POLITECNICO DI MILANO

School of Architecture, Urban Planning and Construction Engineering

Master’s Degree in Management of Built Environment

Economic Curriculum

BIG DATA ANALYTICS FOR REAL ESTATE ASSET

MANAGEMENT

Gabriela Menin Machado

Student ID: 894352

Thesis Advisor: Prof. Marzia Morena

Thesis Co-advisor: Dott. Tommaso Truppi

1

Politecnico di Milano Gabriela Menin Machado

BIG DATA ANALYTICS FOR REAL ESTATE ASSET MANAGEMENT

Advisor: Prof. Marzia Morena Co-advisor: Dott. Tommaso Truppi

MILANO 2019

3

Acknowledgements

First of all, I want to thank my father, my mother and my brother, for all the lessons, the love, the company and the unquestionable support you have had with me through all my life. Obrigada pai, mãe e Kayan, por tanto.

I would also like to thank professors Marzia Morena and Tommaso Truppi, for accepting my proposal, guiding me through the development of this thesis and assisting me on achieving this goal and Cristiano Rossetto, from Coima, who contributed since the beginning on this specific topic.

I state here also my gratitude for all my friends on the course, who helped not only on study groups and exams, but mainly made my days in Italy much lighter. I hope to see you all very soon in Brazil or anywhere else in the world.

A big part of this achievement is also thanks to my great friends from university in Brazil; Bianca, Paula and Flávia, who helped me literally since day one, suffered, celebrated and enjoyed with me every single accomplishment that we have had so far; the “piratas” that made my academic years much funnier, but also taught me so much about accepting and supporting each other no matter what. I wish all of us brilliant careers and I hope you know you can always count on me. I love you all. To all my old friends from life, especially Guta, for supporting me changing my path and being there for me when I needed it; Alice, for sharing her life with me even with the distance; Jordana and Jean, for being family away from home; among so many others that make my days brighter with their friendship.

5

1. Abstract

The present thesis has the aim of exposing and debating applications of big data analytics on the real estate sector, more specifically through the point of view of asset management, as a way to improve real estate funds‟ profits. It is developed in the following way.

Initially, an updated overview is presented on the real estate market with an explanation of the Proptech phenomenon – defined as technology-based platforms that facilitate the trade, operation, management and use of real estate assets on the market – following with considerable delay the trend of modernization of other important sectors of the economy. Next, a section is dedicated to depicting the concepts of big data and big data analytics, their growth in the last decade and the existing applications, focusing on the challenges faced by the companies in the general industry on implementing it.

Following is an overview of how data-based strategies have been utilized in the real estate industry, who are the key players globally that are already implementing it, with a forecast on potential areas to invest on further research. A deeper analysis of three key players on the market was also developed to exemplify the topic and its challenges. The first aims at democratizing real estate data by developing a centered collaborative database with token economy; the second provides more accurate valuations for properties in the United States based on a large amount of stored data and a platform that integrates machine learning, artificial intelligence and human expertise; the third and last one explored, uses cloud services and a centered platform to make it easier and faster to close deals and manage portfolios from anywhere in the world.

The conclusion states that the activity is already a reality in the sector and if the players aim on remaining competitive, they will need to adapt to it. The most critical issue on the present is the lack of a centered, standardized and reliable database to enable all the ideas to take off and make data accessible for all.

7

La presente tesi ha l‟obiettivo di esporre e discutere possibili applicazioni del big data analytics nel settore immobiliare, in particolare attraverso il punto di vista dell‟asset management, come un modo di migliorare i profitti dei fondi immobiliari. La tesi si sviluppa come segue.

Inizialmente, viene presentata una panoramica aggiornata del mercato immobiliare insieme a una spiegazione del fenomeno “Proptech” – ovvero le piattaforme basate sulla tecnologia per facilitare il commercio, funzionamento, gestione e l‟uso di asset immobiliari – seguendo con notevole ritardo la tendenza della modernizzazione di altri importanti settore dell‟economia. Successivamente, viene dedicata una sezione alla descrizione dei concetti di big data e big data analytics, alla loro crescita nell‟ultimo decennio e le applicazioni esistenti sul mercato, concentrandosi sulle sfide affrontate dalle aziende nell‟industria in generale per implementarle.

Di seguito, si presenta una panoramica di come le strategie basate sui dati sono state utilizzate nel settore immobiliare, quali sono i principali attori a livello globale che già le stanno implementando, con una previsione sulle potenziali aree in cui investire per ulteriori ricerche. È stata inoltre sviluppata un‟analisi più approfonfita su tre imprese sul mercato per esemplificare l‟argomento e le sue sfide. La prima impresa ha l‟intenzione di democratizzare i dati immobiliari con lo sviluppo di un database collaborativo centralizzato con l‟economia dei token; la seconda fornisce valutazioni immobiliari più accurate per le proprietà negli Stati Uniti sulla base di un‟enorme quantità di dati e di una piattaforma che integra il machine learning, l‟intelligenza artificiale e le competenze specialistiche; la terza e ultima società studiata utilizza servizi cloud e una piattaforma centralizzata per semplificare e velocizzare la conclusione di accordi e la gestione di portafogli da qualsiasi parte del mondo.

La conclusione attesta che l‟attività è già una realtà nel settore immobiliare e che se gli attori vogliono rimanere competitivi, dovranno adattarsi a questa innovazione. Il problema più critico al momento è la mancanza di un database centralizzato, standardizzato e affidabile per consentire a tutte le iniziative di decollare e fare l‟uso dei dati accesibile per tutti.

10

Index

Acknowledgements ... 3 1. Abstract ... 5 Index ... 10 List of Figures ... 12 List of Tables ... 12 2. Introduction ... 14 2.1. Proptech phenomenon ... 153. Big data and Data Analytics ... 20

3.1 Big Data ... 20

3.2 Big Data Analytics ... 22

4. Big Data Analytics on the Real Estate Sector ... 29

4.1. Examples of Big Data Analytics applications on the Real Estate Sector ... 32

5. Cases ... 43

5.1 Rebloc ... 43

5.2 House Canary ... 52

5.3 VTS ... 63

6. Big data on Real Estate: a Forecast ... 71

6.1 Advantages ... 75 6.2 Pitfalls ... 78 6.3 Opportunities ... 82 7. Critical Analysis ... 88 8. Conclusion ... 97 9. Bibliography ... 100

12

List of Figures

Figure 1 - Overview of the thesis structure 14

Figure 2 - Searches on Google for the term "Proptech" from 2009 to the present. An index of 100 corresponds to a peak of interest and lower indexes are relative to the peak. (Google,

