79

Eu and Usa sanctions and their impact on Russia:

a logical-qualitative assessment

by Massimiliano Di Pace

1Abstract

The paper asseses, under the logical point of view, if Eu and Usa sanctions may have had direct, relevant and measureable consequences on Russian economy. The conclusion is that, notwithstanding the start of Russian economy worsening coincided roughly with the inception of sanctions, these latter could not be the reason of such economic downturn. As a matter of fact, the nature of measures foreseen by the sanctions is such, that they could not produce any evident and relevant direct consequences on Russian economy.

Keywords: content of Eu and Usa sanctions, effects of sanctions, Russian economy. Jel classification: F51, E01.

Le sanzioni di Ue e Usa e il loro impatto sulla Russia: una

valutazione logico-qualitativa

Sommario

Lo studio valuta, dal punto di vista logico, se le sanzioni di Ue e Usa possano aver avuto delle conseguenze dirette, rilevanti e misurabili sull’economia russa. La conclusione è che, nonostante l’inizio del peggioramento dell’economia russa abbia coinciso approssimativamente con l’introduzione delle sanzioni, queste ultime non potevano essere la ragione di tale crisi economica. Infatti, la natura delle misure previste dalle sanzioni è tale, che esse non potevano avere nessun evidente diretta conseguenza significativa sull’economia russa.

Parole chiave: contenuti delle sanzioni di Ue e Usa, effetti delle sanzioni, economia russa. Classificazione Jel: F51, E01.

1 Professore straordinario in Economic Policy, Università Guglielmo Marconi in Rome.

Coordinator of the Mba in Russian language. E-mail: [email protected]

Introduction

As it emerged from the author’s personal experience meeting Russian academic representatives, many of them do not have a clear perception of the content of Eu and Usa sanctions aimed at Russia, and above all, they think that the worsening of Russian economy of the recent years is due (more or less) exclusively to Eu and Usa sanctions.

Nevertheless, the exact content of Eu and Usa sanctions are easily downloadable from internet, and precisely from European Union site, and from Us Department of State site.

Regardless the lack of information on the nature of sanctions, the feeling that sanctions hit badly the Russian economy is shared by the mainstream literature. Even if, as it will be recalled in par. 5, there is not a common assessment of consequences of Eu and Usa sanctions, all researchers take it for granted that sanctions influenced somehow economic trends in Russia, and partly also the European ones.

This paper is aimed at examining this topic from a different perspective, that is focussing the analysis on logical links between measures taken by Eu and Usa and Russian economic situation. Namely, if the effective content of sanctions might have influenced Russian economic phenomena (or not).

Therefore, this study starts from the detailed description of the exact content of sanctions, as they are outlined by the competent authorities (Eu Delegation in Russia for European Union and Department of State for Usa). The second step is the analysis of the evolution of Russian economy in the last years, starting from 2013, that is from the year before the inception of Eu and Usa sanctions versus Russia, which were the response to the actions taken by the Russian government in Ukraine in 2014.

The aim of this second step is to ascertain if, after the introduction of sanctions, the Russian economy changed its path.

The third step, the most important one, is the assessment, guided by logical considerations, if, and to what extent, the main measures envisaged by the sanctions might have affected the economic indicators (i.e. Gdp growth rate, inflation rate) describing Russian economy.

The fourth step is a short recall of some studies on consequences of Eu and Usa sanctions, so as to verify if there is a general agreed evaluation on the effects of measures taken by Eu and Usa on Russian economy.

The results of these steps will be reported in the last paragraph (Conclusions).

It is necessary to highlight that:

1. this paper does not take into account the consequences of restrictions on imports decided by Russian authorities, as response to Eu and Usa sanctions;

2. the assessment carried out in this paper is based on a logical-qualitative approach.

1. The Eu Sanctions

1.1 The Eu strategy on sanctions against Russia

The Eu sanctions versus Russian Federation are clearly outlined in Eu

delegation in Russia internet site

(https://europa.eu/newsroom/highlights/special-coverage/eu-sanctions-against-russia-over-ukraine-crisis_en).

As it emerges from the web page, the sanctions were introduced for a serious reason, that is the illegal annexation of Crimea and deliberate destabilisation of a neighbouring sovereign country (Ukraine) in 2014.

