1

Chapter 1

1. The Problem for Controlling Environmental

damages of the Energy Production Systems

Neoclassical economics is the tool of the current dominator-type set of political theories, in which the environment is simply a subsystem of the economy; a source of resources and a sink for wastes with its primary purpose being that of enabling economic growth to continue, implicitly without limit.

John Peet

1.1. Introduction

Energy problems, facing many of the world’s governments, demand a coherent solution. The urgency of the current crisis is driven by; (i) the continuous high oil prices, based on the scarcity of the resources and on the growing concerns of geopolitical problems,

2

(ii) the unavoidable need to reduce greenhouse-gas emissions, and (iii) the benign neglect that has characterized many national energy policies for the last years.

Criteria that are going to influence the evolution of the energy systems in the present century are complex. Typical objectives are security of supplies, exploitation of national resources and the need to preserve the environment. Therefore, the use of advanced technologies, for cleaner and more efficient use of the existing resources, together with the development of capture devices and storage technologies for pollutant emissions, and the support of renewable technologies have to be enlarged.

In relation to these targets, however, there are two well defined and confronted approaches; the economical approach and the technological approach. Mainstream economists, on the one hand, believe that the barriers for stabilizing harmful pollutants concentration in the atmosphere must be socio-economic and institutional. On the other hand, an alternative approach, mainly put forward by the engineering sciences, believes that the barriers must be basically technological. The technical approach claims that economic and political barriers can be surmounted by a commitment to finance and sustain the research and development into scaleable carbon-free energy technologies and sources1.

Pure economical and technological approaches are two extremes in a wide range of possible actions, where both views can be complemented. Indeed, interdisciplinary approaches to energy use and production are vital if, as expected, the world energy consumption will continue to grow.

The present chapter firstly introduces the existing energy-scenario perspectives followed by the different environmental problems caused by fossil-fuel energy conversion systems and finally provides an introduction of the main approaches, -economic, technical and regulatory- used to control the environmental impacts of the energy systems.

3

1.2. Current World Energy Scenarios

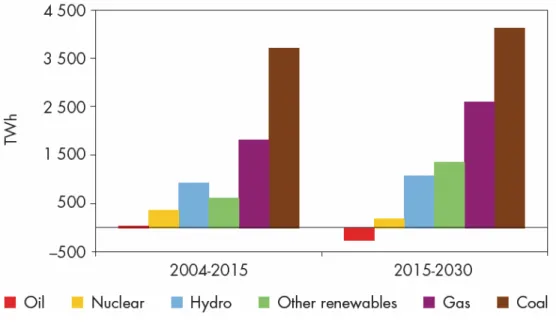

The projections derived from the Reference scenario of the world energy Outlook 2006 (WEO2006) indicate that world electricity demand is projected to double by 2030 in the reference scenario, growing at 2,6% annually on average2. Although contributions of

renewable and nuclear sources may increase, the International Energy Agency predicts that 85% of the increase in demand will be met by the greater use of fossil fuels, see figure 1.1.

Figure 1.1: Increase in World Primary Energy Demand by Fuel in the Reference

Scenario2

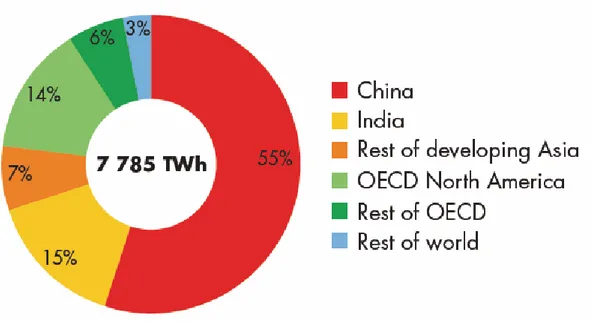

Developing Asia is the main engine of growth: China and India see the fastest growth in demand. Indeed, the future of energy supply is strongly subordinated to the greatest growth in energy demand that is taking place in these nations, where an increasing amount of population demands for an access to energy supplies, in order to attain the industrial countries standards of living, where an excess in the energy consumer manners is linked inevitably to welfare standards. Nearly 70% of the increase in the

4

world primary energy demand between 2001 and 2030 will occur in developing countries as well as in the transition economies2.

Furthermore, the electricity sector will absorb most of the future energy investments in order to meet the projected increase in the electricity demand and to replace the ageing infrastructure, see figure 1.2. The total cumulative investment in power generation, transmission and distribution over 2004-2030 amounts to $11.3 trillion2

(62% in the period 2004-2030 according to WEO2006). China needs to invest, most, some $3 trillion2. The prospects for investment in small, poor countries remain weak.

Figure 1.2: Investment needed worldwide in the power sector2

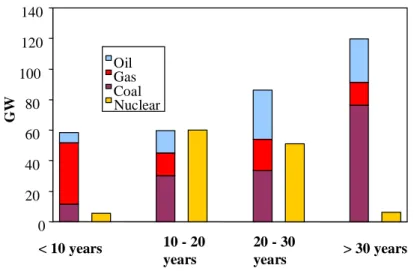

The forecasted for new global generating capacities are expected to reach 4800 GW over the period 2003-2030, where half of them will be in developing countries (most of them based on coal). Just in the Europe, nearly 2000 GW of new power plants will be needed. More than a third of the new capacity will be built to replace ageing power plants as it is shown for the European region in the figure 1.3.

5 0 20 40 60 80 100 120 140 G W Oil Gas Coal Nuclear < 10 years 10 - 20 years 20 - 30 years > 30 years

Figure 1.3: Age of installed capacity in Europe2

1.2.1. The Future of Coal

Coal retains the largest market share of the world’s electricity generation. Global coal demand in the reference scenario is projected to grow at an average annual rate of 1,8% between 2004-20303. Coal use rises by 32% by 2015 and 59% by 2030 (in tonnes, a

significant faster growth than in WEO-2005.

The share of coal on the power generation fuel mix increases, because of high natural gas prices and strong electricity demand, in developing Asia (86% of the total increase in demand), where coal is abundant. Indeed, Asia accounts for over three-quarters of the increase in coal-fired generation between now and 20302.

The share of installed coal-fired capacity accounts for 30% of total world generating capacity, see figure. 1.4. However, according to the Reference scenario, the overall capacity of coal-fired power plants will almost have to double from 1100 GW in 2003 to about 2000 GW in 20304. Taking into account the existing plants that will be shut

6

year builds 75 GW capacity of coal-powered plants). This doubling in capacity is the greatest expansion of power generation in the planet’s history5.

Unfortunately, just few of those planned coal plants are likely to be designed with carbon capture devices. Thus, in order to ensure that at least some of this huge amount of CO2 produced by the coal-fired plants doesn’t reach the atmosphere the least amount possible reaches Thus, in order to ensure that at least some of this huge amount of CO2 produced by these plants does not reach the atmosphere, both the strong political will and the active technological research will be required.

