platforms throughout this work for building our classification method and analysis.

We developed two mobile applications to analyze these platforms called “Fortune Witch,” published in Entertainment category in Google Play Store and “Freak Cup,” published as a game in Google Play Store. In this regard, our aim was trying to get reasonable installation rate, reaching as many users as possible by creating user-friendly, easy going, funny, viral apps. We used Freak Cup to analyze mediation platforms, while we used Fortune Witch in the Standalone Approach to testing each platform separately.

Some researches are studying hidden costs and user complaints about mobile applications in the context of mobile advertising. We analyzed mobile advertising platforms about how they affect the performance of mobile apps and implicitly how it affects mobile device based on these works in literature. Also, we have created our methodology to suggest a mobile advertising platform to developers according to their needs.

For instance, which platforms could be used to get higher eCPM values and to maximize developers’ revenues in case of having a limited number of user or which platforms could

9 be useful for a developer developing an app that requires using less battery and less amount of internet from the user’s device.

We also analyzed which mobile advertising networks are used by the most famous 150 applications in Europe. To do that, we detected the top 150 apps in Europe by aggregating the top 500 most downloaded app lists of 27 European countries. We chose Europe since Europe has a diverse population including people coming from everywhere from the world and holding intercultural demography that could reflect the behavior of people in a better way.

Finally, we provide exhaustive comparisons about the features that mobile ad platforms have like their dashboards, the properties of their dashboards, their documentation, the usability of their API and SDKs, payment types, support of house-ads, personalization, targeting and many more features.

In summary, our contributions are as follows:

• We provide a precise definition of the different actors and intermediaries of the mobile advertising ecosystem;

• We propose a principled selection of ten mobile advertising platforms based on available rankings;

• We develop two mobile apps, one for testing standalone approach, the other one for the mediation approach;

• We propose a methodology for guiding developers in the choice of the platform that best suits their needs;

• We survey the use of mobile ad platforms in the top mobile apps in Europe; • We extensively compare a selection of platforms regarding several technical and

10

1.4. Structure of the Thesis

This thesis contains eight chapters.

• Chapter 1 is the introduction of this work.

• Chapter 2, provides a journey through the advertisement ecosystem with actors and intermediaries, essential characteristics and differences of monetization platforms.

• Chapter 3, explains how we select the platforms that we analyze in this work. • Chapter 4 contains approaches to platform integration and how we do that. • Chapter 5 is about mediation and its analysis.

• Chapter 6 presents standalone integration.

• Chapter 7 is about the comparison of the platforms. • Chapter 8 presents our conclusions.

12

Chapter 2

Mobile Advertising Ecosystem

In this chapter, we give a brief introduction about today’s mobile advertising for mobile applications, and we describe the actors of mobile advertising in the process of reaching an ad from advertisers to users. While actors play an indispensable role in mobile ad ecosystem, some intermediaries are required to build up the connection between them. Thus, we explain what intermediaries are and how they realize this connection between advertisers and publishers. Afterward, we describe the differences and their essential characteristics.

2.1. The journey of Mobile Ad: From Advertisers to

Users

Mobile monetization platforms have been on the market for the last decade, and today their numbers reached to thousands on the market. Mobile monetization includes SMS and MMS advertisements, mobile web and in-app advertisement. With the increment on the usage of applications and advantages of targeting, the in-app advertisement is growing and supported by platforms [11]. Therefore, in this work, we mainly focus on the in-app advertisement.

13 While each of the mobile ad platforms has some standard features, they also have different functions and services. In this part, we explain how a mobile ad reaches from advertisers to users and then we will introduce actors playing important roles during this process. Advertisement represents forms of visual, audial marketing interactions to transmit a generic, openly subsidized message to sell or promote good, idea or any merchantable or non-merchantable things. In this point, funds of advertising are usually individuals doing the business with their services or producing goods. These individuals could be those such as companies, corporations, artisans [12]. Throughout this work, we refer to these individuals as advertisers.

Advertising is an essential need for companies to introduce themselves, their products or services to their potential buyer that they cannot reach in person [13]. There are many ways to do advertising using different sources such as television, desktop devices, mobile devices, newspapers, magazines, outdoor spots, radio or cinema. As can be seen in Figure 6, between 2015 and 2018, the mobile advertising is the primary and leading way of advertising over ad spend growth worldwide, and it makes television and desktop internet advertisement stay in the background [14].

Figure 6. Global ad spending to ad mediums between 2015 and 2018 [14].

In this work, we analyze advertising platforms using mobile devices as their mediums to reach future clients or buyers. In this regard, a journey of a mobile ad takes its root from

14 the need of introducing products or services to the public for bringing together people with the advertised object. During this journey, advertisers look for intermediaries to let people know by ads. In this regard, final clients that advertisers want to access become users since they interact with ads by using their mobile devices as a medium.