It is the case to recall that Eu did not recognise the annexation of Crimea by Russia. The reason is very simple: many countries have residents of different citizenship and coming from several countries, and it is unconceivable that a country can annex a part of another country for the reason that many dwellers of that area are their national citizen (of the annexing country, as it was the case of Russia).

Eu links the duration of the sanctions to the complete implementation of the Minsk agreements, aimed at solving the Ukrainian crisis. At the moment of delivering this paper (June 28th 2017), they were foreseen till

January 31st 2018.

1.2 The content of Eu sanctions

The sanctions implemented by Eu can be grouped in several categories: a) Diplomatic measures:

- exclusion of Russia from G8 (which became G7) meetings;

- suspension of negotiations over Russia’s joining the Oecd (Organisation for Economic Co-operation and Development, which gathers the most developed countries, based in Paris).

- 150 persons (whose list is available at the internet address above quoted);

- 37 entities, which are subject to a freeze of their assets in Eu.

The persons and entities targeted by sanctions are considered responsible for actions against Ukraine's territorial integrity, or for providing support to, or benefitting Russian decision-makers, which confiscated or benefitted from a transfer of ownership of entities in Crimea and Sevastopol, contrary to Ukrainian law.

c) Restrictions on economic exchanges with Crimea and Sevastopol: - a ban on imports of goods originating in Crimea or Sevastopol unless they have Ukrainian certificates;

- a prohibition to invest in Crimea. Europeans and Eu-based companies can no longer buy real estate or entities in Crimea, finance Crimean companies, or supply related services. In addition, they may not invest in infrastructure projects in 6 sectors;

- a ban on providing tourism services in Crimea or Sevastopol. European cruise ships may not call at ports in the Crimean peninsula, except in case of emergency. This applies to all ships owned or controlled by a European or flying the flag of an Eu Member State;

- a ban for the export or for the use in Crimea of goods and technology for the transport, telecommunications and energy sectors, or the exploration of oil, gas and mineral resources;

- a prohibition to provide technical assistance, brokering, construction or engineering services related to infrastructure in the same sectors as above.

d) Financial measures:

- Eu nationals and companies may no longer buy or sell new bonds, equity or similar financial instruments with a maturity exceeding 30 days, issued by:

• 5 major state-owned Russian banks; • 3 major Russian energy companies; • 3 major Russian defence companies;

• subsidiaries outside the Eu of the entities quoted above, and those acting on their behalf or at their direction;

- assistance in relation to the issuing of such financial instruments is also prohibited;

- Eu nationals and companies may also not provide loans with a maturity exceeding 30 days to the entities described above.

e) Trade measures:

Russia, covering all items on the Eu common military list, with some exceptions;

- prohibition on exports of dual use goods and technology for military use in Russia or to Russian military end-users, including all items in the Eu list of dual use goods;

- prior authorisation by competent authorities of Member States of exports of certain energy-related equipment and technology to Russia. Export licenses will be denied if products are destined for oil exploration and production in waters deeper than 150 meters or in the offshore area north of the Arctic Circle, and projects that have the potential to produce oil from resources located in shale formations by way of hydraulic fracturing.

f) Limitations of service provision: the services necessary for the above mentioned projects may not be supplied, such as drilling, well testing, logging and completion services and supply of specialised floating vessels.

g) Limitations to economic cooperation:

- suspension of Eib (European Investiment Bank) and Ebrd (European Bank for Reconstruction and Development) of new financing to Russian projects;

- suspension of Eu-Russia bilateral and regional cooperation programmes, except for the cross-border cooperation and civil society.

As it results from the above list, no Eu sanction is directed against Russian people or Russian companies, except the ones operating in Crimea, and few others operating in specific sectors (the ones quoted above).

In other terms the sanctions are precisely targeted, and of limited extent, and therefore cannot hit in a relevant and measurable way the economy of a large country as Russia.

2. The Usa Sanctions

2.1 The Usa strategy on sanctions against Russia

The Usa strategy on sanctions against Russia is clearly outlined in the

Us Department of State web page

(https://www.state.gov/e/eb/tfs/spi/ukrainerussia).

Sanctions are still operational at the moment of delivering this paper (June 28th 2017).

In short, United States wanted to increase diplomatic and financial costs of Russia’s actions towards Ukraine.

14 defence companies and individuals in President Putin’s inner circle, as well as imposed targeted sanctions limiting certain financing to 6 of Russia’s largest banks and 4 energy companies.

