POLITECNICO DI MILANO

Department of Management, Economics and

Industrial Engineering

ALTERNATIVE FINANCE:

A MARKET STUDY ON BLOCKCHAIN FINANCING

Supervisor: Prof. Alessandro Perego

Supervisor: Dott. Valeria Portale

Master Thesis by:

Federico Cislaghi

Matr. N. 878351

I

Table of Contents

Abstract ... V

Executive Summary ... 1

1. The Blockchain disruptive potential ... 12

1.1 The rise of a new technological paradigm ... 12

1.1.1 Definition of technological paradigm ... 13

1.1.2 Is blockchain a technological paradigm ... 15

1.1.3 The emergence ... 17

1.1.4 Financial industry special needs ... 20

1.2 The functioning of the blockchain ... 23

1.2.1 Distributed ledger ... 24

1.2.2 Cryptography and security ... 25

1.2.3 Consensus protocol ... 26

1.2.4 Smart contracts ... 27

1.2.5 Cryptocurrency and Tokens ... 28

1.3 Industrial uses and real-world applications ... 29

1.3.1 Banking and financials ... 30

1.3.2 Manufacturing ... 31

1.3.3 Healthcare ... 33

1.3.4 Public services ... 33

1.3.5 Utilities ... 34

2. Fundraising methods ... 36

2.1 Traditional fundraising methodologies ... 37

2.1.1 Debt ... 37

2.1.2 Equity ... 38

2.2 Non-traditional fundraising methodologies ... 43

2.2.1 Crowdfunding ... 43

2.2.2 Initial Coin Offering ... 46

3. The Initial Coin Offerings ... 49

3.1 ICO Process ... 49

3.1.1 Decision about the suitability of ICO for the proposed business ... 50

3.1.2 Create a product ... 50

3.1.3 Create a token ... 51

II

3.1.5 Create a community ... 52

3.1.6 Get the token on a market Exchange ... 52

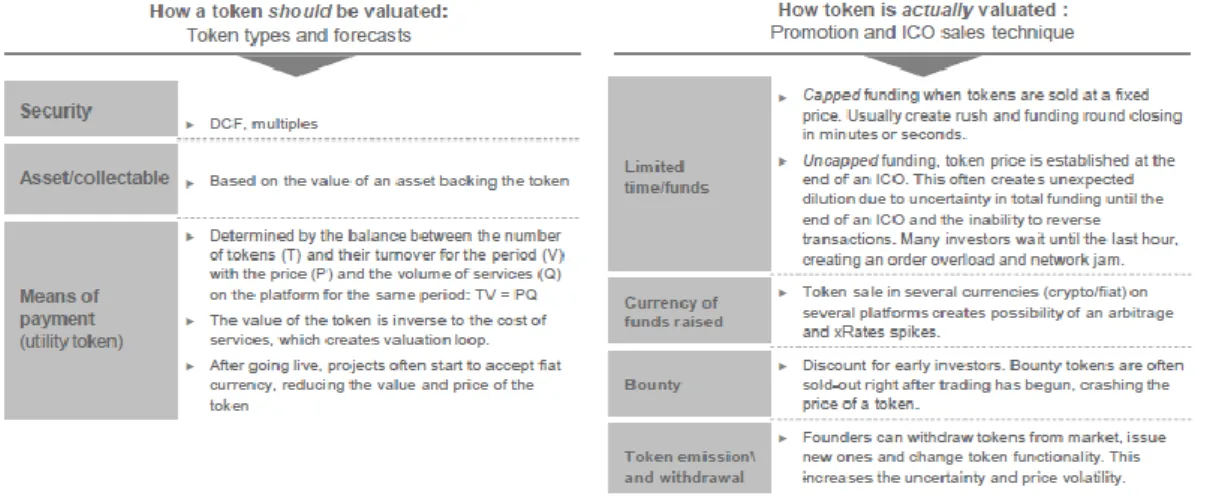

3.2 The valuation of a token ... 53

3.3 Unique risks for investors ... 55

3.3.1 Market risk ... 56 3.3.2 Complexity risk ... 56 3.3.3 Financing risk ... 58 3.3.4 Political risk ... 58 3.4 Regulation ... 60 3.4.1 Existing framework ... 60 3.4.2 Regulatory actions ... 63

4. A deepen view on ICO market ... 66

4.1 Database methodology and presentation of the census ... 66

4.1.1 Period Area... 68

4.1.2 Funding Area ... 71

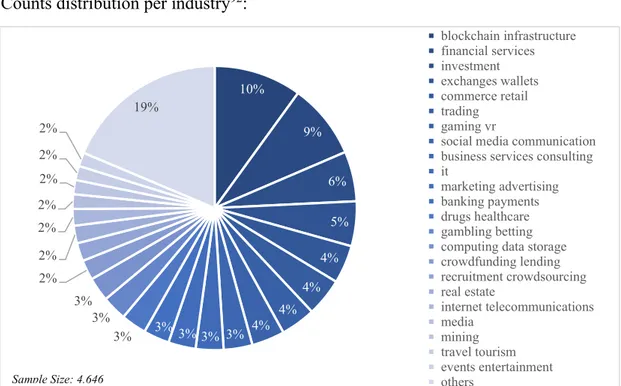

4.1.3 Application area ... 82

4.1.4 Token Nature ... 95

4.1.5 Country Specifics ... 104

4.2 Cross-section analysis and considerations ... 110

4.2.1 Time variability ... 110

4.2.2 Reaching the cap ... 115

4.2.3 VC-backed ICOs ... 117

4.2.4 Industry movement dynamics ... 121

4.2.5 A standard blockchain ... 123

4.2.6 Token type dynamics ... 125

4.2.7 Geographical scope ... 127

4.3 A general framework: Use case and process impact ... 132

4.3.1 Finance ... 134

4.3.2 General purpose ... 136

4.3.3 Logistics ... 137

4.3.4 Media & Arts... 139

4.3.5 Technology ... 140

4.3.6 Utility ... 142

4.3.7 Other use cases ... 143

4.3.8 Geographical focus ... 145

III

4.5 Weaknesses ... 151

5. Alternative finance ... 153

5.1 The Bubble ... 154

5.1.1 ICO vs IPO vs VC ... 154

5.2 About the bubble context ... 155

5.3 The bubble burst ... 157

Conclusions ... 159

V Abstract

From the Great Recession of 2008, the entire world has experienced a slowdown in the economy that constrained the credit disbursement from the banking system, particularly for riskier business in early stage phases. At the same time a solution came to the market, a peer to peer electronic cash system that could disintermediate the financial intermediaries. The last decade has seen the rise of a new form of decentralized currency, the cryptocurrency, that has changed the way new ventures run business and collect funds.

The objective of this thesis is to investigate the novelty of this market, its size, the main features and in which field the newcomers start their business and the way they decide to finance it.

This thesis project starts with a deep understanding of the literature on the paradigm of innovation and on the new technology that stands behind the market: the blockchain. Resorting to a study of the literature on the crypto economy, and on different financing instruments, the aim of this project is to define the initial coin offering market and introduce a framework model to segment the crypto economy, in different use cases and ease the comprehension of the new alternative finance.