Figure 7. The ecosystem of Mobile Ad Platforms

As can be seen from Figure 7 above, advertisers, publishers and intermediaries are the main actors in the journey of an ad. Intermediaries are mentioned as DSP, Ad Exchange, SSP and Ad Network. The journey starts from advertisers, passes through intermediaries and reaches to the user via publisher, and during this path, the advertiser pays to intermediaries. Intermediaries take their commissions for serving the ad to their customers (who are the publishers on Figure 7) of being medium. In this point, intermediaries consider publishers as their mobile inventories, and publishers get their revenues from intermediaries since they host ads coming from intermediaries. After this point, we will discuss all of these actors, intermediaries and the process in details [15].

15 2.1.1 Actors of Mobile Advertising

There are three main actors in the journey of mobile ads from its starting point to its destination. These actors are advertisers, publishers, and users. In this point, users represent real people that could be potential buyers of products, services or clients of companies, businesses.

Publishers are typically mobile app developers who have included ad spaces to display ads and advertisers are companies or individuals paying for ad spaces to promote their products or services via ads.

• Users

Users represent the most critical group in mobile advertising ecosystem. Basically, in this context, they represent the individuals using the applications of publishers. Therefore, at this point, publishers become the first actors for advertisers that want to access these users to promote their products or services. For example, users could be the people who downloaded our app Fortune Witch that we will introduce in next chapters.

• Advertisers

Advertisers are individuals separating a budget for promoting their products or services on mobile devices. In this point, advertisers could be any individuals producing a good, providing a service or even a non-profit organization.

The common point of all these individuals is the demand of advertising since it is not possible for them to reach the final customer in person and without introducing their products, services or ideas, they cannot make any profit. Thus, in this work, we will refer to these groups as advertisers.

16 Figure 8. Interactions between the actors of mobile advertising ecosystem

To illustrate, in Figure 8, Amazon advertisement could be seen shown in our app Fortune Witch as Interstitial ad format. In this point, Amazon company becomes advertiser giving its advertisement to Applovin, mobile ad platform.

In this work, we take advertisers into account preferring mobile ads as their advertising way to reach their target clients. However, developers form the majority in the group of advertisers.

• Publishers

Publishers could be individuals like persons or companies developing mobile apps in various categories, and this regards mobile monetization serves a way of earning money for publishers from their applications, and mobile advertising is one of the ways for receiving money from their application.

To do that, they need to reserve places dedicated to displaying ads in their applications. These private places are called ad units. However, there is no direct connection between advertisers and publishers. Therefore, the publishers need to commercialize their ad units via intermediaries.

Implicitly, publishers provide environment via their mobile apps on which users could interact, and users expose to ads while interacting with apps. Therefore, publishers

17 become the first layer in the process of reaching mobile ad from advertiser to their targeted users.

To illustrate, as authors of this work, we developed two applications and we have ad units in our app Fortune Witch for the banner, interstitial and rewarded video ad formats. When we worked with Applovin, which is one of the mobile ad platforms, we become publishers to display ads coming from this platform.

Developers constitute the backbone of publishers and publishers can also become advertisers since they could also need advertising to promote their mobile application.

2.2. Intermediaries

Intermediaries are mobile advertising platforms to make advertisers reach to their desired targeted group of users. For example, Italian speaking youths between 18 – 24 years old, living in Milan could be a targeted group of users for an application called “Milano Teens” which recommends free time activities to teenager population in Milano in the Italian language. Therefore, Milano Teens app’s advertisers could demand a particular targeting for this user group in their advertisement campaign.

However, Milano Teens’ PR team still do not have any ideas about how to reach these targeted users, since their targeted users have no direct connection with them. In this regard, they can resort to intermediaries that can provide the desired connections since intermediaries have a connection with publishers which advertisers do not connect directly.

As can be seen from Figure 7, DSP, SSP, ad exchange and ad networks are intermediaries between advertisers and publishers, and they represent the second layer in the process of delivering ads to users from advertisers.

18 2.2.1 DSP

DSP (Demand-Side Platform) is a platform providing functionalities to advertisers to facilitate the management of ad campaign and the process of buying ad units online. In DSP platforms, it is also possible to do targeting for reaching desired user groups. Therefore, DSP is tailored for advertisers to find the best ad units delivering their requirements to target the user group they would like to reach [16].

Advertisers can manage their ad campaigns in a better way via DSPs. Beside of targeting, advertisers pay according to impressions that they would need. Impressions are the number of display of a single ad unit on a single application. If an application has the highest number of daily users and has an engaged cluster of users, the number of hosted impressions by this app gets higher. Thus, the number of displays of ad increases in these apps and advertisers get to reach more users. Consequently, advertisers have a chance to spend their budget logically.

DSP provides these impressions via ad exchanges which are a market for app inventory and publishers that are on the other side of ad exchange connecting by SSP, as can be seen from Figure 9 [16]. Therefore, when publishers choose an interesting ad inventory with good impression rates, DSP enables them to purchase it via auction by real-time bidding [17].