Usa also suspended credit finance that encourages exports to Russia and financing for economic development projects in Russia, and lately prohibited the provision, exportation, or reexportation of goods, services, or technology in support of exploration or production for deepwater, Arctic offshore, or shale projects that have the potential to produce oil in the Russian Federation.

These actions, in close coordination with Eu and international partners, sent a strong message to the Russian government that there are consequences for their actions that threaten the sovereignty and territorial integrity of Ukraine.

According to Usa authorities’ perspective, a secure Ukraine, integrated with Europe and enjoying good relations with all its neighbours, is in the interests of the United States, Europe, and Russia.

2.2 The content of Usa sanctions

The Usa sanctions are clearly described in the web page quoted at the beginning of this paragraph.

They are contained in 4 executive orders issued by the previous Obama Administration of Usa:

1) Executive Order 13660; 2) Executive Order 13661; 3) Executive Order 13662; 4) Executive Order 13685.

They are all downloadable from the web page.

The first Executive Order, the 13660, signed on March 6th 2014,

authorizes sanctions on individuals and entities responsible for violating the sovereignty and territorial integrity of Ukraine, or for stealing the assets of the Ukrainian people. The sanctions consists in the block of assets in Usa and in restrictions on the travel to Usa of individuals and officials who took part, or contributed, to the destabilisation of Ukraine, annexation of Crimea, misappropriation of state assets of Ukraine.

The second Executive Order, the 13661, issued on March 17th 2014, on

the account of deployment of Russian military forces in the Crimea region of Ukraine, foresees the blocking of property and travel restriction of

additional persons, that is officials of Russian Government, as well as persons or entities operating in the arms sector.

The third Executive Order, the 13662, issued on March 20th 2014,

expanded the scope of sanctions, consisting always in the freezing of assets and in travel restrictions to Usa, which now could include Russian companies operating in the following sectors: financial services, energy, metals and mining, engineering, and defence. It is up to the Secretary of the Treasury, in consultation with the Secretary of State, to decide which entities could be subject to the sanctions.

The last Executive Order, n. 13685, issued on December 19th 2014,

foresees as sanctions the prohibition of:

a) new investment in the Crimea region of Ukraine by a United States person;

b) importation into the United States, directly or indirectly, of any goods, services, or technology from the Crimea region of Ukraine;

c) exportation, reexportation, sale, or supply, directly or indirectly, from the United States, or by a United States person, of any goods, services, or technology to the Crimea region of Ukraine;

d) any approval, financing, facilitation, or guarantee by a United States person of any operation above quoted.

As it emerged from the analysis of Eu sanctions, Usa sanctions too have a limited geographical and sectorial scope, which cannot change significantly (and measurably) a large economy as Russia.

3. The evolution of Russian economy since 2013

The economic situation of Russia is described in detail by Imf (International monetary fund) reports, and more precisely, the data quoted in this paragraph about Russian economy are taken from 2 Imf reports:

1) World economic update, issued on January 16th 2017;

2) Staff report for the 2016 article IV (Imf Country Report n. 16/229) about Russian Federation, issued on July 2016.

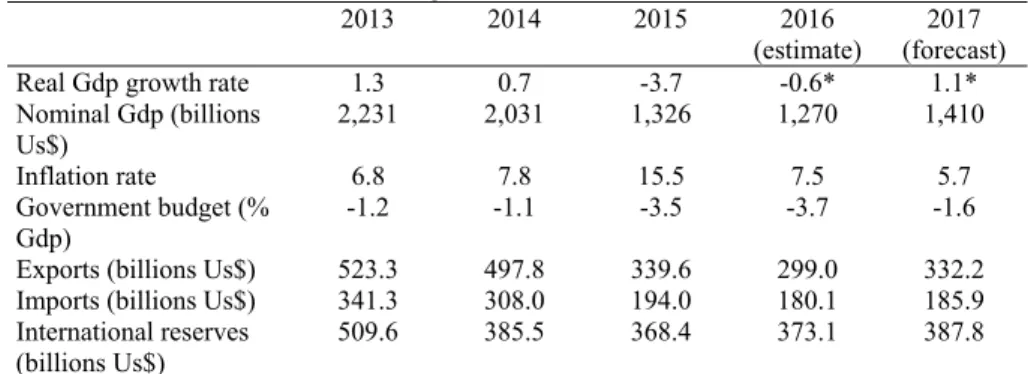

The data on Russian economy from 2013 to 2017 are reported in table 1. Using as benchmark 2013, the last year before the introduction of sanctions, it is possible to state that in 2014 and 2015 (whose data are definitive) the economic situation worsened in Russia under every view point (Gdp, inflation, Government budget, exports, reserves). The estimates for 2016 see an improvement for the Gdp growth rate and for inflation indicators (but still a worsening of the remaining indicators), while for 2017 is foreseen an improvement of all indicators.