2019) 16

Figure 3 – Uncertainty about Proptech (FTI Future:Proptech Research) 18 Figure 4 – Profile of respondents (FTI Future:Proptech Research) 19 Figure 5 - Broad nature of Big Data Analytics (Bilal, et al., 2016) 23 Figure 6 - Screenshot example of HomeSeeker application (Li, et al., 2018) 35

Figure 7 - Rebloc's logo 43

Figure 8 - Rebloc's problem overview (Rebloc, 2019) 44 Figure 9 - Rebloc's possible users (Salmanson, 2018) 45 Figure 10 – Simplified scheme on Rebloc’s activities (Rebloc, 2019) 46 Figure 11 - The Rebloc Indexer (Salmanson, 2018) 48 Figure 12 - Example of the mechanisms of the Geocoder (Rebloc, 2019) 49 Figure 13 - Example of a data explorer screen (House Canary, 2019) 53 Figure 14 - Example of Property Explorer (House Canary, 2019) 54 Figure 15 - Market explorer screen (House Canary, 2019) 55 Figure 16 - Services provided by House Canary (House Canary, 2019) 56 Figure 17 - Example of an Agile Suite result (House Canary, 2019) 57 Figure 18 - Historical prices analyses (HouseCanary, 2019) 59 Figure 19 - House Canary's accuracy (House Canary, 2019) 62 Figure 20 - VTS's Business Intelligence screenshot example (VTS, 2019) 64

Figure 21 – Asset plan reporting (VTS, 2019) 65

Figure 22 - VTS's tenant management screen example (VTS, 2019) 66 Figure 23 - Tenant updates & contacts (VTS, 2019) 67 Figure 24 - Competitive advantage from analytics declining (Ransbotham, et al., 2016) 72 Figure 25 - Reasons for difficulties with analytics (Ransbotham, et al., 2016) 73 Figure 26 - Lower running costs via smarter management (Bouriot, 2016) 84 Figure 27 - Scheme on analytics implementation (Du, et al., 2014) 85

List of Tables

Table 1 - Examples of companies that use analytics in Real Estate 41 Table 2 - Advantages and Pitfalls of big data analytics implementation 81

14

2. Introduction

According to the Cambridge Dictionary, real estate market is “the buying and selling of land and building”, which per se would correspond to an economic activity of great importance. In reality, the real estate market comprises not just selling but also leasing, and the different typologies of built assets make the market very heterogeneous and with specificities that deserve particular attention. Its importance to the global economy is undeniable and in fact, the variations on this sector are even used as a thermometer of the situation of a country‟s economy.

The real estate sector is crucial and closely related to the economy‟s growth and health. In 2018, investments in the global property market reached a record high of $1.8 trillion, despite the doubts on the economy (Summerfield, 2019). Focusing on the European region, the data is even more outstanding – almost a fifth of the GDP is related to the real estate sector (construction and trading) (Scenari Immobiliari, 2018) and Italy is between the top 5 countries for real estate influence in the economy, with 19% of the GDP related to the sector (Marchesini, E., 2018).

In this thesis, the focus will be on the branch of the real estate investment market called asset management. Asset management is “the direction of a client‟s cash and securities by a financial services company” (Kagan, 2019), focusing on real estate investment companies, that aim on developing a real estate property or portfolio maximizing their value or revenue for the owner (Scenari Immobiliari, 2018).

Real Estate Market

Innovation in Real Estate: Proptech Big data and analytics on Real Estate Market Big data and analytics on Asset Management

15

Over the past decades, improvements not only related to the real estate sector but for the general economy are moving towards the increasing use of technology in order to improve efficiency, reducing costs of production and negotiation and improving customer satisfaction. In the real estate properties‟ field, this modernization is arriving at a very slow pace when compared to other sectors, and this is, in general terms, related to the low level of specialization of most workers and to the inelasticity of the market – a change in demand for properties takes a long time to be absorbed by the industry and reflected into a change in offer. The trading of real estate assets, being strongly related to the construction sector, also follows with a slow pace towards modernization. This can be problematic when considering that real estate is the largest commodity in the world, and its efficient management could possibly evolve into significant economic compensations (Forbes Technology Counsil, 2018).

2.1. Proptech phenomenon

Proptech is a key topic at the moment for the actors interested in innovation on the real estate market. To make it simple, Proptech stands for all technological and digital innovations relating to property (KPMG, 2018). The term has its variations globally and can also be found with similar meanings as “RealTech”, “CRETech”, “ConTech” or “Real EsTech” and the differences among their definitions are vastly discussed. In the development of this thesis, only the term “Proptech” will be used to cover all these activities.

While innovation varies across industries, there is a unanimous element – technology and more broadly, data. The fusion of technology and data has enabled the rise of a new dynamic sub-sector of real estate – Proptech (Bangkok Post, 2018).

The “Proptech” term has emerged in 2005, but the late maturity of the market made the interest on it rise only from 2016 (Figure 2), showing how recent is the phenomenon on the market. It is important to point out that the term comprises all sorts of activities related to technological improvements in the real estate sector and in fact, startups and companies can be categorized as proptechs even if their activities are not related to each other, causing some misunderstanding about the use of the term.

16

Figure 2 - Searches on Google for the term "Proptech" from 2009 to the present. An index of 100 corresponds to a peak of interest and lower indexes are relative to the peak. (Google, 2019) The complexity in understanding and classifying the Proptech enterprises come from the significant number of emerging companies related to sector and the differences among them that aren‟t well defined or even established currently. There is, therefore, even a lack of terminology to approach their activities. Regarding this subject, Baum‟s “verticals” help classifying these companies and give a good idea on a first attempt to differentiate the initiatives (Baum, 2017).

Smart Real Estate: technology-based platforms that facilitate operation and management of real estate assets.

The heart of smart real estate is Smart Building that can be defined as an asset that runs efficiently through automated technology in its building systems, special tenants that look for this type of asset are particularly interested in the energy consumption of the properties. Delivering an asset with sustainable practices is now becoming a baseline and not a differentiation in the market. Information is therefore a driver for control and management that allows delivering this information effectively and accurately to the tenants. Predictions for the next years bet that investing not only in smart buildings (buildings that use technology in favor of the users) but also in buildings that support this technology – such as data centers or headquarters for technology companies – is a good idea given the accelerated growth in the sector (Breheny, 2019). 0 10 20 30 40 50 60 70 80 90 100 2 0 0 9 -0 6 2 0 0 9 -1 0 20 10 -02 2 0 1 0 -0 6 2 0 1 0 -1 0 2 0 1 1 -0 2 2 0 1 1 -0 6 2 0 1 1 -1 0 2 0 1 2 -0 2 2 0 1 2 -0 6 2 0 1 2 -1 0 2 0 1 3 -0 2 2 0 1 3 -0 6 20 13 -10 2 0 1 4 -0 2 2 0 1 4 -0 6 2 0 1 4 -1 0 2 0 1 5 -0 2 2 0 1 5 -0 6 2 0 1 5 -1 0 2 0 1 6 -0 2 2 0 1 6 -0 6 2 0 1 6 -1 0 2 0 1 7 -0 2 2 0 1 7 -0 6 2 0 1 7 -1 0 2 0 1 8 -0 2 2 0 1 8 -0 6 2 0 1 8 -1 0 2 0 1 9 -0 2

17

Shared Economy: technology-based platforms that facilitate the use of real estate assets.