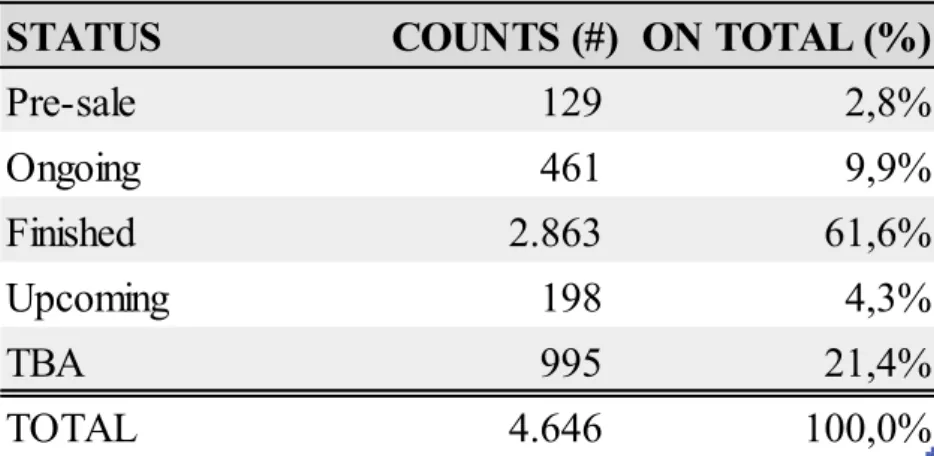

To analyse the market, I developed a database that collects every initial coin offering, from the first appearance in the market (July 2012) to the upcoming until October 2019. The database collects 4.646 projects that implemented blockchain technology and have been financed with a token sale.

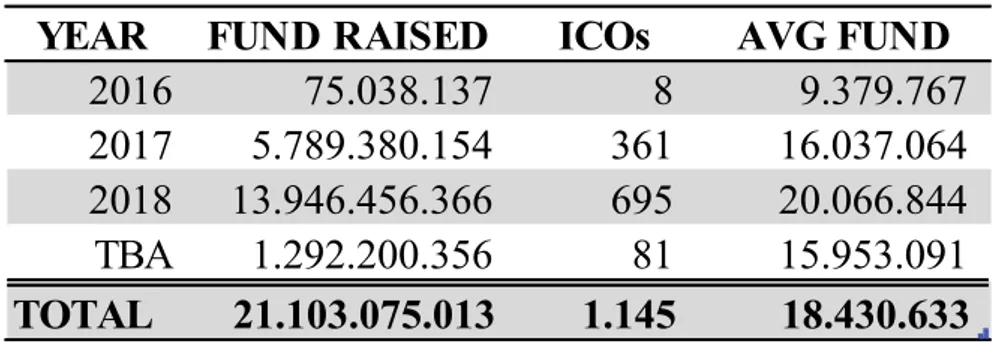

Through the database it was possible to define the market size of more than $ 21 billion and derive the major features that drive success: average duration (30 days), average deal size ($ 18,4 M), registration Country (US, Singapore, Switzerland), and many others. With all data available then, it was possible to define a common framework to segment projects in 12 use cases and channel all of them in processes impacted and detailed solutions depending on the industry where the venture is positioned, and the product or service proposed. The most present use cases are Finance (30%) and Technology (18%) that represent together the 68% of the market of funds.

The project concludes showing that this new market represents an alternative finance solution to more traditional way of financing, especially for early stage ventures.

VI A partire dalla Grande Recessione del 2008, l’economia mondiale ha subito un notevole rallentamento, sfociato nella contrazione nell’erogazione di credito da parte del sistema bancario, specialmente per le imprese piccole o in fase di startup. In questo contesto, viene alla luce una nuova soluzione: un sistema monetario elettronico, con il tacito obiettivo disintermediare gli intermediari finanziari. Durante l’ultimo decennio, con la crisi di fiducia nel sistema bancario si è sviluppata una nuova valuta, o

cryptocurrency, sostenuta da un sistema decentralizzato, che ha cambiato il modo di

fare impresa e ottenere finanziamenti.

L’obiettivo di questo elaborato di tesi è di investigare il nuovo mercato dei finanziamenti alternativi legati alla blockchain, la sua dimensione, le caratteristiche che ne stanno comportando l’affermazione ed i settori in cui questa innovazione sta comportando i maggiori cambiamenti, sia tecnologici che finanziari.

L’elaborato si fonda sullo studio del paradigma dell’innovazione e sulla comprensione della nuova tecnologia che ha generato questo nuovo mercato: la blockchain. Attraverso lo studio della letteratura sulla crypto economia e sull’accesso ai capitali, l’obiettivo di questa tesi è definire il mercato delle initial coin offering ed introdurre un modello che segmenti la crypto economia in diversi use case per facilitare la comprensione di questa nuova forma di finanza alternativa.

Per analizzare il mercato è stato necessario costruire un database costituito da tutte le

initial coin offering, dalla loro prima apparizione sul mercato (Luglio 2012) fino a

quelle programmate fino a Ottobre 2019. Il database raccoglie 4.6.46 progetti che hanno sfruttato tecnologia blockchain e si sono finanziati vendendo token sul mercato. Lavorando sul database creato, è stato possibile definire l’ampiezza del mercato maggiore di $ 21 miliardi ed esaminare le caratteristiche dei casi di successo: durata media del token sale (30 giorni), capitale medio raccolto ($ 18,4 M), paese di origine (US, Singapore, Svizzera), e molte altre. In seguito, con tutti i dati raccolti, è stata definita una matrice comune per segmentare i progetti in 12 use case, declinandoli in processi impattati e soluzioni di dettaglio a seconda dell’industria e del prodotto o servizio offerto. I progetti più presenti sono Finance (30%) e Technology (18%), rappresentano insieme il 68% dei capitali raccolti.

L’elaborato conclude mostrando come blockchain rappresenti una modalità di finanziamento alternativa a modelli tradizionali, specialmente per le startup.

1 Executive Summary

The following thesis project was born with the objective to investigate a rising star in the alternative finance ecosystem: the blockchain financing.

The year 2008, with the failure of Lehman Brothers, has changed dramatically the financial system, and consequently the entire ecosystem of companies looking for finance to establish, grow, and run their business.

Every regulatory act since then, had the objective of simplifying the access to capital markets and make easier for entrepreneurs to collect funds and invest in their ventures. New forms of financing developed in this context, in 2012, through the approval of the Jobs Act in the United States, the restrictions on accredited investors were removed, giving rise to the first equity crowdfunding platforms to give a chance to entrepreneurs to find collective funds, instead of resorting to the banking system or to a single corner stone investor, such as venture capital funds.

Few weeks after the collapse of the financial system, in the middle of a crisis of trust toward financial institutions, an anonymous innovator, Satoshi Nakamoto, published a paper proposing a decentralized solution that extends the concept of monetary independence, offering a currency that can free itself from governments and central banks. In that moment the Bitcoin, the first functioning blockchain infrastructure, was presented to the world as the solution.

2 From that moment on, something has started: Bitcoin was presented as an innovative currency but the underlaying technology was considered by professionals and theorists to be the real revolution with a real disruptive potential not only for the financial system, but also for many other industrial sectors.

INTRODUCTION

The emergence of companies looking for new financing ways and the surge of the new forms of economy, crypto and crowd-based economy, have created a new token market that attracted the attention of academics, entrepreneurs and institutions. The market, at its actual stage, claims to be properly analysed in its size and drivers to determine a framework for future growth and development.

This master thesis represents a market study on blockchain financing performed though an analysis of every company that has ever launched a token sale, from the first ICO held by Bytecoin in July 2012 to the still-to-come ICOs scheduled to take place until October 2019. To run the analysis, it was necessary to create a database that records a large set of information for every project in this novel and highly volatile market. The creation of the census database was fundamental for two main reasons, first because there is not yet a clear representation of the ICO phenomenon and second because, in a full-of-dispersed information setting (as it is the crypto economy), it is necessary to have a unique and unbiased source of data to evaluate the market drivers of success and a framework analysis.

LITERATURE REVIEW

Before addressing the census and the creation of the database, it was completed a literature review concerning three main topics, disruptive innovation, blockchain technology, and alternative and traditional ways of financing, for a total of roughly eighty papers and articles.