DSP provides a dashboard that is plugged into ad exchange to get the impressions of publishers. Here ad exchange plays a marketplace role between publishers and advertisers. Publishers put the ad units that they would like to fill along with their impression rates into ad exchange. Afterward, advertisers look and decide which one they want to buy. Therefore, publishers make their ad units fill.

In this regard, DSP becomes an interface in advertiser side to analyze impressions of platforms and fetch the ones that could fit the needs of the advertisers. The prices of these impressions are set via auctions in which advertisers bid. The highest bid wins the impression then the price gets set [17].

19 2.2.2 SSP

The other end of the second layer for publisher side is called SSP (Supply Side Platform). SSP could be thought as publisher side of DSP. Publishers can put their ad units into sale in an automated way. It also provides a dashboard and an interface to publishers like DSP to enable publishers to maximize their revenue according to the impression rates they sell. Therefore, publishers get connected to ad exchanges then to DSP via ad exchanges. If there are ad networks in between, SSP could be called ad mediations which we will discuss in Chapter 5 in detail [18].

Figure 9. The relationship between of DSP, SSP and Ad Exchange in detail [19]

SSP systems have a reverse flow by comparison with DSP. First of all, publishers put their ad units into SSP systems. Afterward SSP systems send the estimated impressions into ad exchanges on which DSPs come into play. From ad exchanges, DSPs buy these impressions considering the targeting information. Then the compatible impressions are purchased by advertisers [20].

2.2.3 Ad Exchange

An ad exchange is an intermediary between publishers and advertisers that are enabling them to trade available ad units to display ads. Ad exchange platforms’ first goal is to exchange inventories of ad units and mobile ads [21]. Potential customers of ad exchange platforms could be almost all of the actors we have explained so far.

Publishers use ad exchange platforms to get some ads to display in the ad units of their apps. Thus, they put their impressions into ad exchange. Afterward, advertisers decide which impression they would like to buy [21].

20 Ad exchanges use Real Time Bidding (RTB) in the trade between publishers and advertisers. Publishers connect ad exchanges via DSPs and advertisers accesses it via SSPs. In this system, ad impressions matter for advertisers and holders of ad impressions are publishers. In this regard, advertisers represent a potential client of ad impressions. Thus, they interact with DSPs to decide which publishers they will invest their money to show their ads [22].

Ad exchanges and SSPs enable publishers to access DSPs, and RTB automatizes this process and publishers can use the tools of ad exchange to announce which platforms they would like to display ads with prices that advertisers need to pay. These conditions recalled business rules, and it helps to automatize this process [22].

For example, we developed two apps to test ad monetization platforms. One of them is a board game, and another one is a fortune telling app. In this regard, we aimed to gain more users as far as we can do. At this point, we can use ad exchange to connect DSPs after embedding these platforms into our apps. In this regard, advertisers insert their needs of ad impressions and targeted users into DSP platform and how much they would like to pay for these ad impressions.

21 RTB comes into play at this point. To illustrate, let’s assume that we, as publisher, would set $4 for our banner ad unit with 13 423 ad impressions and our user target of Fortune Witch is users between 18 – 24 ages, worldwide. According to this criterion, if 65 advertisers are looking for these business rules, RTB eliminates the ones bidding less than $4 for this ad units. After that, it assigns the best bid to this ad unit.

2.2.4 Ad Networks

Ad networks are intermediaries selling their mobile inventories composed of publisher’s apps to advertisers in return for a price. In this point, ad networks sell publishers impressions to advertisers that publishers cannot sell to advertisers directly [24].

Ad networks collect publishers’ inventory then sell this limited inventory to advertisers by targeting them according to the factors such as gender, location, age. Afterward, ad networks sell their inventory after separating it into pieces via targeting. Therefore, advertisers could cheaply purchase impressions by accessing into a more significant portion of audiences.

However, neither advertisers know where their ads are shown and nor publishers have an idea from whom they are getting ads. Besides, ad networks facilitate the process of filling ad units, therefore, non-premium, unsold ad units coming from especially new apps with lower impression rates. Therefore, all of these reasons make ad networks less transparent [25].

2.3 Essential Characteristics and Differences of

Monetization Platforms

Today, borders between mobile ad platforms are so blurry since mobile ad platforms extend their services to take significant portions from mobile advertising markets and to beat their rivals. However, there are still specific characteristics belonging to intermediaries to differentiate them.

22 If we would like to qualify an intermediary as a DSP, this intermediary must:

• Be able to integrate with or be contained in advertiser campaign management products;

• Be prepared to integrate with ad exchanges or with SSPs directly to buy impressions in real time;

• Allow users to make bids on ad inventory on an impression-by-impression basis (in real time) [17].

Figure 11. DSP, Ad Exchange and SSP Ecosystem [26].

We observe that usually DSPs, Ad Exchanges, and SSPs work together and it is not possible to discuss one of them without mentioning other twos. Therefore, we can specify an ecosystem that DSPs, Ad Exchanges, and SSPs work together as can be seen in Figure 11. Thus, whenever we compare ad networks with DSP, SSP and Ad Exchanges, we need to evaluate DSP, Ad Exchange, and SSP combination.