The „Sharing Economy‟ represents an economic revolution built around the concept of sharing space and capital goods that emerged in the early 2000s (Baum, 2017). It has already impacted massively the transport industry, home, hospitality and even the services industry. Famous examples of companies grounded on the philosophy of shared economy are WeWork, Airbnb and Uber. This trend is changing and will continue to change the way people work, live, travel and relate, moving towards a higher sense of community and, in theory, more sustainable consumption habits.

Real Estate Fintech: technology-based platforms that facilitate the trading of real estate assets ownership.

Real Estate Fintechs concept comprises some different types of activities. Housing being the largest category of assets, tech platforms that support the match between the tenant/buyer and the property, making the search for a property go from offline to the online environment, were the first to arise in this category. There are also platforms that support not the interested in acquire the property (or a share of it) for its use but as an investment. In this category there are major innovations such as crowdfunding investments, equity raising platforms, digital platforms for remote investors, among others. It is in the real estate investment tech-supported platforms that this research will focus its attention on.

It is important to highlight that this classification excludes technology-based platforms that support the design or construction of buildings or infrastructure, considering this type of activity as “ConTech”. A good example of this would be the now widely used “CAD” software and variants as REVIT or Grasshopper, among others, that help professionals with a more efficient and accurate design and project of new assets. Even though these are technology-based platforms that support the real estate sector (in the construction/ design stages) they are not considered by Baum‟s classification as Proptechs.

With all the heating on the industry about what seem to be an infinite field to be explored and an enormous amount of data unused that could be converted into

18

better and faster deals, therefore more profitable investments, Proptech – specifically the ones related to big data and analytics – emerge as the innovation that is “expected to cause the greatest impact on the real estate industry for the next five years” (Proptech Monitor, 2018).

There is, though, a confusion among real estate company owners and managers about what to be implemented among so many new options arising and different approaches that promise to lead to a more efficient and profitable way of managing these properties. The limitations to its growth and consolidation on the market are mostly related to the lack of clear understanding of the benefits that they can bring and the uncertainty of the results of their implementation, in other terms, its profitability, more specifically to the actors related to asset/ property management and big data, as shown at the “Future: Proptech” research, where top figures of real estate companies were asked about their thoughts on the future for the industry (Figure 4; Figure 4).

Figure 3 – Uncertainty about Proptech – (FTI Future:Proptech Research)

0% 15% 18% 13% 21% 32% 30% 38% 77% 72% 0% 15% 14% 18% 26% 26% 34% 47% 72% 72%

There are no challenges Other Negative previous experience Inability to scale across the

organization Too many proptech options to chose

from

In-house technology solutions already in use

Cost of implementation Unsure of ROI Resistance to change Lack of understanding of the benefits

it can bring

Q: What do you believe are particular challenges for proptech organizations becoming fully embedded into UK real estate?

All respondents Working in proptech

19

Figure 4 – Profile of respondents – (FTI Future:Proptech Research)

“Such a pervasive lack of understanding around proptech’s ROI and benefits puts the onus on us to be very clear on the value proposition. The property industry is an extremely entrepreneurial one; if you’re able to articulate how you’re solving a business problem and delivering ROI in a way that the industry can understand, property owners, managers, and agents are going to respond. They want to invest in return on investment! […]”. Said Eoin Condren, the UK Managing Director at VTS on the same research. It is clear that big data analytics is the key to Proptech‟s development, and that in order to make changes acceptable on the market the return on the investments needs to be clear and certain.

Another research, related to big data application and circular economy, made with ten head figures on companies in Europe in the sectors of manufacturing, food, IT services, construction, real estate and infrastructure, found that Big Data Analytics is perceived to be a facilitator for decision making, as one respondent explained: “Data driven decisions will lead to more sustainable way of doing business though the percentage dependency on strategic decisions of data will vary from industry to industry”. Other respondents think that big data can have a positive impact in decision areas such as daily production and maintenance availability, manpower performance, health, safety and environment, and critical raw material availability status (Gupta, 2018).

Other recurrent data-related problem on the real estate sector is the lack of data transparency. Real estate transactions involve big amounts of capital and might be

45% 40% 18% 14% 15% 22% 15% 15% 11% 4% 7% 5% 4% 23% Software providers Big data Property management Leasing and asset management News/advice Artificial Intelligence Online agent - residential Virtual & Augmented reality Online agent - commercial Co-working Smart homes technology Lending - peer-to-peer/ crowdfunding Blockchain Other

Q: In which of the following areas do you particularly identify your organization's expertise?

20

strategic decisions for corporate investors and these transactions are therefore usually non-disclosure agreements. This particular aspect of valuable assets trading makes finding comparable properties and deals that help evaluating a new building on the market or an area to invest more difficult and the results less reliable or useful. A step towards data sharing and building a data base for the properties in the market and its past transactions is currently necessary for all the players in the market and could make the industry fairer.

With that in mind, the proposal of this study is to analyze the trend of using big data and data analytics, with an investor‟s point of view, to improve real estate investments management and maximize their profitability. What follows is an explanation of big data and data analytics and their current and potential applications for the real estate sector.

3. Big data and Data Analytics

As already mentioned, the key to the development of the real estate industry towards technology and therefore more effective transactions is data. Nowadays the technology to collect and process all the data that could cause this transformation already exists, such as space use, prices per zone, and investors‟ profile among other important information, but this data is not being used to generate value in the companies. In this topic, big data and big data analytics will be exposed in order to understand its current uses, potentials and limitations.

3.1 Big Data

Quintillions of bytes of data are generated every day (Lypchenko, 2018) in all fields of the modern industry. As early as 2000, in the first few weeks of Sloan Digital Sky Survey, the data size observed by telescope in New Mexico was bigger than that had been collected in the entire history of astronomy (Du, et al., 2014). Big data was defined by the Oxford English Dictionary as “data of a very large size, typically to the extent that its manipulation and management present significant logistical challenges”, more updated studies say that there is no rigorous definition to big data and it can be also considered as “the ability of society to harness information in novel ways to produce useful insights or goods and services of significant value” and

21

“…things one can do at a large scale that cannot be done at a smaller one, to extract new insights or create new forms of value” (Mayer-Schönberger & Cukier, 2013), moving towards the use of these huge amounts of data to generate new levels of data use creating extra value to all types of industry and services, including the real estate sector.