The paradigm of innovation defined by Kuhn, states that progress is composed by both a normal phase and a revolutionary one. In the normal phase, he identified a “development by accumulation”, where progress is achieved by exploiting previous knowledge, the evolution indeed, is based on well-known theories and laws, performing experiments and observations. On the other hand, the revolutionary side of the equation, the ordinary course of events is interrupted by a radical change in perspective, which abolishes previous consent on laws and theories, often reforming

3 entirely the way a case is studied and approached. The former definition perfectly fits for the blockchain market. From a development by accumulation developed over the distributed ledger technologies to a revolutionary side, a peer to peer electronic cash system that capable to revolutionise the way through which companies can be financed and can establish and run new business though a token sale in an initial coin offering. The first chapter of this master thesis presents how and why blockchain technology is considered to have a disruptive potential, picking real case examples and applications from the literature. During the first chapter, the reader can understand what drives technology innovation and why blockchain can be considered to be disruptive. The second chapter reviews the literature of traditional and alternative financing models bringing on top the definitions and the market study of the main market-based financing instruments:

- Initial Public Offerings (IPO): or stock market launch is a type of public offering in which shares of a company are sold on the open market to institutional and retail (individual) investors;

- Venture Capital funding: capital invested in a project in which there is a substantial element of risk, typically a new or expanding business;

- Crowdfunding: open call through the Internet, for the provision of financial resources either in form of donation or in exchange for some form of reward and/or voting rights in order to support initiatives for specific purposes

- Initial Coin Offerings (ICO): type of funding using cryptocurrencies, the process is done in crowdfunding or in private ICO. In an ICO, a quantity of cryptocurrency is sold in the form of tokens of coins to backers, in exchange for legal tender or other cryptocurrencies.

OBJECTIVE OF THE STUDY

This study aims at fulfilling a clear gap in the academic literature lacking a comprehensive identification and categorization of the project financed through an initial coin offering.

The contribution of the study is synthetized by the identification, measure, classification and mapping of every project financed with a token sale (4.646 projects). The study relies on depth empirical research totally absent in the academic literature and is supported by a census database gathered over a period of six months. Moreover,

4 through the development of a rigorous taxonomy determined in agreement with the Osservatorio on Blockchain and Distributed Ledger, this master thesis defines a framework of use cases and processes impacted by the solution proposed by the blockchain venture financed via token sale.

The real analysis was carved out with a cross sectional analysis of the database with the objective to determine the main drivers of the success of the token sale and to collect information on the existing stage of development of the market and a prospect on the evolution path.

Finally, it was interested to investigate the appropriateness of the alternative finance definition, comparing the market of blockchain financing against the other alternative financing solutions.

The objective of the study can be summarized in three research questions:

RQ1 – Which is the stage of development of the blockchain financing market? What is

the size and the main figures of the initial coin offerings fundraising?

The market is in an early stage and experiences a growth pace typical of bubble market, having more than doubled its funding amount raised over 2017-2018, reaching a market size of $ 21,2 billion in less than three years of activity. The market counts a total of 4.646 projects with an average funding amount raised of $ 18,4 million. Every project on the market has its own row on the database on which it was possible to detail its duration, funding amount, country of origin and many other variables, suitable to analyse the market and reporting every figure that can be meaningful to define it. RQ2 – Is there any framework in which the market can be classified? Are there clusters

of homogeneous projects within those financed with a token sale and is there any correlation in reaching success?

The high number of projects analysed and the satisfactory heterogeneity in the initial coin offerings market allows for their classification and segmentation according to specified discrimination criteria. Starting from the industry of provenance and the product it was possible to determine 12 use case categories of project and further specifications on the process impacted and the detailed solution proposed.

RQ3 – Is there space in among the alternative finance instruments for the initial coin

5 The actual literature allows to define and study any financing instrument available for companies. In the market of financing solution, especially in the early stage or startup phase, there is almost always place for a new financing tool but due to enthusiasm and simplicity of access, there is usually also place for bubbles. When the euphoria crashes into panic, there is crowding out effect where bad projects are discouraged and, eventually the market stabilizes and establish itself out of the initial niche.

METHODOLOGY

To answer the research question and define the main figures and the framework to segment the market, it was built a database with data gathered over period longer than six months with a collection of 25 information set per project. The database acts as a census and collects 4.646 projects.

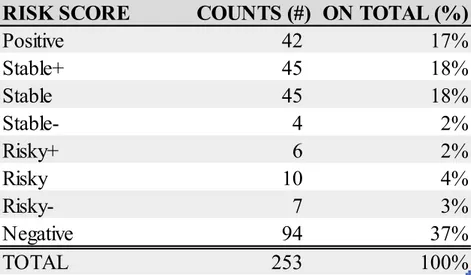

The first data gathering on launch date, end date, funding round, goal, industry, product, scores and other secondary variable was collected through a web scraping from the ICO Rating Agency website performed by the Osservatorio on Blockchain and Distributed Ledger on May 24, 2018. The dataset was comprehensive of 2.450 ICO projects that had already performed the token sale or had scheduled to do it soon. The database showed the absence of some important data and needed continuous manipulations and integrations from different sources, over the period from June to September. The final version of the database, updated on September, was the result of a huge Microsoft Excel® Query from the main source icorating.com.

The Excel tool built, retrieved data directly from the website, updating the former database with the newly issued ICO projects reaching 4.646 tokens corresponding to an equivalent number of ventures. Again, a two-week manipulation and integration was needed to verify correctness and consistency of the data gathered.

With the database complete moving to the analysis was easy, the 25 columns of information set have been divided in 5 areas (Period, Funding, Application, Token Nature, Country), each one analysed both as self-standing and as crossed with the others.

The large dataset counts more than 120K statistics that have been collected in tables, graphs and figures, with the aim of understanding the main parameters that drive a successful ICO. The cross-analysis was comprehensive of period length and time variability, industry dynamics, blockchain standardization, geographical scope and

6 back money from Venture Capital Funds. Given the high amount of data many analysis have been performed but much more could have been (and will be) on the same database.

To answer the second research question, it was important to determine a first framework where the blockchain projects are financed. Starting form the industry f provenance and studying the product/service proposed by the blockchain venture it was possible to determine a major use case impacted. The use cases were initially provided by the Osservatorio on Blockchain and Distributed Ledger, and have been extended in this master thesis.

The framework identified was driven by the aim of determine the most important segment of the market where blockchain can make a real impact, entrepreneurs are willing to establish, and investors are prone to risk their money for future returns. To answer the third research question the methodology followed have been both quantitative and qualitative. The first thing was to collect market data on the various financing instruments from different sources and compare them to the actual market size of the blockchain financing market. Then, the more qualitative part regards a thought on bubble economy and on how could be the future perspective of the initial coin offerings in respect with future regulatory actions and the possible end of the euphoria phase.

RESULTS AND MAIN FINDINGS

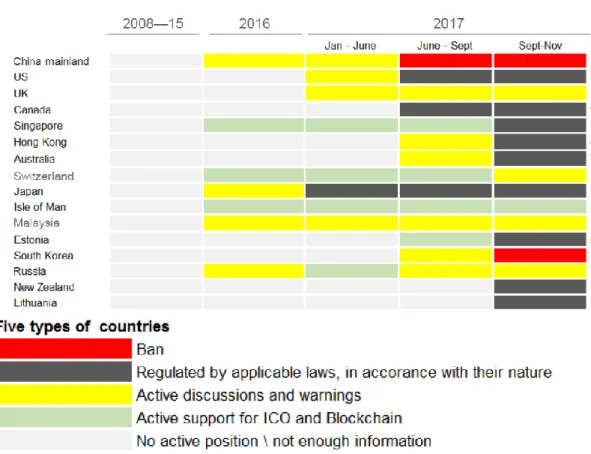

The token market is a new market, with dynamics and features totally different from the old and established models, for this reason, before presenting the analysis and the results, it was important to study the market regulation that, at the actual stage, is not uniform for all countries and explains partially of the subsequent results. There are more favourable countries like Switzerland, that provided a clear set of rules, or totally against countries like China, that prohibited any form of crypto-related fundraising. Others, like United States and the countries in the European Union, settled few rules but are still observing the stages of development of the market, leaving it by now in a regulatory sandbox.