To illustrate, SSP cannot compete with ad networks by itself since it deals with mostly procurements rather than providing a direct connection from publishers to advertisers and DSPs do more or less same work from the advertisers’ side, and Ad Exchange provides the link between them. All these components use Real-Time-Bidding in DSP-Ad Exchange-SSP ecosystem.

23 Table 1. Differences between Ad Exchanges and Ad Networks [27]

24 However, Ad Networks do not use Real-Time-Bidding, and it has a similar function of DSP-Ad Exchange-SSP ecosystem and can handle everything without requiring any other component. Also, Ad Networks usually get confused with Ad Exchanges since they provide more or less similar services rather than DSPs and SSPs. In this point, Table 1 provides a clear picture of the differences between Ad Networks and Ad Exchanges.

As we can see from Table 1, ad networks and ad exchanges resemble each other in the means of their functionalities and services they promise. However, there are massive differences dividing them. In this regard, ad exchange has more transparency rather than ad networks. Because of the fact that in an ad exchange, advertisers could see the ad impressions of publishers directly. Therefore, they give a real-time bid to ad impressions they would like to purchase and reserve a place for their ads. Thus, advertisers know which sources would display their ads.

DSP Ad Exchange Ad Networks SSP Key Agents AppNext, Smaato, Tapad, Fiksu, DoubleClick, myDSP MoPub, DoubleClick, AppNexus, OpenX

AdMob, AppLovin, AdColony, Vungle, Unity Ads, MobVista,

Chartboost, TapJoy, Fyber, InMobi, Avazu, Mobrain,

IronSource, DoubleClick,

Aerserv

Table 2. Some Agents of DSP, Ad Exchange, Ad Network, SSP

Ad exchange plays a role in an open market with real-time bidding, while ad network is a closed market between publishers and advertisers [28]. However, ad networks are the intermediaries between publishers and advertisers, and they communicate with them.

26

Chapter 3

Platform Selection

In this chapter, our goal is to provide a reliable ranking of mobile advertising platforms to decide the platforms we would analyze. Therefore, we discuss some rankings created for this aim by reputable mobile marketing and analytics companies. In this regard, we cover three rating called AppsFlyer Performance Index, Singular ROI Index and Tune Index. Since we need a robust way to combine these different rankings, we report the method we have used to aggregate these three rankings to obtain one final ranking. Then, we discuss the differences between our final ranking list and the ratings coming from these three companies.

3.1 Existing Ranking of Mobile Advertising Networks

There is a growing trend of mobile advertising, and there are hundreds of mobile advertising platforms to deliver this demand. However, it is not scalable to compare each mobile ad platform throughout this work. Therefore, we decided to perform our methodology using a uniform, robust ranking list to choose the best mobile ad platforms on the current market. Thus, we have used three rankings, performed by three leading mobile marketing and analytics companies.

27 3.1.1 Appsflyer Performance Index

Appsflyer is a leading mobile marketing and analytics company to provide support to individuals around the globe. They have over 3000 partners integrated into their systems such as leading mobile apps, brands, mobile ad networks [29]. Appsflyer has been publishing performance index to provide a ranking of mobile advertising platforms with their method since 2015.

In their methodology, they do not consider mobile advertising platforms, not able to deliver their requirements on volume, meaning adoption of clients per platform and region. They also tried to remove the effects of ad fraud and use clean numbers such as install rates on their rankings [30].

Appsflyer Performance Index measures the performances of mobile advertising platforms. In their rankings, they assessed 5.500 apps with minimum 2.000, not organic installs, 80 billion sessions, 250 media networks having at least 20 000 installs. Their analysis is held in the first period of 2017 (January 2017 – June 2017). In this period, they monitored the media sources having more than ten applications in region level [30].

AppsFlyer Performance Index illustrates some critical insights as consequences of their work. The impact of ad fraud is one of them. In their work, they observe that the cost of ad fraud committed to manipulating app install numbers is between 2.2 billion and 2.6 billion US dollars in 2017 [30]. Thus, they claim it has adverse effects on budgets spent for inventories for advertisers, even in large-scale mobile ad platforms. The outcomes of ad fraud also reflect integrated data.

Another insight of this work is that Apple Search Ads take the most critical piece from the whole pie of mobile ad market since they utilize data coming from their users using AppStore and they can show related ads to their users according to their search history on AppStore. Therefore, they got almost all of the first spots in iOS ROI index and performance ranking, despite coming into the market recently [30].