In the last decade, cloud computing and the IoT (Internet of Things) caused the so-called “era of big data” (Du, et al., 2014). Data centers are an outstanding investment option and workers claim to be feeling overwhelmed with the amount of information to be processed on a daily basis. That is the reason why algorithms for processing Big Data have become essential in order to keep dealing with this huge demand of data processing.

Because of its utilities, the industry of big data is growing rapidly. Wikibon, a market research company, forecasts a continuous compound annual growth rate (CAGR) of 11.4% each year, resulting in a size of $103 billion by 2027. Compared to $7.6 billion value in 2011 it becomes easy to notice the importance of paying attention in the industry and move towards it (Finance Magnates, 2018).

To understand Big Data, we need to separate it into two main categories: Big Data Engineering (BDE) and Big Data Analytics (BDA) (Bilal, et al., 2016). The former has the role of supporting data storage and processing, needed in analytics in order to understand and generate value from the data collected and organized (Provost & Fawcett, 2013). BDE most famous and currently in use alternatives are Hadoop and Berkeley Data Analytics Stack (BDAS). Big Data Analytics, on the other hand, aims at extracting knowledge from data towards a more conscious decision making process, BDA is more concerned with discovering patterns of the data and derive insights from them. The next section will approach BDA, what interest us the most, in a deeper level.

It is commonly said that Big Data has three defining attributes, also known as “3 V‟s”, those being volume (for the giant amount of data to be dealt with), variety (for the heterogeneity of formats such as texts, sensors, audio, video, graphs that it can warehouse and generate) and velocity (for the continuous and fast stream of data it

22

processes) (Bilal, et al., 2016). This section will explore how to deal with this data and generate value with its caption and storage.

According to managers that are already implementing the technology in their businesses, the effective use of big data provides advantages such as organizational efficiency, strategic direction, better customer service, identification and development of new products and services with potential on the market. Analytics has been for long in use in the market, but there are tangible differences between conventional and big data analytics, as big data involves the gathering, processing and analytics to unstructured data formats (Campos, et al., 2017), the analysis methods for big data is based on machine learning and generates flows of data of terabytes to petabytes. Traditional analytics is simply based on hypothesis-testing, the formats consist on columns and rows and the flow of data is substantially smaller, being easily interpreted and worked by a human being.

3.2 Big Data Analytics

From the Big Data exponential development in the last years and data mining activities rising up – defined as the practice of examining large pre-existing databases in order to generate new information, the use and interpretation of this information to generate insights is called Big Data Analytics. The term is defined as the analytical techniques in applications that are so large (from terabytes to petabytes) and complex that they require advanced and unique data storage, management, analysis and even visualization technologies (Chen, et al., 2012). The opportunities arising from big data analytics for organizations are considered pivotal: analytics has been described as „„the mother lode of disruptive change in a networked business environment” (Baesens, et al., 2014).

Big Data Analytics derives from a rich intellectual tradition and borrows from a variety of fields. Some disciplines very much known for a long time in science have the same objective: finding useful patterns in data. Those are: statistics, data mining, predictive analytics, business analytics, knowledge discovery from data (KDD), data analytics, data science and now big data (Bilal, et al., 2016). Big Data Analytics is therefore a broadening field of data analysis that incorporates many techniques from other disciplines, as shown on Figure 5.

23

Figure 5 - Broad nature of Big Data Analytics (Bilal, et al., 2016)

To anchor these concepts, follows a very brief explanation on each one of these disciplines:

- Statistics: The study of collecting, analyzing, and drawing conclusions from the data, with the primary focus of selecting the right tools and techniques at every data analysis stage. Rigorous and efficient techniques to answer research questions, also used in many fields to estimate or predict behaviors and outcomes (Wasserman, 2013).

- Data Mining: A technique that is concerned with the automatic or semi-automatic exploration and analysis of large volumes of data to discover meaningful patterns or rules. It has a broader scope than other traditional data analysis fields (such as statistics) as it tends to answer non-trivial questions (Fayyad, et al., 1996).

- Predictive Analytics: Is the branch of advanced analytics that makes predictions about unknown future events. It uses many techniques from data mining, statistics, modeling, machine learning and artificial intelligence to analyze data and make predictions about the future. The outcomes can be used to identify risks and opportunities for companies in the future (Kotu & Deshpande, 2015).

- Business Analytics: The skills, technologies and practices for continuous iterative exploration and investigation of past business performance to gain insights and drive business planning. A technique in use for a long time in the

24

market but that has gained a new meaning and grew in potential with the rise of big data (Vasconcelos & Rocha, 2019).

- Knowledge Discovery from Data (KDD): KDD uses findings from statistics, databases and artificial intelligence to construct tools for gaining insights from massive data sets. Its goal is to “turn data into knowledge”. A concept very close to data mining (Pazzani, 2000).

- Machine Learning: The technology instruments of Data Mining. It is defined by the International Organization for Standardization (ISO) and the International Electro-technical Commission (IEC) as “automatic learning, process by which a functional unit improves it performance by acquiring new knowledge or skills, or by reorganizing existing knowledge or skills” (Cattaneo, et al., 2018).

- Data Analytics: strictly connected to “Big Data”, incorporates more statistical thinking than Data Mining. It is composed of initial standard statistical techniques, such as visualization of data, then machine learning algorithms construct rules and statistical tests are used to validate them (Cattaneo, et al., 2018).

- Data Science: It is a broader and more generalist concept that means the use of scientific methods, process, algorithms and systems to extract knowledge and insights from structured and unstructured data (Dhar, 2013).

Big data analytics is already vastly in use by many different industries. In medicine, wearable trackers transmit information to doctors to inform if the patient took the medicine or if they are correctly following the treatment; in retail, it is used to gather information of what keeps the shoppers longer inside a store or how to attract the most valuable customers; in construction, analytics is used to track from material-based expenses to average time to complete a task, moreover, its use to make faster and more accurate materials quotation has proven to be effective; furthermore, in every existent industry there is a use for analytics and it is probably already implemented or under implementation nowadays.

With the development and growth of possibilities in the use of machine learning, the discussion around the necessity of human intelligence to generate the insights

25

needed from data analytics has been raised. Compared with statistical methods (as linear regression), machine learning tend to lead to more accurate predictions and results, however, there is an intrinsic trade-off between model interpretability and model complexity (Fan, et al., 2019). Machine learning models are very hard to depict and understand even for technicians, so the more sophisticated and data-driven the model, the less human interference is possible. This characteristic is an entry barrier for the technology on the market, as the main stakeholders tend not to trust or even accept a system they cannot depict and understand at the fullest. Therefore, there is a need to invest in human aspects of big data analytics, as it is necessary to manipulate the big data to be able to make it effective and useful for decision-making purposes (Campos, et al., 2017).