Figure 1.4: World incremental electricity generation by fuel in the reference scenario2

In the reference scenario of IEO2006, world coal consumption nearly doubles, from 5,4 billion tons in 2003 to 10,6 billion tons in 20306. Coal consumption increases by 3% per

year on average from 2003 to 2015, and then slows down to an average annual increase of 2% from 2015 to 2030. Regionally, the increased use of coal in non-OECD countries accounts for 81 % of the growth in world coal consumption projected over the entire IEO2006 projection horizon.

7

Coal is the most abundant non-renewable energy source available, and has traditionally made a big contribution in ensuring energy supplies, providing fuel for 37% of the world’s electricity generation. The total recoverable reserves of coal around the world are estimated at 1.000 billion tons7

, see figure.1.5, enough to last approximately 164 yearsat current consumption levels8

.

The advantages of coal over other fossil fuels are owed to; its geographical diversity across the globe (around half of the coal reserves are located in just three countries, the United Stated, Russia and china, but twenty other countries each hold substantial reserves of at least 1 billion tonnes), to a large number of players in the coal market and to its strong, highly competitive and expanding international markets. When comparing with other fossil fuels, international coal prices have had a strong track record of stability due to it’s wide availability in a politically stable regions.

8

However, coal as an input fuel for power generation systems must face major challenges. Nowadays, environmental commitments are increasing significantly, what is in fact a reason of the disputes of the role of coal in future world energy supplies. Coal in fact is the most CO2-intensive fuel (twice as much CO2 per kWh as Gas, 50% more than oil), but it also includes SOx, NOx, mercury, lead and PM. These considerations have triggered discussions over the wide use of coal, only if sequestration of CO2 emissions is practical and stable. This debate, which would otherwise hardly have occurred given its previously mentioned advantages, calls on foreseen regulation mechanisms.

The forecast for world coal-fired electricity generation, see figure 1.6, and its respective CO2 emissions, see figure 1.7, including reference and alternative1 scenarios emissions, will continue to grow rapidly over the next 25 years and this after taking into account energy efficiency gains and technological progress that can be expected under existing scenarios10. Indeed, if the future is in line with these present trends, there are evidences

to suggest that the vital role of coal in energy supply can not be neglected, emphasizing the lack of realism of those who advocated quick changes in energy mixes. So, either there is a big transformation in the way we use and produce energy, or the energy industry will satisfy the future growing energy demand -despite all its dialectic about new technologies- at least in the short-medium-term mostly with current fossil fuel technologies, where coal will remain the dominant fuel.

1 Alternative policy scenarios -ecologically driven- assume an unprecedented level of international

cooperation and understanding concerning the necessities of environmental and climate protection, requiring extremely high costs for restructuring the energy industry.

9

Figure1.6: Incremental coal-fired electricity generation by region in the reference

scenario, 2004-2030

10

The policy approaches that should be undertaken in order to replace these reference scenarios, also known as “Business-as-usual”, require extraordinary efforts, -technology breakthroughs, political will, research and development targets, and international cooperation such as Kyoto protocol-, that no government, without a global commitment, by itself has the disposition to accomplish them. Unilateral actions are very unlikely to affect the damage of global warming significantly. Nevertheless, since environmental problems will not produce uniform effects (gains and losses) across all countries, getting political agreement on targets and the allocation of emissions reductions among countries will also be difficult. The driving factors for these policies must built-in incentives of cooperation. This should include transferring resources as -technological, environmental, economical, political and social information-. Given these factors, economic incentives instruments as taxes and tradeable permits need to be considered. In this respect energy technology and economics should be complementary.

1.3 The Harmful effects of Fossil-fuel Energy Conversion Systems on

Human heath and the Environment

The most important undesirable consequences for the human health and the environment of energy conversion systems are based on the harmful effects of their pollutant emissions. The emissions, mainly produced at the combustion processes, are directly responsible for the major dangerous impacts, globally and locally speaking. The next part provides a brief outline of the foremost existing human/environmental concerns caused by the fossil fuels combustion in the energy conversion systems.

1.3.1. Global warming and the greenhouse effect

The United Nations has just released (2 February 2007) its long-awaited report on climate change, warning global warming is almost certainly caused by humans. "Warming of the climate system is unequivocal, as is now evident from observations of

11

increases in global average air and ocean temperatures, widespread melting of snow and ice, and rising global mean sea level," the report said. What little debate still existed regarding human causality for climate change has been squashes as The United Nation's Intergovernmental Panel on Climate Change (IPCC) has issued their strongest statement yet that "very likely" human activities(>90% chance) are changing the climate. “Most of the observed increase in globally averaged temperatures since the mid-20th century is very likely due to the observed increase in anthropogenic greenhouse gas concentrations. Global atmospheric concentrations of carbon dioxide have increased markedly as a result of human activities since 1750. The atmospheric concentration of carbon dioxide in 2005 exceeds by far the natural range over the last 650,000 years as determined from ice cores”. The report continues saying -“the global increases in carbon dioxide concentration, -being the most important anthropogenic greenhouse gas-, since the pre-industrial period results primarily from fossil fuel usedgas-, with land-use change providing another significant but smaller contribution” 11.

Most scientists agree with catastrophic climate changes, such as heat waves, stronger storms and melting icecaps that could raise sea levels by almost one meter by 2100 as the most predictable effects of global warming. In fact, the problem is very complex; damage effects can be anticipated, but their scale and severity is open to great uncertainty, so the policy response might have to be both anticipatory of and responsive to unexpectedly severe effects.

In this context, coal being the foremost CO2 intensive emission fuel will play an essential role. Indeed, the number of coal-fired power plants, whose CO2 is neither captured nor stored, is rising inexorably together with the levels of CO2 in the atmosphere.

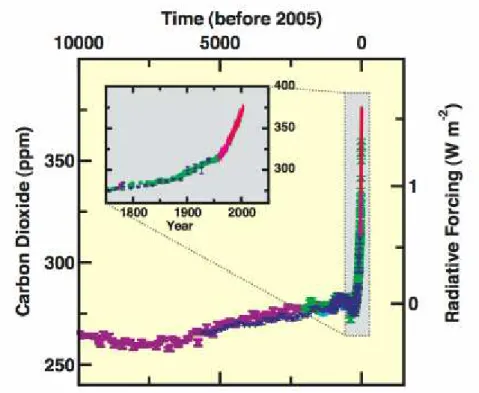

CO2 undoubtedly is the most important of the greenhouse gases, being responsible for around 60% of the human-induced greenhouse effect12. Meanwhile, climate scientists

are arguing that CO2 levels should not be allowed to get much higher that 550 ppm. The current level is 380 ppm., while in the pre-industrial era it is considered to be at 280 ppm., see figure 1.8. The curve in the figure 1.8 provides evidence for the rapid increase

12

in CO2 concentration since the onset of industrialization. This increase has closely followed the increase in CO2 emissions from fossil fuels13.