28 # Volume Ranking of Gaming

Category

Volume Ranking of Non-Gaming Category

1 Facebook Facebook

2 AdWords AdWords

3 Unity Ads IronSource

4 AppLovin Mundo Media

5 Vungle InMobi

6 TapJoy Twitter

7 AdAction Interactive AppLovin

8 Fyber Apple Search Ads

9 IronSource Taptica

10 AdColony TapJoy

11 Chartboost You Appi

12 Taptica MoBrain

13 AppLift AdColony

14 InMobi Startapp

15 Twitter Cheetah Mobile

16 Mundo Media AppNext

17 Apple Search Ads RevMob

18 Digital Turbine AppLift

19 Liftoff Unity Ads

20 AppNext Motive

21 Leadbolt Display.IO

22 Cheetah Mobile Vungle

23 DAU Up Clicks Mob Fyber

24 You Appi Chartboost

25 Startapp DAU Up Clicks Mob

Table 3. Volume Rating of Gaming and Non-Gaming Categories [26].

They also say Facebook and Google are the other tech giants dominating the market of mobile advertising along with Apple. According to their ranking, Facebook is the number

29 one media provider in the globe, and right after Facebook, we can see Google in worldwide gaming and gaming rankings. However, Twitter is more successful in non-gaming ranking with fourth position [26].

According to their work, they state that video ads have a more significant impact on users rather than other types of ads since users can get an overall idea about the advertised product, app or services in a better way than different ads types [26].

Another result of this work is that gaming apps use less mobile ad platforms integrated with their apps when we compare them with non-gaming ads. Because of the general nature of the non-gaming app, they have a local impact for which the specific country they have been developed. However, gaming apps could have a global impact because of its nature [26].

Appsflyer Performance Index provides six rankings in totals such as Power Ranking and Volume Ranking in gaming and non-gaming apps in the globe as performance indexes, ROI Indexes for Android and iOS platforms. The first one, Volume ranking, based on the number of total fraud-free installs coming from mobile ad platforms, shown in Table 3 [26].

Power rating is the second rating that they have done by giving three scores to each of the mobile ad platforms like fraud-free number of installs, quality and average sessions for each user. It is possible to separate this rating into two categories such as gaming and non-gaming. We can see this separation in Table 4.

Return on Investment (ROI) index is formed according to reported revenue and cost of apps from mobile ad platforms. ROI represents the measure of advertisement’s success. In this index, results coming from gaming and non-gaming apps are combined.

30 # Power Ranking of Gaming Category Power Ranking of Non-Gaming Category

1 Facebook Facebook

2 AdWords AdWords

3 Unity Ads Apple Search Ads

4 Apple Search Ads Twitter

5 AppLovin AdColony

6 Chartboost Vungle

7 Vungle AppLovin

8 AdColony Mundo Media

9 Liftoff You Appi

10 Twitter Cheetah Mobile

11 IronSource Chartboost

12 You Appi AppNext

13 TapJoy Unity Ads

14 Leadbolt IronSource

15 Digital Turbine Display.IO

16 Mundo Media Motive

17 AppLift AppLift

18 Taptica TapJoy

19 DAU Up Click Mob MoBrain

20 AdAction Interactive Taptica

21 Cheetah Mobile StartApp

22 InMobi RevMob

23 AppNext DAU Up Clicks Mob

24 Fyber InMobi

25 Startapp Fyber

31

# ROI Index for Android ROI Index for iOS

1 Facebook Apple Search Ads

2 AdWords Facebook 3 AppLovin AdWords 4 AdColony AdColony 5 IronSource AppLovin 6 Chartboost IronSource 7 Vungle Vungle

8 Unity Ads Unity Ads

9 Taptica Chartboost

10 Fyber Fyber

Table 5. ROI Indexes for Android and iOS

3.1.2 Singular ROI Index

Singular ROI Index is another ranking of mobile advertising platforms that we will take into account for building our aggregated ranking. This index is performed in 2016 by Singular company which provides useful insights about their clients’ marketing activities on a single platform [31]. This platform enables their customers to reach valuable data related to their campaigns. Therefore, they can manage their ad campaigns in a better and smarter way.

Singular ROI Index is the first analysis that is done to rank mobile advertising platforms according to the Return on Investment (ROI) of apps generated by these platforms. The difference of Singular ROI Index is that they regard the cost of getting user engagement along with revenue per install and retention scores as used in AppsFlyer [31]. However, this work does not count the effect of ad fraud.

Singular ROI Index analyzed more than 1000 mobile advertising platforms and 1500 apps around the globe. During this research, more than $3 billion ads spent occurred for more than 2.4 billion of installs [31]. In Table 6, it can be seen the top twenty mobile advertising platforms according to the results of Singular ROI rankings for Android and iOS.