Through the database it was possible to analyse the, market and evaluate the main figures. The average project that starts and initial coin offering goes on the market with

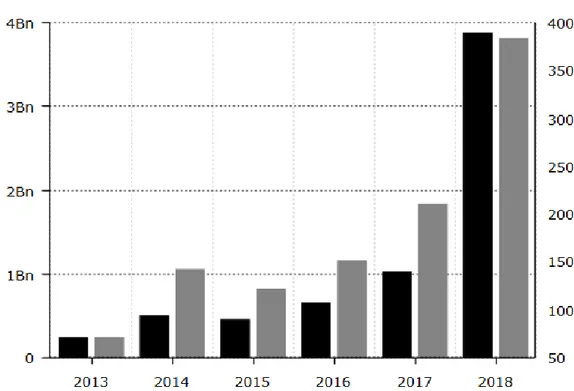

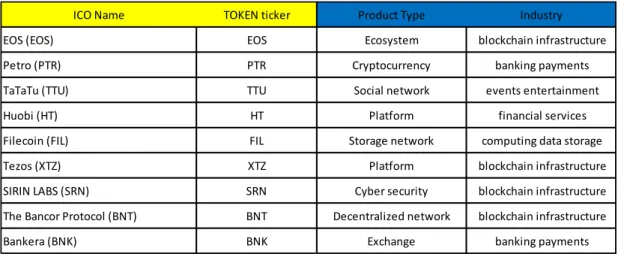

7 an Ethereum token, runs the crowdsale with a duration length of 30 days, is not able to reach the predetermined cap, but, if successful can raise about $ 18,4 million. The determination of the success of the market, its growth pace and of some of its results can be visualized by the following graphs extracted from the analysis.

The two previous graphs are significative in determining the amplitude of the phenomenon and show easily what has been the impact in terms of capital raised and project launched over the last two years and the reason why there is much talking about the ICO topic.

However, the next graph gives a further information on the market: not all projects are successful. 2.000 4.000 6.000 8.000 10.000 12.000 14.000 16.000 2016 2017 2018

Funds Raised per year ($M)

0 1000 2000 3000 4000 07/12 11/13 03/15 08/16 12/17 05/19

8 Only 25% of the projects can successfully raise funds through an ICO, and among the successful ones, the 25% of the projects is able to get the 75% of funds.

This makes clear the inefficiency in the market that is still in a niche.

The subsequent analysis are devoted to establish a framework that could ease the understanding of the future stages of development of the blockchain technologies. The market has been divided in 12 use cases and each of them have been singularly analysed and described.

- Finance: ventures that exploit blockchain technologies to improve the services offered by main financial institutions such as banks, professional investors, intermediaries, markets, …

- General Purpose: all those ventures that offer general services not focused on any specific scope. A venture that can be taken as example of this use case is Blockstream, that develops software solutions and hardware for companies launching blockchain-based networks.

- Logistics: all the ventures that provide a simplification management of goods by tracking intermediate passages on the supply chain and providing retail services to the end of the chain. This use case is characterized by two main processes declined in different details: commerce, supply chain services, tracking and transport, data management, payment.

- Media & Arts: all those ventures that care about marketing and media services, or both digital and physical multimedia content and artworks. The process details are various and belong to two major categories, marketing and social 5.000 10.000 15.000 20.000 25.000 - 200 400 600 800 1.000 1.200

Cumulative ICO value - ABC curve

9 media. Examples of details are advertisement, entertainment, social network, internet browser, service exchange platform, ticketing, and artwork registration.

- Technology: all those ventures that provide technological support and technological infrastructure to the blockchain market. Here are collected all those companies that develop software and systems aiming to exploit distributed ledger with technological services such as data management, IoT, shared developers’ platforms and IT technology.

- Utility: all those ventures that provide utilities services. These in particular refer to energy, water, telecommunication and environmental services.

- Healthcare: all projects linked to sanity services, in particular those about sensitive data treatment for patients.

- Insurance: includes all insurance-linked project, this use case is isolated from finance use case because it represents a considerable sample of project to have its own category.

- Recruiting: includes all those project that belong to human resource management, both in term of recruiting marketplace and payment/reward systems.

- Scientific research: includes all ventures and teams that run scientific research and use a token sale to get financed (ICO as crowdfunding), the processes impacted regard healthcare, education and software development.

- Virtual currency: here are reported all those ventures that supply services or products linked to cryptocurrencies, the main process impacted has been summarized in mining that is performed in various declinations: from cloud-based services, to marketplace and exchange of computational power.

The following graphs represent the fund distribution of funds raised per use case making evidence of the most successful project type on technology and finance; and the number of projects counted highlighting the industrial fields most appreciated by the blockchain entrepreneurs.

10 The final results regard the comparison of the ICO market with the alternative financing solutions, in particular against Venture Capital.

Venture Capital Funds, rather than replaced by ICOs, could actually find a productive relationship and benefit from each other. Companies who choose the ICO way could use it as a seed round and then they would be in a better position to negotiate their next round. Which means that ICOs could be more like a crowdfunding part of a company and the venture capital round would come later.

1.000.000.000 2.000.000.000 3.000.000.000 4.000.000.000 5.000.000.000 F in an ce Ge ne ra l P urp ose He alt hc ar e In su ra nc e Lo gisti cs M ed ia & A rt s Oth er Re cru it in g S cien tifi c Re se arc h Tec hn olo gy Util ity Virtu al Cu rre nc y 2016 2017 2018

Sample Size Funding : 1.149

0 250 500 750 1000 F in an ce Ge ne ra l P urp ose He alt hc ar e In su ra nc e Lo gisti cs M ed ia & A rt s Oth er Re cru it in g S cien tifi c Re se arc h Tec hn olo gy Util ity Virtu al Cu rre nc y 2016 2017 2018

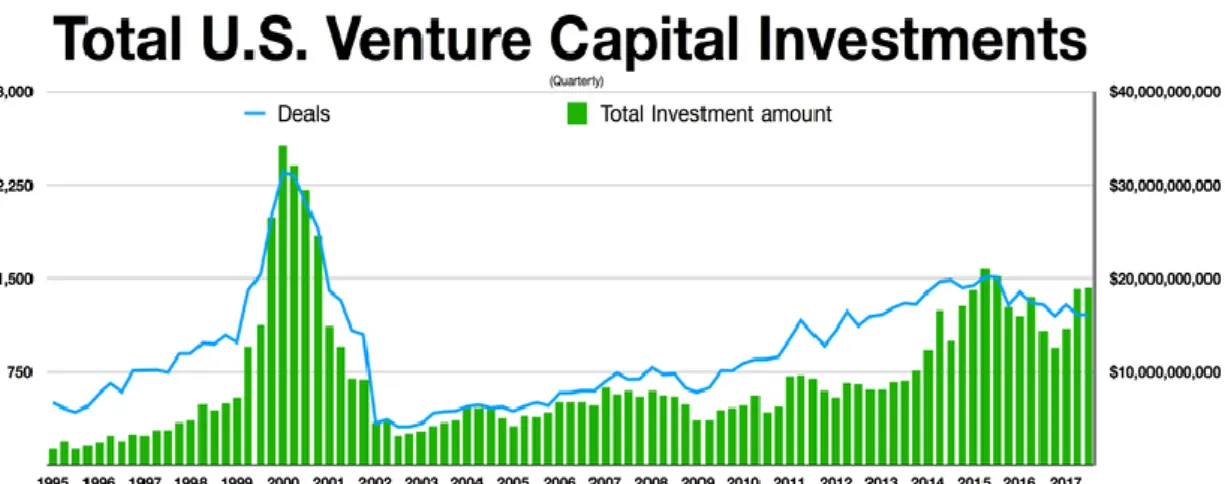

11 The graph below represents the output study comparison of ICO VS VC market on a showing the flow of funds over the period of the study.