This growth can be partially explained by the anthropogenic CO2 emissions, the main source of which is fossil-fuel combustion for industrial use (releasing about 150 billion tones of CO2 since 17505). Additionally, other agents have also contributed to this growth; the great deforestation that has taken place in the last centuries (reducing the biological CO2 absorption capacities on earth) as well as different non-anthropogenic CO2 sources having the natural phenomena to contribute to this growth.

Figure 1.8: Changes in CO2 atmospheric concentration over the last 10,000 years

(large panel) and since 1750 (inset pane)l. Measurements are shown from ice-core and modern data11.

Probably, the climate change caused by the greenhouse gases is better understood if it is considered as a great obstruction to the thousand millions years process that the earth

13

has taken to transform its primary atmosphere, mainly constituted of CO2 into the current atmosphere composition, where the CO2 concentration was reduced to 280 ppm. The great part of this reduction was owned to natural carbon store systems. These systems were the oceans, where this primitive carbon still can be found, around 35 billions tones, and the capture and storage of carbon in the primitive photosynthetic plants. These archaic forests and lakes absorbed a large amount of CO2 converting it into O2, -increasing its concentration into the atmosphere-, and into carbon hydrates. A great part of this organic material was geologically sequestrated, stored in a permanent form, which has further on produced hydrocarbons; coal gas and oil depending on the raw material they were coming from.

The CO2 capture natural process was working perfectly, reducing the CO2 atmospheric concentration to around 280 ppm and originating the conditions for life in earth as we all know now. But as the industrialization took place, resulting in the intensive exploitation of hydrocarbon resources, mainly coal, gas and oil for the energy production and industrial use, the stored carbon was delivered to the atmosphere in form of carbon dioxide, which has continuously risen since the beginning of the industrial era.

In the last 120 years, energy production activities are increasing the rate of emissions and the concentration of the carbon dioxide in the atmosphere, and consistently all the primitive carbon that was stored into the earth’s crust is being released again to the atmosphere, hundred millions years later, without any control. This mechanism turns over the antique natural stored carbon process that begun hundred millions years ago, driving us to confront new atmosphere compositions.

Many climate scientists predict that CO2 concentration will reach 550 ppm in 2100. Even though, there are still many uncertainties about how this will affect the earth ecosystem, some consequences can already be recognized.

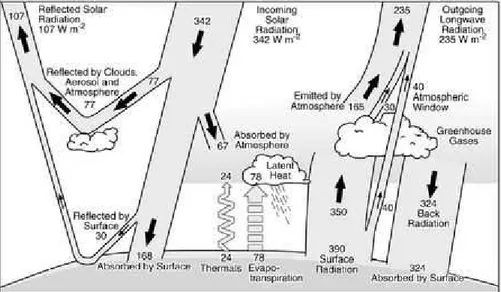

The principal consequence of the CO2 concentration increase in the atmosphere is the “Greenhouse effect”, see figure. 1.9. A number of gases, the so-called greenhouse gases –carbon dioxide, chlorofluorocarbons, methane and nitrous oxide, water vapor – that are

14

located in the earth’s atmosphere, absorb infrared radiation acting as a greenhouse that helps to trap the sun’s heat absorbed through the atmosphere. As these greenhouse gases raise their concentrations in the atmosphere, the total amount of radiation catch into the earth’s surface will increase, so the average temperature of the surface rises producing a global warming effect.

Figure 1.9: A schematic representation of the earth energy balance. Numbers are in

watts per square meter of Earth's surface, and some have a range of uncertainty of as much as +/- 20%. The greenhouse effect is associated with the absorption and re-radiation of energy by atmospheric greenhouse gases and particles, which results in a

downward flux of infrared radiation from the atmosphere to the surface (back radiation) and therefore, a higher surface temperature. Note that the total rate at which

energy leaves Earth (107 W/m2 of reflected sunlight plus 235 W/m2 of infrared [long-wave] radiation) is equal to the 342 W/m2 of incident sunlight. Thus, Earth is in

approximate energy balance in this analysis14

Currently, fossil fuel burning accounts for about 60% of annual carbon dioxide emissions that together with the already mentioned deforestation, also playing an

15

important part as reduction of the absorption possibilities, claim for new energy policies in order to preserve the existing atmospheric conditions for life.

Although, carbon dioxide concentration will continue to increase over the next years, long-term future atmospheric carbon dioxide concentrations will depend primarily on policies allowing switching to carbon-free fuels, increased energy efficiency, CO2 capture and sequestration technologies (broadly developed in next chapter) and extensive energy conservation measures.

1.3.2. Acid rain

The acid rain gets its name from the solutions of sulphur oxides SOx, (SO2 and SO3), nitrogen dioxide NOx and chloride (Cl-) in their acid form. The conversion to acids occurs in the atmosphere, in clouds and rain droplets, causing the resulting sulphuric and nitric acids to fall as an acid rain. The main sources of SOx and NOx emissions are the fossil-fired power stations. The SOx is produced by burning coal and oil with high sulphur content, while the NOx is formed at the combustion processes.

Acid rain is implicated in several types of damages; damages to buildings, to forests, to crops, and to land base flora and fauna, reducing local biodiversity. SOx and NOx are also implicated in respiratory diseases. A major concern is the acidification of lakes and the effects on fish populations.

Controlling acid rain is essentially an issue of international bargaining and cooperation because; emitters and recipients differ. In this sense, the international community has responded to the problem with uniform limits to acids gases concentration in flue gases and transferable emission permits. This is certainly possible thanks to the development of diverse abatement technologies for capturing the acids gases present at the fuel gases of combustion processes. A brief overview of the main commercial technologies is presented in the next chapter.

16

1.3.3. Particulate Matter (PM-10)

Particulate mater is a collective term used for very small solid and/or liquid particles found in the atmosphere. They can collectively appear as black soot, dust clouds, or grey hazes.

One of the major sources of atmospheric particulates is solid fuel combustion processes, which produces ash and soot.

The effect of particulates on human health and the environment varies with the physical and chemical makeup of the particulates. Fine particles (PM-10) may contain substantial quantities of sulphate, ammonium, nitrate, elemental carbon and condensed organic compounds. Carcinogenic compounds and heavy metals such as arsenic, selenium, cadmium and zinc are also concentrated in these particles.

Studies of air pollution on health have linked particulate matter (alone or in combination with other air pollutants) with a number of significant health effects. These include increased mortality and aggravation of existing respiratory and cardiovascular diseases. Particulate matter causes also ecological damage. It is a major cause of visibility impairment by scattering and/or absorbing light. Particulate matter can damage vegetation both directly and indirectly

1.3.4. Mercury

Mercury is a potent neurotoxin, which in general is exposed to the population through inhalation and consumption of contaminated food or water. Coal burning power plants are the largest source of mercury emissions related to human activities in the industrial countries.

Releases of mercury in the air may settle into water bodies and affect water quality, contaminating fresh and saltwater fisheries. The exposure to methylmercury, the most toxic form of mercury, comes primarily from the consumption of contaminated fish and selfish.