This clarified, it is not said that limited measures, as the ones envisaged by Eu and Usa sanctions, could determine such a result.

Table 1 - Economic indicators relating to Russia 2013-2017

2013 2014 2015 2016 (estimate)

2017 (forecast) Real Gdp growth rate 1.3 0.7 -3.7 -0.6* 1.1* Nominal Gdp (billions Us$) 2,231 2,031 1,326 1,270 1,410 Inflation rate 6.8 7.8 15.5 7.5 5.7 Government budget (% Gdp) -1.2 -1.1 -3.5 -3.7 -1.6 Exports (billions Us$) 523.3 497.8 339.6 299.0 332.2 Imports (billions Us$) 341.3 308.0 194.0 180.1 185.9 International reserves

(billions Us$)

509.6 385.5 368.4 373.1 387.8

Source: Staff report for the 2016 article IV (Imf Country Report n. 16/229) about Russia

Federation, issued on July 2016

* Data from World economic update, issued on January 16th 2017

As a matter of fact, it is well known that many factors may influence an economy, and considering that Russian productive sector depends largely on commodities markets, it becomes very difficult, under the logical point of view, to support the idea that the worsening of Russian economic system was due to limited measures, such as the ones foreseen by European and American authorities, in the framework of economic and diplomatic initiatives against Russia.

4. Analysis of possible direct consequences of sanctions on

economic trends

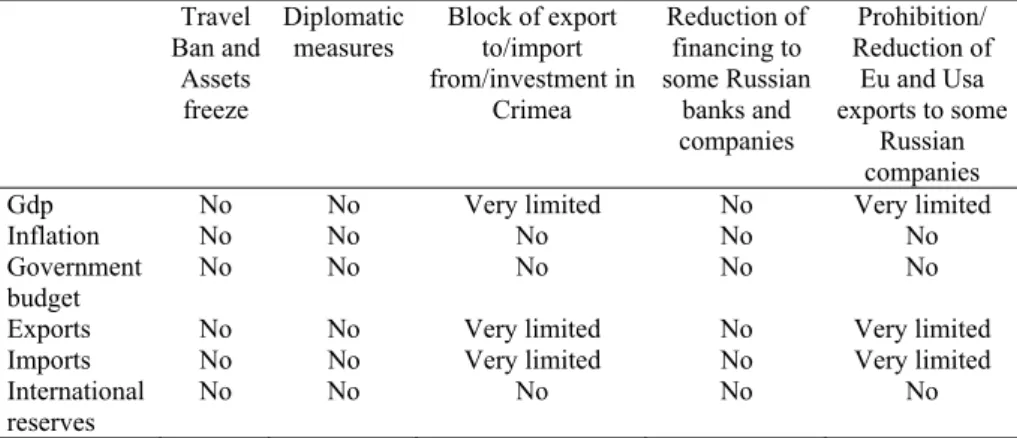

In this paragraph it will be assessed the potential harm on an economic system (in our case Russia) caused by the measures foreseen by Eu and Usa sanctions.

In order to facilitate this assessment, every measure foreseen by Eu and Usa sanctions is assigned to one of the following 5 homogenous groups of measures:

1) Travel Ban and Assets freeze2; 2) Diplomatic measures;

3) Block of export to/import from/investment in Crimea;

4) Reduction of financing to some Russian banks and companies;

5) Prohibition/reduction of Eu and Usa exports to some Russian companies (arms, energy, oil research, mining).

The next step is the choice of the main economic indicators describing the economic situation of a country (Russia).

It is reasonable, in order to set up a logical link between sanctions and economic situation, to choose the same indicators as the ones of table 1, that is:

a) Gdp growth rate; b) Inflation rate;

c) Government budget deficit; d) Exports (in Us$);

e) Imports (in Us$);

f) International reserves (in Us$).