The whole discussion of data analytics has its bottom line on generating extra economic value for the companies that are willing to take the risks and implementing it. Economic value can be measured by an organization‟s increase in profit, business growth, and competitive advantage resulting from big data adoption (Davenport, 2006; Davis, 2014; Tyagi, 2003). It often comprises monetary benefits that are appropriated by organizations. For example, organizations that rely on big data to guide organizational strategies and day-to-day operations are expected to perform better financially than organizations that do not (Günther, et al., 2017).

However, high hopes and extensive publicity regarding big data do not guarantee the gaining of actual value, and may lead organizations to believe they can gain more value from big data than they are actually able to realize in practice (Ransbotham, et al., 2016; Ross, et al., 2013), because initial discussions about the phenomenon may be characterized by ungrounded optimism.

As Günther described at her literature review around big data value realization there are currently six main debates on the field of big data analytics, categorized in work practice, organizational and supra organizational fields (Günther, et al., 2017). They are:

26

On the work practice:

- Inductive and deductive approaches to big data analytics; related to big data implementation. In the inductive approach, depending on the level of detail and the variety of the data it can be difficult to foresee which insights can be accrued from several data sources previously (Aaltonen & Tempini, 2014; Constantiou & Kallinikos, 2015). Collecting this amount of data without a pre-defined purpose is considered an expensive exercise, demanding essential business focus that is not always deliverable. On what regards the deductive approach, it can cause a risk of confirmation bias, as the researchers can look for the specific data that proves the hypothesis already generated in the large data base, starting “from a general theory and using particular data to test it” (Bholat, 2015). Bholat also states that induction and deduction should be used in a complementary basis, not excludable, in order to achieve the maximum benefits from the use of the data bases.

- Algorithmic and human-based intelligence; algorithmic intelligence has gained popularity with the raise in big data and organizations are increasingly able to rely on artificial intelligence to analyze big data (Madsen, 2015). Furthermore, humans can be influenced by time constraints and skepticism with relying on data to interpret these outputs. On the other hand, human intelligence is important to examine data patterns, deploy and refine insights, or to solve problems on which the conditions are unknown. To prevent loss of value from the data bases, humans need to develop strategies to gain insights from the big data, that will continue to be developed to “have a human on the loop” (Jagadish, et al., 2014).

On the organizational level:

- Centralized and decentralized big data capability structures; studies how to structure technical and human resources for the best use of big data. While centralized structures might ease data governance and seem safer (Tallon, et al., 2013-14), the effectiveness have been questioned as it can be hard to connect to business and make it hard to convert insights in to value through

27

business units (Sharma, et al., 2014). A more decentralized system can help to combine different skills and engage analysts on the project to help managers dealing with data interpretation (Olbrich, 2014). Organizations may assess the synergistic benefits of centralized capability structures and recognize the need for specific expertise associated with decentralizing (Sidronova & Torres, 2014).

- Big data-driven business model improvement and innovation; startups are taking advantages of low barriers to entry and are able to set up new business models. For existing companies this might mean a necessity to rethink their business models and how big data may affect their organizations (Loebbecke & Picot, 2015). Companies can also generate value identifying new business segments and leveraging through big data to conquer new costumers and markets. In other words, big data allows organizations to radically alter their business strategies and move to new industry contexts (Woerner & Wixom, 2015). At the organization level, there is the debate about what appropriate organizational models can be developed and appropriate value from big data. The literature, though, appears scarce as how to achieve this in practice. This may not be surprising as limited evidence exists thus far in terms of cases where there have been improvements in or innovations to business models based on big data.

On the supra-organizational level:

- Controlled and open big data access; companies willing to take the risk and apply big data strategies need to rely on effective data exchange among their partners. Data sharing can be an issue for privacy and security concerns, and some actors might not be willing to open their data for strategic reasons. On an extreme case, data can even be modified intentionally to cause any reaction on the market (Madsen, 2015). As an effect, organizations will have to deal with the ethical and legal consequences of sharing and using data.

- Minimizing and neglecting the social risks of big data value realization; as an example, combining personal data sources can reveal very personal and sensitive information, generating concerns about privacy, identity theft, illegal

28

discrimination (Alshboul, et al., 2015; Ekbia, et al., 2015). Use of personal information for improving public control and safety can also be considered an attack to individuals‟ freedom, privacy and autonomy (Newell & Marabelli, 2015). This shows that apart from regulation, organizations will have to deal with public expectations and ethical considerations. Questions rise on how far consumers are willing to share their data in order to get a better experience on the market (Goes, 2014). The study shows that the current literature is still at a nascent stage in terms of explaining how organizations realize value from big data. A number of notable papers focus on „„paths to value” from big data, both from a theoretical (Sharma, et al., 2014) and an empirical perspective (Gao, et al., 2015).

Further issues are related to data non reliable, timely, complete or precise enough, what can lead to decisions based on wrong insights or affect the quality of the products and services developed (Hazen, et al., 2014). Additionally, even when insights from big data are developed in parallel with the development of appropriate organizational models, organizations may fail to realize value when they are unable to deal with stakeholder concerns (Clarke, 2016). Therefore it is crucial for organizations to constantly realign work practices, organizational models and stakeholder interests to realize value from big data. The current literature on this value realization is characterized by a limited number of empirical studies and some interpretation of old ideas.

Keeping these concepts in mind and understanding that Big Data Analytics can cross definitions and even use each of the tools presented together with traditional knowledge to achieve the results desired, the concept will be further analyzed and studied by the optic of the real estate sector.

29

4. Big Data Analytics in the Real Estate Sector

According to Forbes, big data adoption in general industry which stood at a minimum of 17% in 2015 is now standing at 53% (September of 2018). Even though investment and hedge fund firms were the first to dig into the alternative data trend, real estate industry is already studying the process, beyond just figures and finances (ScrapeHero, 2018).

The global real estate market is expected to generate revenues around USD 4,200 billion by 2025 (Grand View Research, 2018). Researches show that there is an increasing demand globally especially for housing properties, mainly due to rapid urbanization. A fast grow of countries like India, China and some African countries is also causing enhances on income levels, what reflects positively on the real estate market.

According to JLL, the transactions closed in 2018 were expected to sum USD 730 billion on the global real estate market and the amount of cross-border transactions in the global property market has increased to 32% in 2017 (Tranio, 2019), that means that international transactions are becoming each time more frequent and there are many possible improvements technology-wise that can help making these transactions faster and safer.