17

The effects of mercury on the environment have focused almost exclusively on wildlife impacts that in the same way as in humans, results mainly from the consumption of contaminated food.

1.4. The question for mitigating the environmental impacts of the

energy production systems

The quantitative tradition in economics has enabled researchers to internalize environmental elements as costs into the analysis. Nevertheless, in integrating economic and environmental models, some methodological problems are usually met, such as differences in time and spatial scales and differences in measurement levels of relevant variables.

The question of environmental accounting of energy production systems could be faced by different approaches. Indeed, there is an ongoing debate about how these different environmental approaches will be implemented; either by economic policies, internalizing environmental externalities (e.g. taxes, subsidies, price supports) or regulatory policies (e.g. government regulations, performance standards, implementation of advanced clean technologies or capture sequestration technologies).

The core of the debate is whether the means to achieve friendly environmental energy production systems should be socio-economic or technological. A guideline in the accounting of the environmental impacts is shown below in figure 1.10, and developed in the following sections.

It can be seen that a regulatory approach taxing the output of the power system, namely the emission, propose solution as the use of capture technologies or low emission fuels as natural gas, without much taking into account the use of the resources. While the carbon taxes applied to the input, namely, the coal contain in the fuel is the only one to propose a reduction in the resource consumption and therefore a new economic models, where the economic growth is disjoined of the energy growth.

18

Internalization of the external costs

Subsidy

Higher efficiency

Correct used of

energy resources fuel decarbonization,

Pollutant capture and sequestration

Regulation “command and control” Opportunity for Developing of

New Clean technologies

Environmental taxes Regulatory Approach Eco-efficiency Economic Approach

Figure1.10: Different approaches for the environmental-impact accounting of energy

conversion systems.

Whatever, each approach has its advantages and limitations and a combined approach has much to commend it. Indeed, non of these three approaches, separately, seems to give a convincing answer to pollution control in energy conversion systems, still requiring dynamic financial and policy efforts by both the public and the private sectors and unprecedented co-operation between developed and developing nations.

The mechanisms to be adopted should collectively accelerate energy efficiency improvements, to deploy the most cost-effective available technologies, and to promote the use of emissions-free technologies.

19

1.5. Economic approaches to reduce emissions from energy production

systems

Environmental economics assumes that the environment provides resources (renewable and non-renewable), assimilates waste, and provides aesthetic pleasure to humans. Nevertheless, the market system fails to correctly evaluate the efficient use of unpriced environmental resources and to differ between -“critical natural capital”- resources that cannot be substituted, and other environmental resources that can be exploited because of substitution possibilities. The market failure arises because it only takes into account the market price of a resource when the resource is used to produce a profitable product15

. Traditionally, the value of a resource was not recognized because there is no market (to establish a price) which is why there is a market failure. Therefore, when markets fail, the result will be inefficient or unfavorable allocation of resources. Since economic theory wants to achieve efficiency, environmental economics is used as a tool to find a balance in the world’s system of resource use.

Economists have long advocated public policy intervention for environmental protection. The main argument for that is that pollution is an externality - an unintended consequence of market decisions, which affects individuals other than the decision maker – or, in other words, it represents the uncompensated side effects of human actions. This incurs no internal cost upon the producer but it does create an external cost upon the society. These external costs account for environmental contamination, causing biological and other changes in the ecosystems, and as a consequence producing harm or damage to animal, plants and people involved. In economic parlance, there is an uncompensated loss of social welfare due to the imposition of the external cost related to the emissions to the air, discharge to water, etc.

The use of environmental policy is provided by the existence of these environmental externalities, namely, the impacts on the environment which are side-effects of processes of production and consumption and which do not enter the calculations of those responsible for the processes. A range of different economic approaches has been

20

developed to control the pollution, including instruments such as products charges, pollutants disposal taxes, tradable pollution permits, subsidy system and deposit refund systems. Therefore, the use of the market to protect the environment can be performed in two ways; (i) the imposition of economic taxes/charges to the pollutant substances, in order to force their producers to reduce their emissions, where charges are usually imposed by a public administration16

, or (ii) the implementation of subsidies or fiscal revenues in order to provide incentives for cleaner technologies that have not yet reached the economy of scale of long-established energy production technologies. However, since markets in reality do not function as perfectly as in theory, the external costs might only be partially internalized.

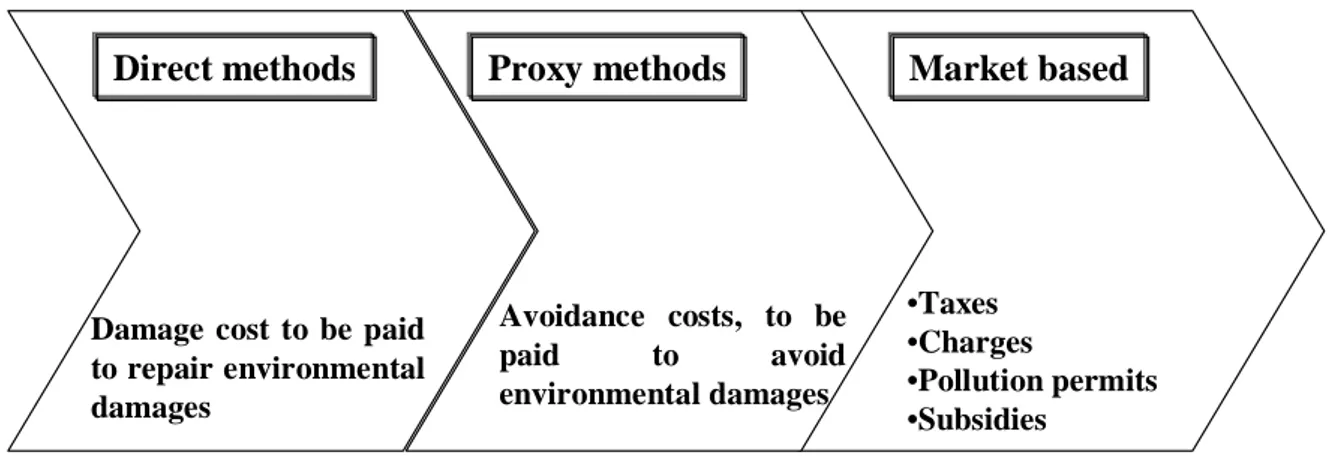

The most used approaches in the literature for estimating the externalities are direct and proxy methods and for internalization of externalities - market based methods, shown in figure 1.11.

Figure 1.11: The foremost economic instrument approaches that can be applied for the

environmental-impact accounting in energy conversion systems

The Direct methods are a very controversial issue, since required mechanisms that are not always available. There are many damages caused to the environment that are irreversible, that is, they can not be repaired. The avoidance methods are all the methods

Damage cost to be paid to repair environmental damages Direct methods Avoidance costs, to be paid to avoid environmental damages Proxy methods •Taxes •Charges •Pollution permits •Subsidies Market based

21

related to prevent the damages, e.g. the capture and storage technologies used to mitigate CO2 emissions. The impact on capital cost of the introduction of CCS technologies in power plants in $/kW can reach values of about the 75%17.