Putting on lines of a table the latter and on columns of the same table the groups of measures envisaged by sanctions, it turns out table 2.

Table 2 - Potential logical effects of sanctions on (Russian) economy

Travel Ban and Assets freeze Diplomatic measures Block of export to/import from/investment in Crimea Reduction of financing to some Russian banks and companies Prohibition/ Reduction of Eu and Usa exports to some Russian companies Gdp No No Very limited No Very limited Inflation No No No No No Government

budget

No No No No No

Exports No No Very limited No Very limited Imports No No Very limited No Very limited International

reserves

No No No No No

Source: Author’s assessment

Table 2 highlights the potential direct impact on each economic indicator of every specific group of measures foreseen by sanctions.

2Persons and entities involved in Crimea annexation and some Russian government

It is the case to underline that this is the author’s assessment, and its nature is exclusively qualitative (and not quantitative).

The latter could be measured obtaining from the targeted Russian companies or Russian areas (Crimea) hit by sanctions an exact estimate of the cost brought about by Eu and Usa sanctions.

That said, and starting this analysis with the first group of sanctions (Travel Ban and Assets freeze), it is possible to state that these measures could not have any impact on any economic indicator, considered that it targeted few tens of persons and companies, whose weight on Russian economy is very likely much less than 0,1%. Considered that, probably, they did not lose all their economic activity, but only a part, it is clear that the effect of this first group of measures cannot have any influence on Russian economy.

The same consideration can be made for diplomatic measures, which have no potential influence on economic indicators.

On the contrary, the measures of the third group (Block of export to/import from/investment in Crimea) might influence 3 economic indicators (Gdp, Exports, Imports).

Recognised that, it cannot be denied that Crimea is a region which became part of Russian Federation (and its annexation was the main reason for sanctions), and therefore its economic activity, even if weakened by sanctions, represented an added value for Russian economy, and therefore this third group of sanctions could not reduce Gdp, nor Export/Import, nor International reserves of Russia, but, on the contrary, it has likely increased them, even if very slightly.

All in all, the third group of measures could not worsen the Russia’s economic system.

The fourth group of sanctions (Reduction of financing to some Russian banks and companies) could not have any direct impact on any economic indicator.

First of all, for the fact that just few enterprises had been hit by sanctions.

Second, even if in a very limited way, the sanctions might harm only under the condition that those companies could not find elsewhere the financial resources they needed. But this is not the case of Russian financial market, for the simple reason that Russia had a stock of domestic credit valued 818 billions of Us$ at the end of 2016 (Cia world factbook), not to mention that Russian international reserves at the end of 2016 were estimated in 365 billion of Us$ (Cia world factbook, which placed Russia

at the 7th ranking in the world for this indicator).

Therefore, it is not reasonable imagine that the few Russian companies targeted by sanctions could not find elsewhere the funds not provided by European and American financial institutions.

The last group of sanctions (Prohibition/Reduction of Eu and Usa exports to some Russian companies) might theoretically have influenced 3 economic indicators (Gdp, Exports, Imports).

In this case too, it has to be acknowledged that the restrictions were focussed on specific sectors (arms, energy, oil research, mining), and applied only to a limited number of companies.

A potential harm to these few companies might have taken place only under the condition that the reduced import of machinery and other industrial products could not be replaced by the same items, imported from countries not engaged in sanctions, or produced by domestic companies.

Better, the damage might have emerged only under the condition that the Eu and Us companies exporting to Russia detained a sort of world monopoly on those products.

To prove this condition (monopoly or impossibility to replace imported goods from Eu and Usa in those limited fields) is not easy, and in any case, not to be taken for granted.

In conclusion, even if the content of table 2 is simply the result of a logical consideration of potential direct effects of measures foreseen by Eu and Usa sanctions, it is difficult to state that 3 out of 5 groups of measures (Travel bans and Assets freeze of a limited number of individuals and entities, Diplomatic measures, Reduction of financing of a limited number of Russian financial companies) might have had any direct impact on Russian economic situation.

In the same way it is difficult to prove that the block on trade exchanges and investment from Eu and Usa in a very small area of the country (Crimea) compared to the rest of the country (Russian federation), as well as the prohibition or reduction of exports from Eu and Usa to some Russian companies operating in specific sectors (arms, energy, oil research, mining), might have had a direct impact on Inflation, Government budget, International reserves (owned by the Russian central bank).