32 # Singular ROI Rankings for iOS Singular ROI Rankings for Android

1 Facebook Facebook

2 AdColony AdWords

3 Vungle AppLovin

4 Unity Ads AdColony

5 AppLovin AdAction Interactive

6 Fyber Vungle

7 Mobvista Unity Ads

8 AdAction Interactive IronSource

9 Chartboost Motive

10 Apple Search Ads TapJoy

11 TapJoy Chartboost

12 IronSource Fyber

13 Twitter AppLift

14 Liftoff Taptica

15 AppLift MobVista

16 Cross Install Glipsa

17 NativeX Lucktastic

18 InMobi Twitter

19 AdWords You Appi

20 Fiksu DSP LifeStreet

Table 6. Singular ROI Index for iOS and Android

Singular ROI Index has significant findings. The first finding is that Facebook beats AdWords, Twitter and Apple Search Ads [31]. This outcome is also consistent with the results of AppsFlyer rankings. Besides, Singular classifies Native X, Fyber, Motive, Mobvista and You Appi as mobile advertising platforms on the rise [31].

As another fact, Singular also claims Apple Search Ads has a rapid rise despite its recent join into the mobile advertising industry. This finding is also parallel with AppsFlyer rankings consequences. Last but not least, Singular also states iOS ads are 1.3 times more efficient than Android advertisements [31].

33 3.1.3 TUNE Ranking

Other newsworthy work, providing us a sharp picture about the best mobile ad platforms, is presented by another mobile marketing and analytics company, called TUNE. Tune revealed Tune ranking in 2016 [32]. TUNE has over 1000 mobile advertising platforms and more than 1000 partners that are waiting for insights from them [32].

While ranking more than 1000 mobile ad platforms, they used these data they collected. The final ranking list only integrates mobile ad platforms cooperating with their systems. They acquired their scores from more than 400 ad partners they have.

They ranked these mobile advertising platforms considering several measures such as installs, revenue per install within 30 and 60 days of ad campaigns, retention scores, reputation and the membership to their certified partner program, number of installs, number of clicks and taps [32]. Because of the overall characteristics of advertisement, TUNE tried to select ad partners placed in this ranking as worldwide. They claim that the targeting capabilities of mobile advertising platforms makes the real difference between them and has impacts on their position in these rankings each year [32].

Native X, Liftoff, and AppLift are the platforms managed to stay on the list for two years in a row. On the other hand, mobile ad platforms like Google, Twitter, AdColony, InMobi, Motive Interactive, Jampp, Applovin, Chartboost, Glispa, Vungle, and TapJoy are the other platforms staying on this ranking for three years in a row [32].

34 # Tune Top 25 Mobile

Advertising Platforms Ranking 1 AdWords 2 AdColony 3 AppLovin 4 Twitter 5 IronSource 6 Vungle 7 InMobi 8 Chartboost 9 AppLift 10 AdAction Interactive 11 Taptica 12 Glispa 13 Unity Ads 14 TapJoy 15 Fyber 16 Motive 17 MobVista 18 YouAppi 19 Opera Mediaworks 20 Liftoff 21 Phunware 22 Jampp 23 Crobo 24 Nend 25 NativeX

35

3.2 Metric for Selection of the Platforms

Previous chapters, we talked about the different rankings provided by three different mobile marketing and analytics companies. Based on these rankings, we intended to build a unique ranking list by aggregating these rankings we discussed so far. Thus, first of all, we describe what rank aggregation is.

There are many ways to merge different rankings in literature. However, in this work, we resort to ranking algorithms to handle this problem. Rank aggregation is the general name given to the problem of merging objects in ranking lists to obtain a single consistent ranking of the items [33]. Therefore, aggregation of discussed rankings to get a single aggregated ranking list of mobile ad platforms is a problem of rank aggregation.

Three of the rankings we discussed so far might order mobile ad platforms depending on the scores that they give to them. However, it is not possible to obtain these scores using the same metrics or equations since they are not publicly available. Therefore, in our case, we can use the position of mobile ad platforms in these rankings rather than using their scores.

Because of the reasons discussed so far, we used MedRank Algorithm proposed by Fagin et al. MedRank is one of the rank aggregation algorithms, sorting elements coming from different rankings according to the median ranking since only the position matters for us [34].

Before beginning to aggregate Appsflyer Performance Index, Singular ROI Index and Tune Index, we need to aggregate the rankings in Appsflyer. As we have mentioned before, Appsflyer has produced two different rankings for gaming and non-gaming apps in power and volume rankings. In this case, we aggregate these rankings to obtain one singular ranking of AppsFlyer.

36 # Aggregated Ranking of

Gaming/Non-Gaming Power and Volume Rankings of AppsFlyer

1 Facebook

2 AdWords

3 Apple Search Ads

4 AppLovin 5 Vungle 6 Twitter 7 Unity Ads 8 AdColony 9 IronSource 10 Chartboost 11 You Appi 12 TapJoy 13 Mundo Media 14 Taptica 15 AppLift 16 Cheetah Mobile 17 AppNext 18 InMobi

19 DAU Up Clicks Mob

20 Startapp

21 Fyber

Table 8. Aggregation of AppsFlyer's Gaming/Non-Gaming Power and Volume Rankings

Before aggregating Gaming/Non-Gaming Power and Volume Rankings, there were 29 distinct platforms in all of these four platforms. After performing MedRank algorithm to them, we observed only 21 platforms managed to be in the aggregated list. It shows us when we put gaming and non-gaming apps into one category, then if we add the effects

37 of Power Scores and Volume Scores, we can get the best platforms according to the factors of power and volume scores’ calculations.