Among the different economic instruments, market-based is the most used method for internalizing external costs18

. It can be related to Charges/Taxes, -being the most commonly used (taxed assigned to the pollution), to creation of a market for Market creation of pollution permits (allowances released in fixed numbers by the regulatory authority in order to release a finite quantity of pollutant substances), or to pollution reduction subsidies (encouraging polluters to scale up R&D aimed to promote environmentally clean technologies, and to deploy abatement equipments).

However, economic approaches to environmental protection rarely operated in isolation (revenue taxes are an example of this). Frequently, a combination of economic approaches and direct regulation are quite common.

1.5.1. Classification of market-based instruments

Market based instruments create incentives for producers and consumers to shift away from environmental-damaging behaviors. For producer it may act as a spur to innovation even in the short term. This may be influenced by the sensitiveness of energy demand to price changes; if energy demand is inelastic to price changes, the decrease in emissions might be diminished2. Emissions taxes are market-based economic instrument. With this instrument emission intensive goods have higher market prices and consequently market forces spontaneously work in a cost-effective way to reduce

2 if the abatement objective is given, like in a tradable permit system, the companies will have to comply

with the objective, otherwise they’ll face penalties, demand doesn’t really matter here, with taxes the reduction might be diminished if the demand is inelastic

22

the quantity of emissions. The benefits are given by the possibility of gaining “two potential dividends”19; (i) direct effect through price increases that stimulates

conservation measures, energy efficiency investments, improvements of environmental quality, fuel and product switching, and possible changes in economy’s production and consumption structures, and (ii) indirect effect through the recycling of the collected fiscal revenues what could reinforce the previous effects by changing investment and consumption patterns, or possibly reduce others existing taxes and have a positive impact on economic growth (technological development, increase of fiscal revenues, employment, and economical growth).

Usually, the pollution charges have been established primarily as revenue sources and have not been calibrated to achieve specific environmental quality target. Furthermore, the management of the revenues generated by pollutions taxes/charges is an essential element to increase acceptability and possibly even increase its cost-effectiveness20.

Only in the OECD countries, the revenue from environmentally related taxes averages roughly 2% of the GDP19. The tax revenue can alleviate a budget deficit, contribute to

budget surplus, or finance discretionary increases in government expenditures. The revenues can also provide room for reductions in other taxes to reduce market distortions, address competitiveness concerns, or to increase the public acceptance of environmental taxes.

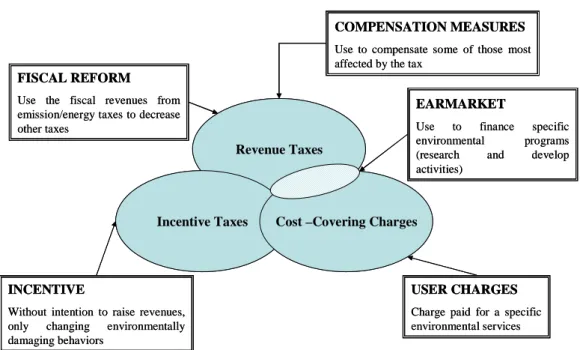

The main objectives of a tax distinguish between the incentive taxes, the cost-covering charges and the revenue-raising functions of a tax. Clearly these three types of environmental taxes, see figure 1.12, are not mutually excluded. Together they clarify the principal objective of a tax, besides the general objectives of all environmental taxes, that of environmental improvement21.

23

Revenue Taxes

Incentive Taxes Cost –Covering Charges FISCAL REFORM

Use the fiscal revenues from emission/energy taxes to decrease other taxes

EARMARKET

Use to finance specific environmental programs (research and develop activities)

COMPENSATION MEASURES

Use to compensate some of those most affected by the tax

USER CHARGES

Charge paid for a specific environmental services

INCENTIVE

Without intention to raise revenues, only changing environmentally damaging behaviors

Revenue Taxes

Incentive Taxes Cost –Covering Charges FISCAL REFORM

Use the fiscal revenues from emission/energy taxes to decrease other taxes

EARMARKET

Use to finance specific environmental programs (research and develop activities)

COMPENSATION MEASURES

Use to compensate some of those most affected by the tax

USER CHARGES

Charge paid for a specific environmental services

INCENTIVE

Without intention to raise revenues, only changing environmentally damaging behaviors

Figure 1.12: Classification of Environmental Taxes

A number of advantages can be claimed about pollution taxes compared to standards or norms represented by command and control regulation. Once a pollution standard has been set a polluter has no incentive to reduce emissions below this level. But this is not true for pollution taxes, which continuously provide an incentive for further reduction in emissions since every reduction made means less taxes will be paid. Additionally, an incentive might be given to polluters to commit funds for research and development of new pollution abatement technologies or lower pollution production methods. Furthermore, taxes upon existing pollutants may reduce emission of associated pollutants.

Besides the several attractive attributes, setting an optimal pollution tax in practice is a complex task. Pollution taxes might also have implications for the competitiveness of the affected industrial sectors. If a certain industry is imposed by a tax in region 1 and the same industry is free to emit in region 2, then the industry in region 1 might experience competitiveness losses especially when the product prices are dictates by international prices. Taxes might as well present negative impacts on low-income

24

households due to increased prices of commodities. Lastly, the administrative costs for a tax system might be significant.

There are also uncertainties surrounding the actual damage cost associated with any pollutant and the benefits of avoiding the pollutant. Broadly, the level of an environmental tax should reflect the severity of the environmental problem at which it is directed, due to both the different forms it can take and the different functions it can perform; specifically, depending on the tax base and the tax rate.

Furthermore, in order that pollution taxes would be adopted in any significant scale, a level of international agreement is likely to be necessary. At present, the feasibility of such agreement remains uncertain12. Indeed, nation’s governments have often changed

their environmental policies, depending on their economic, political and administrative circumstances.

1.5.2. Carbon Pollution taxes

From the different pollutant taxes, particular attention in this section is paid to the carbon taxes. A main reason for implementing carbon taxes is their potential to achieve environmental goals; to reduce carbon dioxide emissions, while simultaneously increasing economic efficiency22,23. A carbon tax, by increasing the cost of a fuel, should

reduce demand for that fuel as consumers economize on use, or switch to a lower carbon source. The extent to which it does this, depends on the price elasticity of demand, i.e. the percentage change in demand for a 1% change in price19. It will also

depend on the extent to which the imposition of a tax encourages the supply of non-polluting forms of energy. Substitution is likely to be most marked over a longer time period, as it may involve replacing old equipment over the new more efficient ones (the carbon tax might stimulate the substitution). For this reason, long-run price elasticities tend to be bigger than short run ones. The substitution effect may be enhanced by introducing the carbon tax at a relatively ‘low’ level and signaling that it will rise through time.