On the contrary, it is likely that, even if in a very limited extent, the measures above quoted (Third and Fifth group of measures) might have had actually a negative direct influence on Gdp, as well as on Exports and Imports volumes.

But, as recalled at the beginning of the paragraph, a quantitative measurement of the direct influence of Eu and Usa sanctions on Russian economy’s indicators would require a precise enquiry carried out

examining targeted Russian companies, in order to quantify the damage they suffered, and therefore the influence of this damage on economic indicators.

It is difficult to imagine to carry out such an enquiry, at least without the collaboration of those companies and the Russian authorities.

5. Literature on the topic of effects of Eu and Usa sanctions on

Russian economy

Notwithstanding the apparently obvious considerations above outlined, many studies have tackled the topic of effects of Eu and Usa sanctions on Russian economy, with the purpose to quantify the damage caused by sanctions.

Anyway the search3 carried out by the author of this paper showed that there is no general agreement on the estimated harm suffered by Russian economy, even if all researchers executed an analytical assessment of the consequences of all specific measures foreseen by sanctions, on all main indicators of Russian economy.

Some researchers recognised that it is difficult to make an assessment of sanctions’ effect on Russian economy. For instance, Domańska and Kardaś (2016), in a commentary of the Centre for Eastern Studies4, admitted that, relating to the sanctions’ effects on Russian economy, “it is difficult to estimate their consequences precisely”. At the end of that paper the researchers concluded that “it will most likely only be possible to assess the full scale of this impact [of sanctions] in a few years’ time”.

On the same wavelength is the Congressional research service of United States. Nelson (2017), a specialist in international trade and finance, working for this service of Us parliament, admitted that “it is difficult to assess whether, and to what extent, the targeted Us and Eu sanctions in response to the conflict in Ukraine, and Russia’s retaliatory measures, have

3It has to be acknowledged that, considering the purpose of the present paper, the search

has not been conducted in depth, but was aimed at finding some studies, which showed different results, so as to confirm the assumption that there is not a shared view on the (negative) effects of Eu and Usa sanctions on Russian economy.

impacted the Russian economy broadly over the past two to three years”. That said, this researcher recalled that “many economists, including at the Imf, have argued that the twin shocks of multilateral sanctions and low oil prices were the major driver behind Russia’s economic challenges in 2014 and 2015”.

Actually the International Monetary Fund Staff Report on Russian Federation (2015) estimated that Us and Eu sanctions, summed up to Russia’s retaliatory ban on agricultural imports, reduced output in Russia over the short term between 1.0% and 1.5%, while over the medium term there could be a more substantial reduction of output by up to 9%.

Notwithstanding the difficulties, Gurvicha and Prilepskiya (2015), tried to make such an assessment, published in Russian Journal of Economics. After a very long and in depth exam of financial effects of sanctions, the authors declared, among several conclusions, that “According to our calculations, the total net capital inflow losses due to the sanctions from 2014 through 2017 will amount to 8% of 2013 Gdp (with low oil prices), whereas the accumulated Gdp losses are estimated at 6 p.p. of 2013 Gdp”.

A different estimate has been carried out by Kholodilin and Netšunajev (2016), using the structural VAR econometric model. According to these economists, who published their results in a discussion paper of the Deutsches Institut für Wirtschaftsforschung, “on average, 1.97% of the Gdp quarter-on-quarter growth is estimated to be lost due to sanctions by Russia”. Furthernmore, the two researchers declared that an indirect effect of the sanctions has been the adjustment of the real exchange rates, and presumably the depreciation of Russian Rouble.

An example of a study examining the effects of sanctions on a specific sector of Russian economy is the one carried out by Gros and Mustilli (2016). In a commentary published by Ceps5, the authors examined the effects of sanctions on the side of Eu-Russia trade flows (and therefore on economic costs to Eu), highlighting that the share of Russian imports from Eu had remained stable (at around 50% of the overall goods imported) until the end of 2015, notwithstanding the introduction of sanctions.

A similar study, but with a different conclusion, has been conducted by Crozet and Hinz for Cepii6 (2016). These researchers estimated in 60.2 billion of Us$ (between 2014 and mid 2015) the reduction of exports to Russia from 37 countries, including Usa, Eu, Japan. Furthermore, they

5A European think tank based in Brussels.

declared that “the bulk of the impact stems from products that are not directly targeted by Russian retaliations (taking the form of an embargo on imports of agricultural products). This result suggests that most of the losses are not attributable to the Russian retaliation but to Western sanctions”. Therefore, these economists, even if they did not make an assessment, share the streamline opinion that Eu and Usa sanctions played an important role on Russian economy downturn.