12 1. The Blockchain disruptive potential

1.1 The rise of a new technological paradigm

Technology has evolved greatly since the early 1900’s. The rise of digital technologies, in particular over the past decade, has brought significant disruptions to many industries and sectors. The most significant phenomenon of the recent period is for sure the Fintech wave, technology applied to financial services.

The society has evolved from the predominant use of physical currencies and local trade, digital transactions and instant global commerce. It is now possible to purchase goods through ecommerce marketplaces in a matter of seconds.

The latest wave of fintech companies regard the blockchain technology, from being just a proposal of decentralized payment network it was possible to witness in the last two years a great evolution, a surge in its usage and also the adoption by major corporation.

The first part of this paper is devoted in understanding the potential of the blockchain technology by describing if it is possible to consider it a technological paradigm, why the society felt the emergency of a transformation, and how this technology is establishing, through real company examples, the potential of its disruptiveness.

13 1.1.1 Definition of technological paradigm

In 1962 Thomas Kuhn1 published his theory about the evolution of sciences, in which, challenging the previous points of view, he stated that scientific progress was composed by both a normal phase and a revolutionary one. In the normal phase, he identified a “development by accumulation”, where progress is achieved by exploiting previous knowledge, the evolution indeed, is based on well-known theories and laws, performing experiments and observations. On the other hand, the revolutionary side of the equation, the ordinary course of events is interrupted by a radical change in perspective, which abolishes previous consent on laws and theories, often reforming entirely the way a case is studied and approached. At the end of this process, when, after the initial shock, a new consensus is reached in the community, Kuhn identifies the birth of a new scientific paradigm, which will undergo the same process of evolution until a new revolution will take place, thus restarting the cycle.

In 1982 Giovanni Dosi2 adapted this concept of scientific paradigm to the field of technology. He defined a technological paradigm as an ensemble of scientific principles and material technologies needed to solve a technological problem.

It is possible to adapt this new interpretation of technological progress to the concept that Kuhn had introduced in his theory: the evolutionary phase corresponds to a development of the technologies adopted from a performance-oriented point of view, at some point in time, due to physical limitations, those performances reach a saturation point, condition that reduces the growth path over time. It is easier at this point for new technologies to increase their share in terms of research and development, and overtake the previous paradigm, by defining a new model of solutions for the considered problem. The arising technology, “fulfils a similar market

need by building on an entirely new knowledge base”3.

1 Thomas Samuel Kuhn (July 18, 1922 – June 17, 1996) was an American physicist, historian and

philosopher of science whose controversial 1962 book The Structure of Scientific Revolutions was influential in both academic and popular circles, introducing the term paradigm shift, which has since become an English-language idiom.

2 Giovanni Dosi (August 25, 1953 – in life) is Professor of Economics and Director of the Institute of

Economics at the Scuola Superiore Sant'Anna in Pisa. His major research areas - where he is author and editor of several works - include economics of innovation and technological change, industrial organization and industrial dynamics, theory of the firm and corporate governance, evolutionary theory, economic growth and development.

14 As Melissa Schilling points out in her belief on technology innovation, technologies may be rendered obsolete by emerging competitors even well before reaching their saturation point, in case they have a steeper increase of performance over time with respect to the other paradigm.

Cantamessa and Montagna4 state that a technological paradigm is the mixture of two different sides: demand and supply.

On the supply side are considered different players: first, all the actors involved into the product (or service) realisation, such as producers and suppliers, which, using manpower, tools and knowledge, are able to create the physical product, second, knowledge, the key factor that connects producers to research and educational institutions. Another key aspect is the presence of a complementary system, of fundamental importance for the development and the diffusion of the product itself. The role of complementors is crucial for the emergence and definition of a new paradigm, as their presence and compatibility with a new technology could play a fundamental role in the acceptance or the rejection of it.

According to the authors, from the demand side, the product is seen by society through the eyes of beliefs, needs, objectives, rules, and meanings. Under this assumption, the cluster of technologies that defines the new and emerging paradigm must therefore be compatible with what society dictates, in order to assure its emergence. As in the economic discipline’s theories, where demand and supply meet in the so-called equilibrium point, we can observe how the success of a paradigm’s emergence is strictly correlated with the reciprocal fit of one side with the other, defining an intersection between the two that gives the right setting for a sustainable business model.

The business model, when sustainable, plays a core role into the success or failure of a new emerging paradigm. According to Piscicellia, Luddenb and Cooper5, what defines the sustainability of a business model is, the ability to generate economic value and, at the same time, create some benefits to both, the environment and the society. Talking about society and setting aside the economical point of view, it is recognised a strong connection between society’s needs and successful paradigms. The contact

4 Management of innovation and product development by M. Cantamessa and Francesca Montagna. 5 What makes a sustainable business model successful? An empirical comparison of two peer-to-peer

15 may happen in two different directions, both starting from the demand side and heading to the suppliers, in the case of a demand-pull scenario, or viceversa, if we consider a technology-push case.

Demand-pull implies that innovation itself is shaped by market demand and by the customers; several products are made to satisfy a need and then are selected by the users. Technology push, on the contrary, is when new products and services are developed on the base of scientific research and then sent to the market. According to Leibowicz6, the right balance between these two policies is what determine success, turning them into two complementary approaches, and not substitutive ones.

1.1.2 Is blockchain a technological paradigm

Although the first ideas about it were theorised many years before, the blockchain saw its emergence recently, with the enormous success of the Bitcoin cryptocurrency. Bitcoins are a new form of virtual money, which owe part of their success to the ability to avoid one of the main problems in the field of the digital economy: the “double-spending”, that is the possibility of spending the same digital token more than once. Another key feature of Bitcoins is the real peer-to-peer technology underneath the system, that allows transaction between parties, authenticated not by a third party authority, but by the whole network itself, through the sharing of involved data. These characteristics were achieved by the implementation of an underlaying structure called indeed block chain.

A block chain is “an open, distributed ledger that can record transactions between

two parties efficiently and in a verifiable and permanent way”.

Open and distributed are the key words of this ledger, which must be intended as a register of all the transactions happened where, just like a chain, every ring (that contains information about the transactions) is connected both to the previous and to the subsequent. Here derives he name “block chain”.

Being open, has the fundamental role of letting any involved party see the contents of the chain and to check and validate the transactions.

16 Being distributed, it makes possible the independence of the system from a third trusted party, allowing anyone to have a copy of the aforementioned ledger.

To solve the problem of synchronisation between copies of it, a reward system involving computational power as investment was developed. When new transactions happen, they need to be added to the chain; they firstly are grouped in a “block”, then they need to be checked, to make sure that the transaction are valid, and then finally a hash must be computed on the base of the transactions contained in the block. The so called “miners” compete among the network, using their computational power, to solve the hash of the new block, as the first one is rewarded. As soon as a miner is able to find it, he adds the block to its copy of the chain and share the hash with the network, which will check the validity of it and will add the block to their copies as well. If the 51% of the network recognise the validity of the new block, a global consensus is then reached, and the block is accepted as a new one in the chain.