25

There is an ongoing lively debate on how the CO2 emissions taxes will be implemented. A true emission tax would impose a charge per unit of greenhouse gas released. However since emissions are difficult to measure, there are four main different types of implemented taxes, see figure 1.13.

CARBON TAX INPUT TAX

Carbon tax is a charge to be paid considering the Carbon contents into the fossil fuel, which is proportional to the Carbon emitted when it is burned. A ton of Carbon corresponds to 3.67 tons of CO2

ENERGY TAX

The charges are imposed to the energy production activities depending on the quantity of energy consumed

OUTPUT TAX

A CO2tax is specified per ton of CO2emitted

EXERGY TAX

The charges are imposed to punish the inefficient used of scarce energy resources that determine a large emission of CO2, the approach is operating to the causes of CO2 emissions

CARBON TAX INPUT TAX

Carbon tax is a charge to be paid considering the Carbon contents into the fossil fuel, which is proportional to the Carbon emitted when it is burned. A ton of Carbon corresponds to 3.67 tons of CO2

ENERGY TAX

The charges are imposed to the energy production activities depending on the quantity of energy consumed

OUTPUT TAX

A CO2tax is specified per ton of CO2emitted

EXERGY TAX

The charges are imposed to punish the inefficient used of scarce energy resources that determine a large emission of CO2, the approach is operating to the causes of CO2 emissions

Figure 1.13: Different types for implementing Carbon taxes,20 ,24.

There are relatively few economic studies valuing the additional environmental benefits linked to carbon reductions, mainly due to the difficulty of quantifying them in monetary terms. Also the distributional impacts of an emission/energy tax are quite complicated. The impact of an emission/energy tax may also result in competitive losses and/or competitive advantages for a national economy or for a certain industrial sector, depending on the specific circumstances.

Even if carbon taxes are cost-effective instrument to reduce the pollution, because of their direct impact on prices, it is important to consider the indirect incentives that may arise from the use of fiscal revenues. Indeed, without any redistribution of fiscal

26

revenues, carbon taxes impose a higher cost to polluters than command-and control policies or emissions trading systems with free initial allocation of permits20,25.

Currently, the revenues from carbon taxes are not always redistributed but absorbed into the government’s general budget. However, an Ecological tax reform could propose some forms of redistributions of the fiscal revenues26

: In addition, carbon taxes could be coupled with sequestration tax credits, to take advantage, e.g. of the sometimes lower (marginal) abatement costs in forestry. However, so far implemented carbon taxes have never been combined with sequestration27.

1.5.2.1. Application of the environmental taxes

Over the last decade and, particularly, after the creation of the United Nations Framework Convention on Climate Change in 1992, many OECD countries have considered the introduction of ‘‘Green Tax Reforms’’ aimed at reducing, through higher prices, either the use of scarce resources or emissions of pollutant substances. In this context, carbon/energy/fuel taxes have frequently been advocated.

To date, few countries have implemented taxes based on the carbon content of energy products, or energy related taxes19

: In the practice only six countries (Sweden, Norway, The Netherlands, Denmark and Finland), and more recently Italy (and only for 6 months), have implemented taxes based on carbon content of the energy products. Austria and Germany lately introduced energy taxes, which do not consider the carbon content of the energy products. Several other countries, like France, Switzerland and the United Kingdom had also proposed carbon/energy taxes. In the meantime, for some other countries carbon or energy taxes have failed, sometimes quite disastrously as in the United States. Following, table 1.1 shows the different countries where these taxes have been implemented and their dates.

27

Country Year

Finland 1990

Sweden and Norway 1991

Denmark 1992

UK (landfill tax) 1996

Italy and Germany 1999

France and Switzerland (proposal, reject 2000 1999

UK (clima change levy) 2001

EU (Kyoto protocol) 2002

Table 1.1: Countries that have implemented different carbon/energy taxes together with

their respective dates22.

In addition to emission taxes, there are other taxes that affect energy products and emissions, even though this may not be their stated intention. In fact carbon emission charges, for instant, are already implicitly taxed in every country, even in those that do not have explicitly implemented carbon taxes. What is called the “implicit carbon tax” is thus given by the sum of all taxes on energy, including taxes on energy sales.

Indeed, it has be observed that implicit carbon taxes vary significantly, and that the average price of a ton of carbon is relatively different from country to country. This is one of the main problems to implementing internationally co-ordinate carbon taxes. The main reason is that energy products possess low elasticities, and thus taxing them is an easy way to collect fiscal revenues. With respect to the carbon content of energy products, it should be noted that, in almost all countries (except Sweden and Denmark) coal has a particularly low implicit carbon tax. In fact, coal is even heavily subsidized in many countries like Germany or Spain28

. Indeed, usually fossil fuels with higher carbon content often have lower implicit carbon taxes that those with lower carbon content29.Therefore, with respect to the objectives of reducing carbon emissions, a

reform of the energy tax structure should accompany the eventual introduction of carbon taxes.

Furthermore, pollution charges are widely used in Europe; they have been established primarily as revenues sources and have not been calibrated to achieve specific

28

environmental quality targets12. The revenues raised have often been “recycled” back to

discharges in the form of grants to cover the capital cost of the installation of new treatment technologies. Practice and economic principles clearly diverge to a considerable extent but this is hardly surprising once one recognizes that pollution control policy inherently exposes contradictory ethical, political and economic efficiency implications, all of which must be managed under a shroud of scientific uncertainty30

.

1.5.2.2. Effects of the environmental taxes

The application of environmental taxes may have different impacts affecting national economies, industrial sectors, political agenda and also the environment, either global or local. These different effects arise depending on how the taxes are applied and on the political context. A main reason for implementing environmental taxes is their potential to achieve environmental goals, in particular reducing carbon dioxide emissions while simultaneously increasing economic efficiency22

. In addition, this reduction may be also connected to the reduction in fossil fuel consumption. Unfortunately, these environmental benefits, which are global and long term, are highly uncertain and difficult to measure, especially in monetary terms. Indeed, the impact of the tax cannot be known in advanced. In the cases when taxes are set at relative low levels or when the energy demand is relative inelastic to price changes, the emission reduction might be insignificant.

Empirical studies evaluating the environmental effectiveness of already implemented carbon taxes are rather limited. The few of these studies, exposed in table 1.2, show that carbon taxes may have an effect in reducing CO2 emissions.

29

Study by Period CO2 Emission reduction

Swedish Environmental Protection Agency (SEPA)

1997 Positive reduction

Statistic Norway31 1991-93 3-4% from only about 40% of total

taxable emissions

Ministry of Housing Netherlands 1997 1,5% from the total domestic emissions

Ministry of Finance Denmark27 2000 4,7% reduction from 1988 levels

Table 1.2: Different effect of Carbon taxes on CO2 emissions

Whatever is also a controversial issue that the effect of environmental taxes does not endure necessity an advantage for the economy of the power plant, for example, in the investment structure of the power plants. The charge here will imply an increase in costs affecting the competitiveness of the plant. Indeed, the generation plant structure could react in different ways, either shifting cost increases to consumers or avoiding the carbon content of the product. Both measures could give rise to environmental improvements20.