Adopting data-based strategies will enable the industry to broaden its market, facilitating for foreign investors to close deals from anywhere in the world. Valuations will be done more accurately based on the data shared or acquired, making the market fairer. Asset managers and investors will have a better control of their portfolios and their relationships with the tenants or clients. These innovations are useful for residential, commercial, industrial or any other type of real estate asset, as it improves the management and the information on the market.

As a multi-trillion dollar industry (Grand View Research, 2018), real estate actors rely on data to make important decisions. This data can be the property valuations in a specific area, the number of available homes in a neighborhood, the percentage of real homeowners on their mortgage, among others. Having access to this type of

30

data supports their business decision making process, but the key problem faced is that accurate and updated data is extremely difficult to find (UTB, 2018).

Real estate investors are quite aware of how much big data analytics can improve operational performance of their portfolios. The possibility to an asset manager to monitor in real time the energy efficiency, water consumption and maintenance of the properties can have a direct impact in the asset‟s efficiency, its attractiveness for the tenants and ultimately, on its market value. The benefits for the tenants are undeniable; it would be possible to save up to 20% with energy consumption, saving many thousands of euros annually for big property complexes (LMF , 2019).

As Du mentions on the survey of analytics in the Chinese real estate market, “in order to keep Chinese economic development in a sustainable, sound and rapid manner, it is very important for real estate enterprises to take full advantage of big data because of the status of real estate industry as a pillar industry of the national economy.” (Du, et al., 2014). In fact, this close relation with the national economy is not exclusively observed in China, but in the whole world, and optimizing the sector means generating a direct positive impact on the economy.

Currently, to have access to the data needed, there are three possible ways. First, there is a small chance that some relatable data is available publicly, but this type of data is often highly unreliable. The second option is to pay or subscribe to a data provider, and the problem in this case is that there is no transparency about the methods on which this data was obtained, forcing the buyers to rely exclusively on the reputation of the provider as a guarantee of the quality of the service. Finally, there is the option of using the data held by industry leaders, organizations that operate in the real estate industry, as these stakeholders have obtained data from primary sources, making it more accurate. The problem in this case is predictable, other players on the market will hardly share data that might help competitors, for strategic reasons (UTB, 2018).

On top of those scarce and limited options to access data, the valuable information needed to make these strategic decisions is often buried within several layers of unnecessary, confusing and unorganized data. In order to achieve the information desired, a lot of perseverance is needed to analyze a ton of data before being able to

31

make an insightful analysis (Dzhingarov, 2018), this makes the process expensive and time consuming.

The significant growth in data access and the possibility of gathering every type of information measurable makes room for development and even new revenue models. The current applications of big data in the sector already includes developers, agencies and property managers that might expand their domains with the use of technology for business model building, human resources management and optimization of expenditures, for example. Big data makes possible to manage properties in a more rational and personalized way, improving both investors‟ and clients‟ satisfaction (Du, et al., 2014), it benefits firms to diversify their investments and the new access to personal information changes the way of thinking and opens new revenue growth opportunities for realty enterprises.

The applications of big data and data analytics on a company needs to pass first for a questioning on which data is available and relevant in the wide range of possibilities of data to be collected and assessed in order to generate value for the different actors on the market. The most common data consulted by real estate stakeholders are geographic location, situation on economic development, urban planning and policy orientation, investment under construction, the land market competition, among others that help making wiser decisions of investments (Du, et al., 2014).

Transaction data for the real estate is already no longer months old, but days. When potential clients visit a property, they now come with a shortlist that uses data to match their requirement and compares it to similar products on the market. With new technologies gathering data more effectively than ever, it is possible to investors and companies to understand risks and opportunities in greater depth. The access to this information brings analysis that were first impossible in terms of volume, timing and accuracy, improving market transparency and making it possible to predict future behaviors (JLL, 2019).

32

4.1. Examples of Big Data Analytics applications on the Real Estate Sector

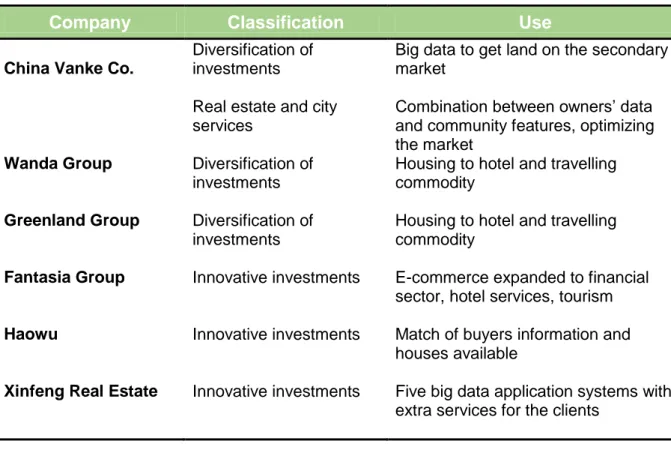

- Diversification of investments

The main use in the diversification is related to supply-demand analysis in order to buying land at the best price. China Vanke Co. concentrates on the residential market and picks data and land resources from third party; they develop an analysis with big data to get land in the secondary market, being able to deal with the rising land price (Xishang, 2010).

The applications of big data in diversified investment within the business-wide bring massive profits. Another innovative example are the Chinese companies Wanda Group and Greenland Group that use big data to expand their business from housing to hotel and travelling commodity service, exploring a market before unseen. In this case, the big data not collected at first may bring extra profit through professional analysis (Mayer-Schönberger & Cukier, 2013).

- Innovative Investments

A lot of data that at first was not considered relevant for the industry is now making way to insights and innovative investment ideas. Even though this data is not very structured, it has a great potential value that can mean new opportunities and benefits for real estate companies.

One example is Chinese Fantasia Group that developed a community of e-commerce combining commercial tenants with customers through app on cellphones, bypassing the need of a real estate agent. With the considerable amount of data they have available, a good marketing platform was created and the app is even expanding to new areas such as financial sector, hotel services, culture and tourism, making Fantasia a very unconventional real estate company (Fantasia Group, 2019).

According to a study by the National Association of Realtors, 51% of home buyers found their homes online in 2017 in the United States (ScrapeHero, 2018), a marketing strategy that is being broadly used on the industry. Indeed, many companies have been turning into e-commerce, developing the online market for real

33

estate assets, displaying some of the information usually searched by clients and all the information needed by request, making information much more accessible worldwide and personalized research for the potential buyer easier, as well as the interaction with an agent without the need of a personal meeting.