This approach allows to create a system in which trust is shared among peers with a common interest, instead of a third trusted party. The potential of a network built with the embedded properties of transparency, self-authentication and distributed auditing goes well beyond the simple application related to the monetary function, attracting many possible markets in which those features are required, such as new generation voting systems, guaranteed origins for products, digital asset market and many more. Moreover, it is important to note that these newest applications that are expanding outside of the economic field, as for example the traceability of manufactured goods and foods, are often kept accessible only by people involved in the processes, making the blockchain “private”. A private blockchain has the same characteristics of a public one, with a restriction on whom transactions are visible to. Lastly, among these categories lies the hybrid blockchain, where some transactions are public and some kept private.

The first tangible application of the blockchain technology was Bitcoin, although the idea had already been in place since the first 90s. Once the idea was mature enough, someone, under the pseudonym of Satoshi Nakamoto released a whitepaper, named “Bitcoin: A Peer to Peer Electronic Cash System”. In this paper, all the technology underlaying the new payment system was explained in detail, allowing people from all around the globe to start the Bitcoin blockchain. This can be clearly identified as a

17 technology push-based method of diffusion for the new technological part. As theory states, it is important to note that lately, given Bitcoin’s success, many other fields of applications have been found, as well as new technologies that can be built over it. Indeed, it is possible to interpret this diffusion method as a demand pull one, with developers adapting the solution to different markets where customers could benefit from embracing a distributed system, abandoning a centralised database holder, or could benefit from the stronger level of safety introduced by this paradigm.

This mixture of the two could indeed turn into the aforementioned right balance that could determine a winning business model, sustainable and profitable.

1.1.3 The emergence

Blockchain can spur innovations that address some of society’s most glaring inefficiencies. Issues such as cutting costs, reducing delays, and upholding the integrity of data need to be addressed.

Blockchain is a decentralized network of computers that securely stores blocks of data. It’s secure, fast and free of control by a central governing body. Thousands of independent computer systems uphold a blockchain network, improving the integrity and security of the data stored on that network.

This technology was born with the Satoshi Nakamoto paper but was able to develop itself and being so pervasive to be on the top of the news due to its aptitude in solving real-world challenges.

A list of potential inefficiencies that the blockchain technology can solve it is provided here and in the following pages but, resorting to the First paper published7, it is important as first thing to highlight the main reason why the Bitcoin and all the subsequent cryptocurrencies, tokens and blockchains have been created for.

“Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the

18

based model. Completely non-reversible transactions are not really possible, since financial institutions cannot avoid mediating disputes. The cost of mediation increases transaction costs, limiting the minimum practical transaction size and cutting off the possibility for small casual transactions, and there is a broader cost in the loss of ability to make non-reversible payments for non-reversible services. With the possibility of reversal, the need for trust spreads. Merchants must be wary of their customers, hassling them for more information than they would otherwise need. A certain percentage of fraud is accepted as unavoidable. These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party. What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party. Transactions that are computationally impractical to reverse would protect sellers from fraud, and routine escrow mechanisms could easily be implemented to protect buyers”8.

Among other main manifested emergences it is possible to point out:

- Double-spending9 is a potential flaw in a digital cash scheme in which the same single digital token can be spent more than once. Unlike physical cash, a digital token consists of a digital file that can be duplicated or falsified. As with counterfeit money, such double-spending leads to inflation by creating a new amount of copied currency that did not previously exist. This devalues the currency relative to other monetary units or goods and diminishes user trust as well as the circulation and retention of the currency. Fundamental cryptographic techniques to prevent double-spending, while preserving anonymity in a transaction, are blind signatures and, particularly in offline systems, secret splitting.

8 Citation from the introduction of the “Bitcoin: A peer-to-peer electroinic cash system” by Satoshi

Nakamoto.

19 - Manually filled health forms, take up a lot of time and often causes duplicate information to be provided to each network visited. Blockchain applications make accessing past healthcare records a quicker process, which reduces patient wait time and avoids duplication on records.

- Unsecured systems, the disconnect between networks and manual document management generate risk of privacy breaches. Data stored and securely encrypted on a blockchain network significantly reduces the risk.

- In real estate, the coordination of many stakeholders (banks, real estate agents, mortgage brokers, lawyers, etc.) is time consuming and costly. Blockchain technology requires less of a need for intermediaries. This results in less time and money spent on consultants to broker a transaction.

- Most of information is currently centralized and prone to manipulation between stakeholders. This increases the possibility of inefficient and potentially inaccurate sharing of information. A decentralized and open property market blockchain database where information is published by the public rather than a central body provides transparency around validity of property data.

- The manual voting, process is time consuming, expensive, and subject to delays and inaccuracies. Votes that are stored on the blockchain network are protected by encryption. This would also allow votes to be conducted on a smart device, which saves time and public resources. In addition, votes are processed efficiently and accurately, and results are published in a timely manner.

- Making data highly available requires investing in and maintaining redundant infrastructure. Blockchain technology makes the lives of IT administrators easier. They function as a decentralized database that automatically distributes data across nodes. This provides better data availability than a centralized database. It also doesn’t require an extensive investment in infrastructure to scale data hosting.

20 1.1.4 Financial industry special needs

At the Blockchain Symposium hosted by the DTCC (Depository Trust & Clearing Corporation), many financial industry participants gathered to discuss blockchain and its potential to fundamentally change the way data is shared in the industry.

The financial services industry is in ferment over blockchain; apart from the possibility of a shared distributed ledger, the technology is prompting the industry to start conversations about topics that were never discussed in the past. This is a rare moment that can lead to a reimagined infrastructure within the financial industry.

The proposed scenario is seen as a place where every participant does not have to write redundant code to integrate with the market infrastructure. The industry is bound to benefit if institutions can share code and build common libraries that every participant can leverage.

This open dialogue provides an opportunity for the industry to collectively reimagine the backbone of financial infrastructure. The back office has a range of needs and integrations which are developed in-house by institutions that spend a considerable amount of their budget on keeping the system running.

Although banks are joining hands and participating in consortiums, there are many challenges and unanswered questions surrounding blockchain implementation. In any case, some potential applications (and drawbacks) that could radically change the industry are included in the following list.

I. Financials10: within the specific financial industry, an industry that relies on acting as an intermediary in transactions, the distributed nature of blockchain could be seen as a major threat, but it also promises significant cost savings for incumbents. The main areas where blockchain can provide significant growth opportunities in the financial supply chain are:

i. Post-trade services: while typical stock exchange transactions happen in real-time, post trade services like settlement, custody, stock lending, and collateral management may take days. Blockchain can help reduce reconciliation and other operational risks;

10 Free interpretation of “Cryptocurrencies, beneath the bubble” report prepared by UBS AG and UBS

21 ii. Compliance: Blockchain can significantly improve the current

know-your-client (KYC) and compliance process across banks by creating digital identities for clients, inter-operable across multiple platforms and institutions. The process would also allow clients to control the kind of information that is shared with the ability to keep track of authorizations.

iii. Trade finance: blockchain can enhance trade finance services currently offered by banks by leveraging smart contracts, which can automatically trigger contingent payments. This would help free up capital, and boost efficiency particularly among small businesses and in emerging markets, where the bulk of transactions are still done on paper.

iv. Insurance claims: a major bottleneck in the insurance industry is the claims management process, where often there are disputes between customers and insurers, and between insurers and reinsures. Blockchain technology can solve the problem by stamping and auditing insurance documents, and also embedding smart contracts that could automate payments while once a payment-triggering event occurs.

v. Digital currencies: blockchain technology can be used to improve the inter-bank settlement system for existing mainstream currencies, by creating a digital cash system that would make payments via a ledger-based technology.