1.5.2.3. The future of environmental taxes: Kyoto, Application and Effects

Environmental taxes have been part of the economists’ tool kit for market-based environmental policies for a long time. Though the recent political discourse seems more favorable, in practice few countries have implemented emission taxes. However, the implementation of the Kyoto protocol has changed the context of global warming policies by prescribing legally binding greenhouse gas emissions reduction targets. The treaty calls for signatories to make an average 5% reduction (relative to 1990 levels) of greenhouse gas emissions (CO2, CH4, N2O, SF6, PFC and HFCs) by 2012. The reductions targets, however, apply only to industrialized countries while developing nations like China and India do not have any objectives in the protocol. In 2001, the Unites States and Australia rejected the protocol claiming that it would overburden their domestic economies. The treaty finally came into force in 2005, when Russia ratified

30

the protocol and the total commitment of the parties accounted for 55% of the global GHG emissions.

The Kyoto protocol also introduced some innovative international economic mechanisms to reduce emissions, namely, international emissions trading, joint implementation and the clean developed mechanism.

Some of these mechanisms are already being employed. Europe started a mandatory emission-trading system in January 2005 allowing companies which are short in carbon emissions permits to buy them from the companies which are long position of permits. Two years after the introduction of the system it is still unclear whether the scheme has led to the reduction of emissions. Furthermore, the market analysts argue that the carbon quotas were set too high. The European system is first of such size in the world and, if proved successful, it could become the nucleus of a global emission-trading scheme32.

To comply with Kyoto targets, industrialized countries might obtain their emissions credits by investing in a wide variety of projects, e.g. alternative energy or mitigation of emissions from landfill sites, etc, in developing countries and transition economies. These project-based mechanisms are called respectively; Clean Development Mechanism (CDM), for developing countries and the Joint Implementation (JI) mechanism for economies in transition, which covers projects in other industrialized countries such as central and Eastern Europe. Some CDMs started as yearly as 2001. In fact, companies now try to get credits for those early made reductions, but the big wave of CDM started in 2005 with the introduction of Emission trade system (ETS).

These systems aim to force rich countries to implement real carbon reduction, according to the criteria called additionally3. But critics complain that these lower cost credits prevent energy efficiency projects and discourage investments in new technologies at

3 A CDM project activity is additional if anthropogenic emissions of greenhouse gases by sources are

31

home. In Europe it depends from the percentage specified in each national allocation plans under emission trading system, many countries would allow not more than 10% import of CDM credits, 90% of reductions should be made domestically, but countries like Spain or Italy might need about 50% of import of CDM credits.

Nowadays, many Kyoto countries including, Canada, Japan, Spain, Italy, Austria and Finland are lagging well behind targets, and face an enormous effort to catch up. So as the 2012 date gets closer, many will be looking to buy credits to make up the shortfall. But if the credits are sold too much and too fast, for example by Russia or Ukraine, whose emissions went down sharply after the political collapse of the Soviet Union, the price of carbon could drop drastically. Indeed, many European countries have said no to ‘hot air’ of Russia and Ukraine.

Another problem is that it is not clear how Kyoto will determine who has met their targets, and what happen to countries that have not. The rules say that countries missing their targets will be suspended from carbon trading and must make up the shortfall, plus a 30% penalty, in the second commitment period after 2012. But the Kyoto compliance committee has not yet decided how to measure countries’ carbon emissions, or how to enforce measures on those that do not comply.

Surely, domestic policies will still have an important role to play in reaching any country commitment4. However, there is still an ongoing debate on how they will be implemented: either by economic or quasi-economic policies (e.g. taxes, subsidies, price support) or regulatory or quasi-regulatory policies (e.g. government regulations, performance standards, voluntary programs)33. Domestic actions will thus have to weigh

the advantages and disadvantages of emission/energy taxes as compares to “command and control” measures and other economic instruments34

4 it is important to take into account that European emission trading scheme covers only 45% of EU CO 2

32

1.5.3. Tradable permits

Another solution could also be to relocate production and emissions in other countries, generally to developing countries. This measure is encouraged due to trade liberalization among countries with different environmental policies. They are usually taken from the producers that are suffering competitive difficulties due to overall economic conditions and where the environmental cost are a high share of new investment cost. However, international regulations over environmental standards may impede foreign investment and decrease predisposition to relocate power plants, since this measure comprises no improvement to the global environment.

However, empirical studies on Carbon/energy taxes’ competitive losses seem to indicate that carbon/energy taxes did not produce significant impact. Moreover, there are evidences not supporting the hypothesis that cross-country differences in environmental standards are important determinants for the global patterns of international trade35.

Empirical studies in the US36 and OECD19concluded that environmental taxation has

very small impacts on costs and prices, which additionally are relatively difficult to distinguish24.

In principle, tradable permits achieve the same result as environmental taxes. Whereas a tax sets a price (the tax) and leaves the polluter to adjust the quantity (the level of emissions), a tradable permit system sets a quantity (a quota of emission permits), and the price (the price of the permit) adjusts according to the resulting supply and demand for permits. In practice, there are several considerations that may favor one option over the other. The basic mechanics of a tradable permit are simple. An overall quota of emission allowances is first determined. For greenhouse gases, this would be a quota based on a national target, which would be allocated to different sectors of the economy. For any sector, the quota of allowances is allocated between firms or economic agents. The mechanism for allocation can vary, but only two are usually considered: auction, whereby polluters bid for the permits, and grandfathering, whereby quotas are allocated without charge according to actual historical emissions. Grandfathering suffers from the basic defect that those who polluted most in the past are most rewarded in the allocation

33

of permits. Once permits are allocated, firms are free to buy and sell them. Typically, firms who find it expensive to reduce emissions will have to buy permits from other emitters if they wish to go beyond their initially allocated quota, and firms who find it cheap to abate will sell permits. Such permits can be traded nationally or internationally. Moreover, there must be provision for imposing fines on actors whose emissions exceed their permit entitlement.

1.6. The Eco-efficiency approaches for energy production systems

The major effort carried out recently in order to reduce environmental impact of energy production systems, has been addressed towards eco-efficiency paths. Eco-efficiency approaches are predominantly technical approaches, which imply the reduction of cumulative environmental influence for a given amount of energy produced. The eco-efficiency paths are connected to environmental protection because they penalize the inefficient energy transformation activities, what pretend to improve the way we use energy, punishing the inefficient use of scarce energy resources, and preventing the increase of emissions.

The central question to be examined should be the concept of energy lost inside the system. The energy rejected to the environment is seen as a way to penalize the inefficient energy conversion, together with growing concern of the depletion of energy resources. The idea will be not to punish the energy production activities but the inefficient use of fossil fuels.