If we aggregate these rankings with Appsflyer ROI Index for Android and iOS separately, we find the best mobile advertising platforms according to AppsFlyer in all dimensions.

# Best Mobile Advertising Platforms for Android wrt AppsFlyer Rankings

Best Mobile Advertising Platforms for iOS wrt AppsFlyer Rankings

1 Facebook Facebook

2 AdWords Apple Search Ads

3 AppLovin AdWords

4 Vungle AppLovin

5 AdColony Vungle

6 IronSource AdColony

7 Unity Ads Unity Ads

8 Chartboost IronSource

9 Taptica Chartboost

10 Fyber Fyber

Table 9. Best Mobile Advertising Platforms For Android and iOS wrt AppsFlyer Rankings

When we aggregate all the AppsFlyer Rankings, we observe that all the top ten platforms are more or less same for Android and iOS with one difference. While Taptica is one of the best ten platforms for Android, it is not in the top ten list of iOS. We could say the same thing for Apple Search Ads from the opposite direction.

When we aggregate the best mobile ad platforms for Android and iOS with respect to AppsFlyer rankings, Singular ROI Index for iOS and Android and Tune Ranking, we get the rankings in Table 10.

38 # Aggregation of AppsFlyer, Singular

ROI Index and Tune Rankings for iOS

Aggregation of AppsFlyer, Singular ROI Index and Tune Rankings for Android

1 Facebook Facebook

2 AdColony AdWords

3 AdWords AppLovin

4 AppLovin AdColony

5 Vungle IronSource

6 Unity Ads Vungle

7 Apple Search Ads Unity Ads

8 IronSource AdAction Interactive

9 Fyber Chartboost

10 Chartboost Taptica

Table 10. Aggregation of AppsFlyer Singular ROI Index and Tune Rankings for iOS and Android.

In this work, we analyze the platforms placed on the second columns of Table 10. However, instead of using AdWords, we use AdMob in this work. AdWords is Google’s mobile ad platform for advertisers. Therefore, we use another Google’s product, called AdMob for publishers.

# Selected Mobile Advertising Platforms

1 Facebook 2 AdMob 3 AppLovin 4 AdColony 5 IronSource 6 Vungle 7 Unity Ads 8 AdAction Interactive 9 Chartboost 10 Taptica

40

Chapter 4

Approaches to Integration of Platforms

Mobile advertising platforms help publishers to finance themselves. However, mobile applications require the integration of the mobile ad platforms chosen by the publisher into the mobile applications in order to gain revenue. In this chapter, firstly, we compared the usage ratios of both platforms by the top 150 apps in Google Play Store to have an understanding of which one is more popular. Then, we cover two techniques to integrate the mobile ad platforms into mobile apps. First one is mediation. We used AdMob to mediate more than one mobile ad platforms with a single mediation platform. Afterward, we cover the standalone approach that makes the integration possible one by one into the desired mobile app.

We conducted a survey about two different app ranking lists of top 150 free apps for Europe in Google Play Store: the top free apps and top grossing free apps. In this regard, we aimed to compare the usage of mobile advertising for income, and different methods to integrate the mobile ad platforms preferred by the popular apps placed in these two different lists. We obtained these lists by aggregating 27 countries top free apps and top grossing free apps lists using MedRank Algorithm. Whereas the applications in Top Free Apps list are ordered by their numbers of downloads, in the top grossing list, they are sorted by their overall revenue coming from app or in-app purchases.

41 Figure 12. Usage of Mobile Advertising in Top Grossing 150 Apps in Europe

In Figure 12, we observed a drop in the usage of mobile advertising as a source of revenue for the apps placed in top grossing 150 free apps. Only 66 of them contains ads out of 150 top grossing free apps and just 8 apps use standalone approach to show ads out of 66 of 150 top grossing free apps. In the list of top free apps, we observed a rise in the usage of mobile ads. 107 apps out of 150 top free apps uses mobile advertising and just the 30 of them prefers to use standalone approach for integrating ad networks out of these 107 apps as can be seen in Figure 13.

Figure 13. Used Integration Methods by Top Free and Top Grossing 150 Apps in Europe

71% 29%

MOBILE AD USAGE IN TOP FREE LIST

Yes No

44% 56%

MOBILE AD USAGE IN TOP GROSSING LIST Yes No Mediation 70% Standalone 30%

USED INTEGRATION METHODS BY TOP FREE APPS Mediation Standalone

Mediation 88% Standalone

12%

USED INTEGRATION METHODS BY TOP GROSSING APPS

42 To summarize, mediation is the most popular approach used to integrate mobile ad platforms by the popular free apps on the market and there is a decrease on the usage of the mobile advertising for the apps placed in top grossing free apps since they use in app purchases as the main source of revenue. We observed all the apps in top grossing free apps list use in-app purchases. However, apps in top free apps list use mobile advertising as the main source of revenue.