Famous companies in the United States as Trulia, Redfin and Zillow are working on processing real estate data and providing people with detailed information about surveys, lists of apartments/homes for sale/rent, maps with various filters and so on, with the aim of data democratization, giving people clear and authentic information, decreasing fraudulent and obscure schemes (Cleveroad, 2018). Zillow, for example, created “Zestimate tool”, that is able of estimating real home value and determine average market value in different regions. Machine learning can make predictions regarding future values on the market accurately, showing the importance of real estate data analysis. Besides, with the “iBuyer” tool, that accelerates the process for homeowners willing to get a lower price for their properties to be sold quickly, purchasing properties online is becoming simple, reliable and even trivial.

Other companies worldwide are also giving a step further over traditional online property trading, such as the Brazilians Quinto Andar and Zap, that are focusing on more flexible contracts, faster deal closure and on the iBuyer market, with remote investors that are benefitted from a transaction that happens entirely on the digital world (Oliveira, 2019).

Advanced filters for property research may include property particularities such as neighborhood features (universities, supermarkets, nightclubs, cinema and so on), crime rate (calculated using big data, of course) or educational levels (quality of the schools in the neighborhood, for example), information that can be easily accessed and display on the same screen, making the decision easier for the buyer (Cleveroad, 2018).

Another example of this practice is the company Haowu that acquired a huge number of buyers‟ personal information and established a big data warehouse, matched the buyers‟ demand with the houses available and accomplished to promote the sales successfully (Miles, 2013). Xinfeng Real Estate created five big data application systems, a resource decision support system, a house book network and an

34

automated assessment system are examples already running. The houses book network receives users‟ inputs of their conditions and will estimate not only the price of the houses available but other information such as loan and mortgage or transaction tax, combining online and offline services, offering a more complete experience online and centralized in one platform (Du, et al., 2014).

Realty Mogul creates bridges between small investments in real estate and investors via Internet crowdfunding, and this analysis and result is only possible with the use of big data. Enertiv, on the other hand, is a company that claims collecting better data, identifying the lowest cost strategy to capture the data needed, whether that is by their devices, buildings‟ sensors or other existing sources, and delivering valuable insights in order to generate value to its client, particularly by optimizing energy performance (Enertiv, 2019).

- Connecting real estate with city services

A use that Vanke also developed is related to building city support services, combining community logistics, medical services and pension with millions of property owners‟ big data, bringing great opportunity, making the city more connected and optimizing the market (Du, et al., 2014).

Another perspective under the same umbrella of the urban environment is the collection and analysis of geographical data crossed with economic development and urban planning orientation to forecast the investment potential in different regions. In this case the enormous amount of data available make up the inaccuracy (Mayer-Schönberger & Cukier, 2013) and the companies can take data-based decisions when analyzing investment options, reducing the risks of surprises throughout the process and improving their revenues.

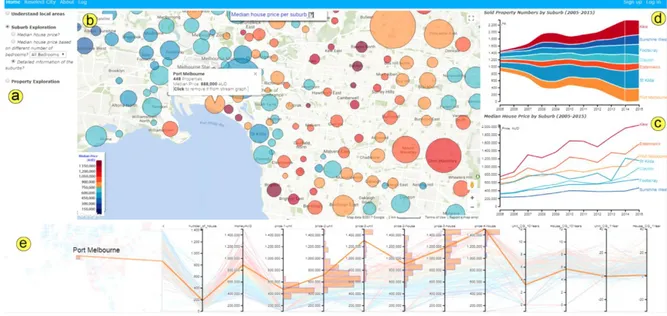

A great example of software developed to connect real estate property research by home-buyers with information about the city services in order to help in their choice is HomeSeeker. It is defined as “an interactive visual analytics system to serve users with different backgrounds of the local real estate market and meet different degrees of user requirements” (Li, et al., 2018). The developers of HomeSeeker identified that data in real estate e-commerce platforms was only related to the description of the properties themselves and a lot of useful geographical information for the user was

35

not captured, also, the existing platforms did not inform the user about the local real estate market and the design, usually presented in a map form, was not enough to support comparison in multiple aspects. They developed the platform aiming at solving these problems and providing a more complete and satisfactory experience for home-buyers in Australia.

Their work is mainly focused on data visualization, which is one of the biggest problems when applying big data analytics to any industry, in Figure 6 it is shown the interface created to display all the information available to the user in just one screen. According to the authors, the users were involved in the development of the interface and there are also explanatory tours and videos in order to help users in difficulty with the data visualization.

Figure 6 - Screenshot example of HomeSeeker application (Li, et al., 2018) - Quality of the service

Some enterprises like Gold Ground group and Green Ground Group in China developed new operations related to cloud service as well. Their focus, though, is customer‟s satisfaction psychologically with their homes and acquisitions instead of just the search for a shelter. Better services helps retain and attract good clients, turning into an increase in profits, a win-win situation.

Another example of focus on the quality of the service is Windermere Real Estate, an American company that plan the potential buyers with their commute routes and cost

36

of time, analyzing information from “one hundred million drivers‟ GPS” (Sonka & Ifamr, 2014), making the decision more accurate in terms of the best location of a home for each buyer.

Also Bowery is a technology-enabled appraisal firm that facilitates the buyer with precise points of data on every point necessary to appraising a property. It aims at simplifying the time-consuming assessment process for its clients, closing deals faster (James, 2019).

In Italy, Crif Res is a company that offers to banks a system of quick evaluation based on AVM (Automated Valuation Model) that allows to confirm and correct in real time a portfolio of real estate valuations (Lovera, 2018).

The New York-based VTS takes utilization of data to a next level. They gather crucial data, modify it into one source information and make it into an accessible commodity by any member of the team on any kind of device. This data is been used to improve workplace conditions in every aspect – illumination, quietness, special requirements, energy efficiency, air quality, thermal comfort, among other aspects. They claim to reduce up to 41% the deal cycle with their services (VTS, 2019).

The quality of the service offered also comprises the energy efficiency of the buildings invested. According to TFT consultant Thom Bouriot, 91% of asset managers believe that energy efficiency has become more important in their companies in the last 5 years and 53% consider energy efficiency as a top 5 priority when acquiring new buildings (Bouriot, 2016). That is caused by the fact that a high-performing building generates maximum profit by high and continuous rental income, low operating and maintenance costs and low depreciation.

Keeping these parameters in mind is reasonable to attest that data gathering and analysis is fundamental in order to measure the efficiency of a portfolio management and on which points it can be improved. A rich database of tenants/ buyers preferences and habits can be useful not just for landlords but also – and specially – for tenants/ buyers themselves. Some benefits that are derived from data analytics in this sense are:

37

Study of space use and how to improve it;

Reduction in maintenance costs with continuous monitoring;

Reduction on carbon footprint with an optimized use of space;

Attraction and retention of good staff for the tenant/ buyer;

Ultimately personalized experience on the property.