II. Digital payments11: Current commercial mechanisms for payment clearance rely on centralized ledgers to record all transactions and maintain account balances. The transaction is transmitted once from the transacting parties to the intermediary, checked for validity, and accordingly both accounts are adjusted. In a blockchain, the transaction is transmitted to all network nodes, which involves many more transmissions and more processing power and time. The transaction also becomes part of the blockchain, copied onto every member computer. This is slower and more expensive than centralized clearance and

11 Integrated mentioning the paper “Blockchain Technology: What is it good for?” By Saifedean

22 helps explain why Visa & Mastercard clear 2,000 transactions per second while Bitcoin can only clear seven. Bitcoin has a blockchain not because it allows for faster cheaper transactions, but because it removes the need to trust in third party intermediation: transactions are cleared because nodes compete to verify them, yet no node needs to be trusted. For any currency controlled by a central party, it will always be more efficient to record transactions centrally. Whether removing third party intermediation is a strong enough advantage to justify the increased inefficiency of distributed ledgers is a question that can only be answered over the coming years in the test of market acceptance of digital currencies.

III. Contracts12: Currently, contracts are drafted by lawyers, judged by courts and enforced by the police. Smart contract cryptographic systems such as Ethereum encode contracts into a blockchain to make them self-executing, with no possibility for appeal or reversal, and beyond the reach of courts and police. “The code is the law” is a motto used by smart contract programmers. The problem with this concept is that the language lawyers use to draft contracts is understood by far more people than the code language used by smart contract drafters. There is a lack of technical expertise to fully understand the implications of a smart contract, and even coders could miss software bugs. This all became apparent with the first implementation of smart contracts on the Ethereum network, the Decentralized Autonomous Organization. After more than $150m were invested in this smart contract, an attacker was able to execute the code in a way that diverted around a third of all the DAO’s asset to their own account. It would be problematic to describe this attack as a theft, since all the depositors had accepted that their money will be controlled by the code and nothing else, and the attacker had done nothing but execute the code as it was accepted by the depositors.

The DAO was the first sophisticated application of a smart contract on a blockchain, many others were born, but uncertainty still walk over the market;

12 Integrated mentioning the paper “Blockchain Technology: What is it good for?” By Saifedean

23 perhaps in the future where code literacy is far more common and code more predictable and reliable, such contracts might become more commonplace. IV. Database & record management13: Blockchain is a reliable & tamper-proof

database and asset register, but only for the blockchain’s native currency, and only if the currency is valuable enough for the network to have strong enough processing power to resist attack. For any other asset, physical or digital, the blockchain is only as reliable as those responsible for establishing the link between the asset and what refers to it on the blockchain. There are no efficiency or transparency gains from using a permissioned blockchain, as the blockchain is only as reliable as the party that grants permission to write to it. Introducing blockchain to that party’s record-keeping is only going to make it slower, while adding no security or immutability, since there is no Proof-of-Work. Trust in third party intermediaries must remain, while the processing power and time required for running the database increases. A blockchain secured with a token could be used as a notary service, where contracts or documents are hashed onto a block of transactions, allowing any party to access the contract and be sure that the version displayed is the one that was hashed at the time. Such a service will provide a market for scarce block space but is unworkable with any blockchain without a currency.

1.2 The functioning of the blockchain

In the previous pages this paper mentioned the concepts of distributed ledgers, blockchain cryptography and security, mining, proof of work consensus and smart contracts, without providing for any of those a fair description of what to they mean and why are important in the blockchain ecosystem.

In the next pages these concepts are summarized to allow the reader to become more confident with the notions underlaying the blockchain technology and the way it is functioning.

13 Integrated mentioning the paper “Blockchain Technology: What is it good for?” By Saifedean

24 1.2.1 Distributed ledger

A distributed ledger14 is a consensus of replicated, shared, and synchronized digital data geographically spread across multiple sites, countries, or institutions. There is no central administrator or centralized data storage.

Therefore, a distributed ledger is a record of information, or simply, a database, that is shared across a network. It may be an open, publicly accessible database or access may be restricted to a specified group of users. From a technical perspective it can be used, for example, to record transactions across different locations. The technology that makes this possible is referred as the “blockchain”. The name comes from the fact that some DLT (distributed ledger technology) solutions store all individual transactions in groups, or blocks, which are attached to each other in chronological order to create a long chain. This long chain is put together using a mathematical formula – complex cryptography – which ensures the security and integrity of the data. This chain then forms a register of transactions that its users consider to be the official record. In addition to blockchains, consensus ledgers are another type of DLT whereby, instead of grouping and chaining transactions, only the balance of members’ accounts is updated after each validation round.

Who can be member of a network depends on whether the ledger is a restricted or unrestricted ledger. In unrestricted ledgers, anyone can become a member, whereas in restricted ledgers, membership is limited. In both types, each member in the network may have access either to the entire ledger or only to part of it and in all cases can contribute with data.

In today’s decentralised structures, the majority of institutions have their own internal validation system for the reconciliation process, which is very costly. If records were kept and updated automatically on the ledger, it could save money. Another advantage of DLT is the possibility to automate contracts. Imagine having bought a ticket to a concert that is only refundable if the singer falls sick. With an automated, or “smart contract”, there would be no need to call the agency to get the money back if the

14 Free citation from various sources: Wikipedia, “Distributed Ledger Technology: beyond block chain”

by the UK Government Chief Scientific Adviser – focus by ECB, “Blockchain Technology: Principles and Applications” by Marc Pilkington, “The blockchain: a gentle introduction” by J. H. Witte, "Blockchains & Distributed Ledger Technologies" by Blockchain Hub.

25 concert is cancelled; it would just happen automatically. With DLT, “smart contracts” can be used to process transactions based on agreements of “if this happens, then do this…” and ownership of the underlying value or asset can be automatically transferred. The terms of the contract are written in computer language. It is like having a paper contract that can read itself and carries out the agreed terms as and when they come into effect.

1.2.2 Cryptography and security

Cryptography is the method of disguising and revealing, otherwise known as encrypting and decrypting, information through complex mathematics. This means that the information can only be viewed by the intended recipients and nobody else. The method involves taking unencrypted data, such as a piece of text, and encrypting it using a mathematical algorithm, known as a cipher. This produces a ciphertext, a piece of information that is completely useless and nonsensical until it is decrypted. This method of encryption is known as symmetric-key cryptography.

An early example of cryptography was the Caesar cipher, used by Julius Caesar to protect Roman military secrets. Each letter in a message was substituted with the letter 3 spaces to the left in the alphabet, this knowledge was essentially the key that encrypted the message. Modern cryptography works on the same level, albeit with far greater levels of complexity.

The code base for most ciphers are open source projects, meaning their code can be examined by anyone. The most widely used cipher in the world called is AES, this cipher is also used by the NSA, the United States intelligence agency, as the tool of choice for encrypting information. Therefore, the security of information recorded on a blockchain can be regarded to be as secure as some of the most sensitive secrets in the world.

In blockchain, cryptography is primarily used for two purposes: securing the identity of the sender of transactions and ensuring the past records cannot be tampered with. Blockchain technology utilizes cryptography as a means of protecting the identities of users, ensuring transactions are done safely and securing all information and storages of value. Therefore, anyone using blockchain can have complete confidence that once

26 something is recorded on a blockchain, it is done so legitimately and in a manner that preserves security.

1.2.3 Consensus protocol

Consensus protocols15 are one of the most important and revolutionary aspects of blockchain technology. They create an irrefutable system of agreement between various devices across a distributed network, whilst preventing exploitation of the system.