4.1 Mediation

Mediation makes the ad networks more advantageous and lucrative by integrating more ad networks into the one the publishers use on their applications. Therefore, mediation enables publishers to switch on different ad networks instantly. Mediation is a useful approach for developers to boost their revenue by acquiring ads from more than one ad networks using the same ad units placed in which applications show ads.

There are four types of ad units to display four different types of advertisements such as banner, interstitial, rewarded video and native. Whenever a user opens an activity including an ad unit, it will show an ad depending on the type of ad unit.

Mediation provides a technique to use many ad networks at the same time. However, we had to integrate at least one ad network into our application to use mediation. This ad network could be AdMob, MoPub or any others supporting mediation feature. As an alternative to exploiting an ad network to mediate more ad networks, mediation platforms can be used as Iron Source. Despite having IronSource in our list of mobile ad platform, we do not cover it in the scope of this work since it offers similar services with AdMob.

It is not achievable to perform mediation without having at least one ad network or mediation platform integrated into the mobile app since chosen ad network or selected mediation platform could use ad units as the main way of embedding ad units into the application depending on the instructions of chosen ad network or mediation platform.

43 It is possible to manage the mediation of ad units via the website of the selected ad network using the credentials of the app after integrating the ad networks to the app. Almost all the ad networks provide detailed menus and dashboards with many functionalities on their websites. Therefore, it is likely to configure the properties of ad units online such as ad type, frequency capping, ad unit name and ad unit id, mediation. Thus, desired ad sources could be added from the configuration of the ad unit to mediate.

For instance, let’s assume a simple application having just one simple welcome screen including a banner ad unit on the bottom of the user interface, and AdMob is selected to serve the ads. If we mediate this banner ad unit by adding certified ad networks from AdMob, AdMob becomes a mediation network for this application. If we do not activate mediation, the application will show the ads just coming from the AdMob.

# Mobile Ad Platform Certified Mediation Partners

1 AdMob

AdColony, AdFalcon, AMoAd, AppLovin, Appsfire, Chartboost, CrossChannel, Facebook, Flurry, Fuse Powered,

Fyber, HUNT, Mobile Ads, I-mobile for SP, InMobi, Leadbolt, LifeStreetMedia, LG U+AD, MobFox, MoPub, Nend, ONE by AOL: (Nexage), T ad (SK planet), Taplt by

Phunware, Tapjoy, Tencent GDT, Tremor Video, Unity Ads, Vdopia, Vpon, Vserv, Vungle, Zucks

2 AppLovin Fyber, ironSource, MoPub, AdMob, Heyzap, Corona, Unity3D, AdobeAir

3 AdColony AdMarvel, Apprupt, AdMob, Freewheel, Fuse Powered, Fyber, HeyZap, LiveRail, MoPub, SupersonicAds

4 Chartboost MoPub, Fyber, heyZap, ironSource, AdMob, DoubleClick for Publishers, Aerserv, Supersonic

5 IronSource

AdColony, AdMob, Applobin, Chartboost, DOMOBB, Facebook Audience Network, Fyber, HyprMX, inMobi, Maio, MediaBrix, MoPub, TapJoy, Unity Ads, Vungle

7 Unity Ads MoPub, Fyber

6 Vungle MoPub, AdMob, DoubleClick For Publishers, HeyZap, IronSource, Fyber

Table 12. Supported Mobile Ad Platforms for Mediation By Selected Mobile Ad Platforms

![Figure 1. The most installed SDK categories [1].](https://thumb-eu.123doks.com/thumbv2/123dokorg/7498913.104356/16.892.123.709.447.804/figure-installed-sdk-categories.webp)

![Figure 3. Figures showing the app downloads in 2016, 2017 and 2021 [6].](https://thumb-eu.123doks.com/thumbv2/123dokorg/7498913.104356/18.892.108.722.337.763/figure-figures-showing-app-downloads.webp)

![Figure 6. Global ad spending to ad mediums between 2015 and 2018 [14].](https://thumb-eu.123doks.com/thumbv2/123dokorg/7498913.104356/27.892.202.768.782.1027/figure-global-ad-spending-ad-mediums.webp)

![Figure 10. The Process of Real-Time Bidding [23]](https://thumb-eu.123doks.com/thumbv2/123dokorg/7498913.104356/34.892.108.724.748.1069/figure-process-real-time-bidding.webp)

![Figure 11. DSP, Ad Exchange and SSP Ecosystem [26].](https://thumb-eu.123doks.com/thumbv2/123dokorg/7498913.104356/36.892.106.721.412.704/figure-dsp-ad-exchange-ssp-ecosystem.webp)

![Table 3. Volume Rating of Gaming and Non-Gaming Categories [26].](https://thumb-eu.123doks.com/thumbv2/123dokorg/7498913.104356/42.892.106.730.175.1019/table-volume-rating-gaming-non-gaming-categories.webp)