Besides, a wide use of data helps guarantee that the owners will price their properties accordingly to the market and will not lose any possible profit or request abusive prices. The interest of this study, though, is on the landlord‟s perspective, and the benefits that would result in higher return on their investments. Some examples of practices related to big data that impact positively on this indicator are:

Attraction and retention of good tenants, caused by a more accurate match tenant-property, based on the information gathered about demand and offer, reducing spare time between contracts when the property is not profitable;

Reduced vacancy, as data-based platforms make it easier and faster to find and close deals with customers interested on the portfolio of the investor;

Efficient design, in case of a new construction or refurbishment, based on clients‟ needs, can even improve the number of tenants on each property, increasing profitability;

Generate best allocation practices, assuring the right match customer- property and closing deals sooner, valorizing time value of the money and improving the liquidity of the portfolio;

Creation of feedback loops that assure the constant improvement of the relation with tenants/ buyers, increasing retention rates and incoming clients and generating good indirect marketing for the company;

Possibility of offering a service of space study with optimization of the property as an output, resulting in a smarter use of the facilities leased to the client and a possibly some vacant space to be leased to other tenants;

38

Blockchain as an alternative, in order to have even more accurate and reliable data about the property in analysis and make better data-based decisions. - Big data to promote sales

Big data can also be used to increase sales, as a data system can be built to categorize customers and extract useful information in order to develop more efficient marketing strategies (Juan, 2013). This can be done in a sequence of steps: categorize customers into classification groups, analyze the precise property demand for each group, match properties for potential customers, sell products and update the database, evaluate marketing effects and improve it, in a continuous feedback and improving loop (Du, et al., 2014).

The huge and precise sources of data can inform about customer location and effective marketing based on previous experience, this information can be used to implement precise marketing, to build a customer data system to categorize the customers and extract the useful information for improving this precise marketing (Juan, 2013).

Besides, on almost every market today consumers look for reviews of other clients before buying any product, and the real estate property market seems to be following the same trend of behavior.

A successful example of the sales promotion using big data is Trulia, an American company that released “Trulia Insight” software, a tool used to study customers‟ preferences and needs, their purchase history and financial statuses, by this tool, Trulia was able to quickly identify 72% of their customers that are ready to buy a house currently (Cleveroad, 2018). Based on the information this company is able to collect, clear insights can be generated on pricing, home-value trends and potential value of neighborhoods (Finance Magnates, 2018).

Another possible use of big data on the real estate is related to assessing the economic situation of a country. As recent researches have shown, there is a significant correlation between asset returns and the pricing factors, meaning that excess returns on real estate portfolio are statistically related to a good economy

39

situation (Shi, 2018). In this sense, big data on the profitability of real estate assets can be used as an economic indicator.

Moving towards a more technology-wise classification that improves various companies in their activities, there are initiatives in the market regarding:

- Virtual Reality (VR)

It is becoming popular among consumers and businesses for real estate. Companies forward-thinking are moving beyond photos or 360° videos and offering clients 3D virtual property “tours” on their devices. There are several opportunities with 3D aggregators on the market, but they all are in recent stages of implementation (Forbes Technology Counsil, 2018). One of the leaders for VR is the company Matterport that incorporates photos, videos and VR to allow user to navigate floor plans in a digital manner, making an “immersive” experience for potential buyers.

- The cloud

Other platform with a great impact on the closing process, as real estate deals tend to be long, inefficient and hard to deal, especially remotely. With cloud and better data management applications, the entire process can be streamlined for commercial and residential purchases, using even electronic signatures. Times as weeks or even months can be reduced to days.

A company involved with these activities for the real estate sector is Private Exchange Australia (PEXA), defined as “an online property exchange network”, helping customers like lawyers and financial institutions completing the financial settlements digitally (Forbes Technology Counsil, 2018).

- Blockchain

Blockchain is the subject when talking about cryptocurrency or bitcoin, that can certainly be utilized in the digital real estate industry, but also blockchain‟s security, transparency and efficiency innovations are what call the attention of realtors, as disclosure can be an issue when taking into consideration multi-million dollar transactions.

40

ShelterZoom is a realtor-founded company that focus on building Blockchain-based solutions for real estate space, making transactions more transparent to buyers, agents and sellers. From all technologies rising in the industry, Blockchain is certainly the newest one and is still in its early stages in the industry (Forbes Technology Counsil, 2018).

Other example is Fetch Blockchain, a London-based firm that specializes in blockchain technologies for land registries, government and property stakeholders, which also studies the use of cryptocurrencies for real estate transactions. They claim to be able to raise liquidity of this asset class, which is currently around 2,5%, by creating a foundation for securitization, tokenization and fractionalization of real estate (Faridi, 2019), meaning that the trade of information, money and property is entirely, and safely, done digitally.

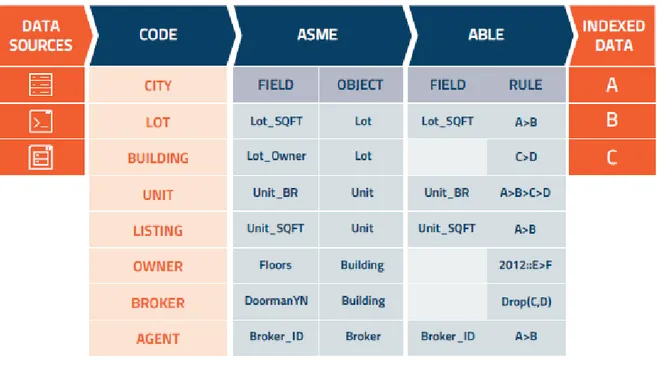

Rebloc is another Blockchain-based startup that looks forward to standardize real estate data with the mission of “democratizing real estate data”, allowing users to buy and sell valuable real estate data. Rebloc is building a system for all stakeholders in the market to benefit from not only using relevant and trustable data but also contributing and validating existing data for other stakeholders (Finance Magnates, 2018).

Propy is a disruptive company in the United States that operates properties in the US, Dubai, Spain and Italy. It is rapidly growing and its main innovation is the possibility of closing deals entirely using cryptocurrency-blockchain transactions, a pioneer for this type of transaction.

There is, though, a discussion whether Blockchain is in fact beneficial to the real estate market. Privacy is a critical concern for most clients, interference in data by other parties is also a concern due to the high value of the assets being exchanged, but Blockchain also reduces administrative costs and brings transparency, auditability and verification of the data in addition to improve data security. Therefore, Blockchain seems to be a fit for real estate transactions, but it certainly still needs to be improved and further developed in order to work properly for the real estate market.