The distributed nature of the network requires untrusted participants to reach a consensus. In blockchain, consensus can be on rules16 or on the history of transactions17. The decentralised consensus on transactions govern the update of the ledger by transferring the responsibilities to local nodes which independently verify the transactions and add them to the most cumulative computation throughput (longest chain rule). There is no integration point or central authority required to approve transactions and set rules. No single point of trust and no single point of failure. Blockchain consensus protocols are what keep all the nodes on a network synchronized with each other, while providing an answer to the question: “how do we all make sure

that we agree on what the truth is?”

1.2.3.1 Proof of work

Proof of work18 (abbreviated to PoW) is a consensus protocol introduced by Bitcoin and used widely by many other cryptocurrencies. This process is known as mining and the nodes on the network are known as “miners”. The proof of work comes in the form of an answer to a mathematical problem that requires considerable work to be solved but is easily verified to be correct once the answer has been reached.

15 A protocol is a set of rules describing how the communication and transmitting of data between

electronic devices, such as nodes, should work. These rules need to be defined before any data is sent, detailing how the information will be structured and how each device will send or receive it.

16 That determine which transactions are allowed and which are not, the amount of bitcoins included in

the block reward, the mining difficulty, etc.

17 That allows to determine who own what

18 Free citations from Wikipedia, Bitcoin whitepaper by Satoshi Nakamoto, Blockchain basics of the

27 The only way to solve these mathematical riddles is through nodes on the network, running a long and random process of presenting answers on a trial and error basis. Technically, this means that the problem could be solved on first attempt, although this is extremely unlikely, to the point where it is practically impossible. This runs a mechanism similar to a lottery.

The answer is known as the ‘target hash’. A target hash is a number that the header of a hashed block must be equal to or less than for a new block, along with the reward, to be awarded to a miner.

1.2.3.2 Proof of stake

Proof of stake19 is the consensus algorithm used by cryptocurrencies to validate blocks. The system was initially suggested in 2011 and the first cryptocurrency to implement it was Peercoin in 2012. The main advantages of proof of stake are energy efficiency and security.

In a proof of stake system, the creator of the next block is determined by a randomized system that is, in part, dictated by how much of that cryptocurrency a user is holding or, in some cases, how long they have been holding that particular currency. Instead of computational power, as is the case in proof of work, the probability of creating a block and receiving the associated rewards is proportional to a user’s holding of the underlining token or cryptocurrency on the network.

1.2.4 Smart contracts

A smart contract20 is a computer protocol intended to digitally facilitate, verify, or enforce the negotiation or performance of a contract. Smart contracts allow the performance of credible transactions without third parties. These transactions are trackable and irreversible. Therefore, a smart contract is a system which automatically move digital assets according to arbitrary pre-specified rules.

19 Free citations from Wikipedia, Ethereum whitepaper by Vitalik Butherin, Blockchain basics of the

Lisk academy association

20 Free citations from Wikipedia, Ethereum whitepaper by Vitalik Butherin, “Ontology of Blockchain

Technologies: Principles of Identification and Classification” by Paolo Tasca, Thayabaran Thanabalasingham, Claudio J. Tessone

28 Proponents of smart contracts claim that many kinds of contractual clauses may be made partially or fully self-executing, self-enforcing, or both. The aim of smart contracts is to provide security that is superior to traditional contract law and to reduce other transaction costs associated with contracting. Various cryptocurrencies have implemented types of smart contracts.

Smart contracts are cryptographic "boxes" that contain value and only unlock it if certain conditions are met, it can also be built on top of cryptocurrencies21.

Without the need for human interaction, verification or arbitration, the software protocol is written so that conflicting or double transactions are not permanently written in the blockchain. Any conflict is automatically reconciled, and each valid transaction is added only once (no double entries).

Financial derivatives are the most common application of a smart contract, and one of the simplest to implement in code.

1.2.5 Cryptocurrency and Tokens

A cryptocurrency is a standard currency which is used for the sole purpose of making or receiving payments on the blockchain. For instance, the most popular cryptocurrency is Bitcoin. Altcoins are the various alternative cryptocurrencies that were launched after the massive success achieved by Bitcoin. Literally, the term means alternative coins.

Blockchain tokens like Bitcoin or Ether, are part of the incentive scheme to encourage a group of people who do not know or trust each other, to organize themselves around the purpose of a specific blockchain. Such crypto tokens are tradable and transferrable among the various participants of the blockchain and every native token of a blockchain network has its own token governance rulesets based on crypto economic incentive mechanisms that determine under which circumstances transactions are validated and new blocks are created.

Crypto tokens often are created using the standard templates like that of Ethereum network that allows a user to create his/her own tokens. Such blockchains work on the

21 Especially Ethereum with vastly more power than that offered by Bitcoin scripting because of the

29 concept of smart contracts or decentralized applications, where the programmable, self-executing code is used to process and manage the various transactions occurring on the blockchain.

In essence, the cryptocurrencies and altcoins are specific virtual currencies that have their own dedicated blockchains and are primarily used as a medium for digital payments. On the other hand, the crypto tokens operate on top of a blockchain that acts as a medium for creation and execution of decentralized apps and smart contracts, and the tokens are used to facilitate the transactions.

Crypto tokens are usually created, distributed, sold and circulated through the standard initial coin offering (ICO) process that involves a crowdfunding exercise to fund project development.

1.3 Industrial uses and real-world applications

Computers store and organize information on a database, mostly on relational databases that structure information in different tables that consist of columns and rows. These tables are stored on hard drives which can be accessed by servers over the internet. Challenging the increasing mole of data on their hard drives and computer processors, the companies that own the databases need to spend money designing, building, and installing faster computers and keep them safe. Given the expense involved in building and maintaining IT infrastructure at this scale, it makes sense that companies would want to monetize the wealth of information they’ve accumulated in their databases.

Blockchain technology challenges this power dynamic22. Blockchain is an alternative way to save and transmit data between computers, all while keeping it secure, private, and decentralized: an extremely safe database that isn’t owned by anybody.

Following this logic, in developed markets, blockchain can help corporations to fix their actual data systems and drive efficiency gains; in emerging markets, instead, blockchain technology could have a particularly big impact in building “trust” and allow countries to move to further stages of digital development.

22

30 From an interview to Jennifer Zhu Scott, Co-founder and Principal in Radian and Radian Blockchain Ventures:

“If the internet has enabled people to share and transfer information, then blockchain technology will enable people to share and transfer value. Regardless Bitcoin, […] blockchain has demonstrated it can create a decentralized peer-to-peer economy. This will empower and transform any online community-drive business, from e-commerce to social media. Blockchain will also change how people transfer and monitor online physical goods of value […] with tracking and tracing systems. […] Smart contracts have the potential to reorganize the utilities trade […]. For governments and large corporations, the applications and implications in identity, traceability, and decentralized transactions are reasonable […] and already reality in different industries”.

1.3.1 Banking and financials

Large banks are increasingly conducting tests of decentralized asset technology and implementing blockchain in business processes. Banks continue to invest in a variety of projects and start-ups that are developing blockchain-based solutions.

According to a study conducted by the Accenture consulting company, which specializes in strategic planning, over half of all top managers admit that blockchain is going to play a key role in the success of financial companies in the near future. Accenture analysts have found that the world banking sector will save up to $ 20 billion by 2022 through implementing blockchain.

Blockchain can solve a lot of problems continually faced by banks and financial organizations nowadays. Blockchain technology provides a high level of safety in storing and transmitting data, open and transparent network infrastructure, decentralization and low cost of operations. These impressive characteristics make blockchain a really promising and in-demand solution, even in the extremely conservative and restricted bank industry.