34

Figure 1.14: The different pathways for the eco-efficiency approaches.

Technologically, significant improvements in the direction of “eco-efficiency” are indeed possibly in the short term, but it is vital to understand that these improvements are subject to severe limitations in the long term. The ability of technological improvements to reduce environmental impact to a sufficient extent will be soon swamped by the idea of never-ending growth in consumption. That is, not to hope that technology will provide the means to make more and more from less and less in perpetuity37,38,39.

Only within the theories of classic economics, it is believed that unending growth in consumption of goods and services is both socially desirable and technologically possible, and then only because of a number of long-established fictions40

.

In general, this is a reductionist approach, where the idea that the efficient parameter is the best agreement to obtain a better emissions control and use of the resource is preserved. But in fact, the efficiency increase does not have a great impact in the pollutant emissions reduction, since it usually appears connected to the rebound effect (more production more consumption and vice versa).

1.7. The Regulatory approaches for energy production systems

Environmental policies has traditionally been secured through the use of “command-and-control” regulatory approaches, which involve the setting of environmental

35

standards or norms, e.g. for air quality or water quality. The standards are enforced via legislation without the aid of market-based incentives12. The regulatory authority sets an

environmental target, and the polluter is required to comply with the standard under a threat of certain penalty system.

Regulatory approaches involve different mechanisms, see figure 1.15, with its advantages and limitations. A combination among the different regulatory approaches is preferred in order to broach the environmental energy problems. The different regulations must be approached together without any discrimination, meaning that no regulation should be taken unilaterally.

REGULATORY

APPROACHES

Reducing energy demand Increase efficiency Fuel Switching PollutantCapture and sequestration

REGULATORY

APPROACHES

Reducing energy demand Increase efficiency Fuel Switching PollutantCapture and sequestration

Figure 1.15: Most common Regulatory Approaches in order to mitigate the

environmental damages of the energy conversion systems.

The typical regulations about the reduction of demand are based, principally, on social, economic and political measures, which have been already analyzed in the previous sections. The following sections examine more in detail the most common regulatory approaches present in literature.

36

1.7.1. Decarbonizing power generation

Fuel switch regulations are based, in principle, on switching from CO2 emitting to non-CO2 emitting energetic sources. The change of feedstock can be applied for power generation towards low-carbon or even carbon-neutral fuels. This regulation favors technologies as nuclear power plants or renewable energy sources, being an effective measure to mitigate CO2 emissions.

But present understanding of this regulation must face very important challenges. Nuclear power plants have relative lengthy construction schedules, so a decision today to switch to nuclear would not realize CO2 reductions in the short or near-medium term. Renewable sources as sun or wind are problematic principally because of their intermittency in production, which must be accompanied by energy storage facilities, still not well developed, or by conventional power plants in order to have a continuous supply.

However, the regulation fails to address the question that coal, as pointed out at the outset of this chapter, will become increasingly used on power generation, due to its alocalisation and abundance on the earth.

1.7.2. Increase Energy efficiency

The IEA says that improving energy efficiency is often the cheapest, fastest and most environmental friendly way to meet the world’s energy needs. Improved energy efficiency also reduces the need for investing in energy supply. Many energy efficiency measures are already economic and they will pay for themselves over their lifetime through reduced energy production costs. But there are still major barriers to overcome. To increase energy conversion efficiencies is mainly based on the principle that improving energy efficiency of energy conversion systems makes a more effective use of resources and reduces emissions. The specific emissions of CO2 and other pollutants (NOx, SO2, etc.) are directly linked with the net efficiency of power generation. This can be applied for existing processes designs by means of technological advances that allow

37

operating more efficiently, or for developed new processes which allow conventional fuels to be used more efficiently. The future of clean coal technologies will be discussed in detailed in chapter 3.

Reducing worldwide CO2 emissions can be achieved nowadays, when replacing old low efficiency plants by modern technologies. Of the 1100 GW existing power generating capacity worldwide, approximately 3800 GW capacity are based on coal, 11% of these power plants are older than 40 years, and near the end of their service life, 60% are older than 20 years. The substitution of this 20 and more years old fleet by modern coal technology would result in an annual reduction of 1,5 Gt/a of CO2 from today’s emissions of 5,5 Gt/a of CO2 (consumption presumed constant)2.

But as it has been proved in the last century, increasing efficiency, with which we do use fuel, does not compensate for any possible future supply problems. On the contrary, when raising the efficiency reduces productions costs, the demand might increase. This result was first published in “The coal question” by Jevons41, where he describes the

paradox of engines designed to be more efficient to save coal in fact ended up using more coal, and therefore producing new emissions and negating the efficiency improvements.

1.7.3. Capture and storage of CO

2emitted from power-generation

A realistic acknowledgement of the breadth of the present energy scenarios reveals that fossil fuels, especially coal, will stay as the basic fuel of the future energy supplies. This short-term medium-term conclusion together with the difficulty founds on the other regulations, yields that the most important regulation for engineers appears to be the proxy (avoidance) regulations, namely, the emission abatement and sequestration. This avoidance regulation requires the need to reduce CO2 emissions to the atmosphere, together with NOx and SO2 emissions. CO2 capture and storage comprises the separation of CO2 from an anthropogenic CO2 source, transporting it to a storage location, and isolating from the atmosphere for a long time period. However, any CO2 removal

38

measures will unavoidably and significantly reduce the station efficiency and power output- and increase the consumption of primary energy sources, as well as a significant growth of the specific cost of the plant. Typically, the loss in conversion efficiency due to the extra energy use for CO2 capture is in order of 15 to 30 %42. The estimated investment costs for CO2 sequestration and disposal are very high since the recovery equipments are expensive and the CO2 flow rate is usually high43,44. In literature, the CO2 sequestration costs have been estimated to affect the capital costs of the plant by around 75%17,24,45,46, and an even larger percentage has been suggested by ,

Summerfield43.A wide perspective of the CO

2 capture technologies is further developed in chapter 2.

1.8. Conclusions

What has been shown in this chapter is that the material benefits of modern economic systems cannot be delivered with zero environmental risk. Some sort of cost- and/or risk benefit balancing process is required in which acceptable trade-offs between risk levels and the cost of reducing these risks are struck. The trade-offs can be made implicitly or explicitly depending on the policy approach adopted. Two broad types of environmental policy approaches toward the internalization of pollutant externality can, therefore, be distinguished; the market-based approach and the regulatory approach.

Market-based instruments may be contrasted with so-called command-and-control methods, which have been widely used in environmental policy, and which operate by setting standards. Individually or collectively, polluters are given an environmental standard to which they must adhere. For example, there may be a common emission limit for all plants in a particular industry. Alternatively, there may be a limit for a firm or one particular industry sector. Another approach (a technology-based standard) imposes a particular form of technology on all operators. Such methods may seem effective in delivering a particular emission-reduction objective, but the disadvantage is that they limit, to one degree or another, the freedom for polluters to choose the method