Summing up, there is not a general agreement on the size of effects of Eu and Usa sanctions on Russian economy.

Not being the exam of the literature on this topic an objective of this work, in case the reader is interested, he/she may examine further studies.

Conclusions

As it emerged from par. 1 and 2, measures foreseen by Eu and Usa sanctions could not have, under the logical point of view, a sensible (and measurable) direct impact on Russian economy, considering that they targeted few Russian companies for specific aspects (financing, sale of machinery and few other industrial products), as well as a very little area (Crimea), considered the size of the country (Russia).

Therefore, the worsening of Russian economy since 2014 (the year of implementation of Eu and Usa sanctions against Russia), highlighted by par. 4, is not logically linked to sanctions.

That said, the search of factors unleashing the depression of Russian economy has to be directed elsewhere.

It is not aim of this paper to investigate the causes of Russian economic downturn from 2014, which actually coincided with the introduction of sanctions.

That reminded, it is reasonable to think that the worsening of Russian economy is due in part to the psychological profound impact of sanctions on Russian citizens and economic operators, whose behaviour probably changed after the introduction of Eu and Usa measures, starting from losing confidence on the prospect of Russian economy.

A first signal of this change of expectations of Russian operators was the fall of the Russian national currency, the Rouble, whose loss of value at the end of 2014 was, necessarily, consequence of decisions of many Russians (mainly investors), who preferred to sell their national currency in order to buy Us dollars and Euros. This brought about the abrupt loss of

value of Rouble, whose exchange rate versus Euro and Us dollars plummeted to 50% of its previous value in few weeks.

As a matter of fact, the value of a currency is the result of the balance of purchases and sales of that currency, and it stands to reason that, Eu and Usa, not possessing huge quantities of Roubles to sell (not being the Rouble a reserve currency), had no role in this event.

A further reason of Russian economy downgrade is probably traceable in oil price fall, highlighting in this way the fragile structure of Russian economy, too depending on natural resources market prices.

In conclusion, it is author’s opinion that there was not a direct influence of Eu and Usa sanctions on Russian economy, while it is possible that those sanctions had an indirect impact, depressing Russians, or better, their economic expectations.

Anyway, the consequences of Eu and Usa sanctions have been for sure overestimated by Russians, a circumstance that probably did not spur the majority of Russian economists to look for real causes of Russian economy’s weaknesses, whose understanding represents the first step in a long path aimed at improving Russian economy, and consequently, Russian citizens’ well being.

Bibliography

Official documents: World economic update. Imf, issued on January 16th 2017.

Staff report for the 2016 article IV about Russian Federation. Imf Country Report n. 16/229, issued on July 2016.

Staff report for the 2015 article IV about Russian Federation. Imf Country Report n. 15/211, issued on August 2015.

Papers:

Crozet, M. & Hinz, J. (2016). Collateral Damage: The Impact of the

Russia Sanctions on Sanctioning Countries Exports. Cepii working

paper n. 16/2016.

Domańska, M. & Kardaś, S. (2016). The consequences of the

of the Centre for Eastern Studies, issued on March 24th 2016.

Gros, D. & Mustilli, F. (2016). The Effects of Sanctions and

Counter-Sanctions on EU-Russian Trade Flows. Commentary of

Ceps, issued on July 5th 2016.

Gurvich, E. & Prilepskiy, I. (2015). The impact of financial sanctions

on the Russian economy. Russian Journal of Economics, Volume 1,

Issue 4, December 2015.

Kholodilin, K. A. & Netšunajev, A. (2016). Crimea and Punishment:

The Impact of Sanctions on Russian and European Economies.

Discussion Papers of Deutsches Institut für Wirtschaftsforschung, issued on April 11th 2016.

Nelson, R. (2017). U.S. Sanctions and Russia’s Economy. Congressional Research service, issued on February 17, 2017.

Internet sites:

http://europa.eu/newsroom/highlights/special-coverage/eu_sanctions_en#5 for the content of Eu sanctions against Russia.

https://www.state.gov/e/eb/tfs/spi/ukrainerussia for the content of Usa sanctions against Russia.