POLITECNICO DI MILANO

DOCTORAL PROGRAMME IN

MANAGEMENT, ECONOMICS AND INDUSTRIAL ENGINEERING

B

REAKING

U

P THE

G

LOBAL

V

ALUE

C

HAIN:

D

YNAMICS AND

P

ERFORMANCE

Ph.D. Candidate: Filippo Albertoni

Supervisor: Prof. Lucia Piscitello Tutor: Prof. Stefano Elia

Chair of the Doctoral Program: Prof. Paolo Trucco

To my grandfather Aldo, the most gentle, honest and stubborn person I have ever met

I

Summary

The thesis studies the breaking up of the global value chain and the dynamics over time in the offshoring of business services. Companies increasingly relocate from advanced to emerging economies not only production activities, but also business services. Indeed, in the last 15 years, the offshoring of business services has shown an impressive growth; not only simple tasks, but also high-value added activities –such as R&D, engineering and product design– have been increasingly relocated. Furthermore, in the last few years, a new and opposite phenomenon compared with offshoring has been emerging; companies have been bringing back to the headquarters’ location some business functions. Therefore, this thesis investigates the dynamics following the strategic decision to offshore business activities abroad. The work is a collection of seven papers, with the first chapter being the introductory cover essay summarizing the main findings (i.e. chapter 1). The thesis is then structured in three main parts with each chapter analysing in-depth the research issues. Chapters 2 and 3 provide a general statistical overview of the offshoring and reshoring of business services. Chapters 4 and 5 deal with the persistency and the evolution over time of the mode of entry (i.e. the change from one contractual form to another). Chapters 6 and 7 specifically study the dynamics regarding the location adopted by offshoring companies (i.e. the emerging phenomenon of the reshoring of business services). It is worth noting that the thesis is paper-based, therefore each chapter addresses an autonomous topic and it follows its own publication strategy. Moreover, each paper adopts a specific theoretical framework; the theories adopted span from the offshoring literature to the international business theory and from the evolutionary economics to the real option framework. The database adopted in this research is mainly the one provided by the Offshoring Research Network (ORN) that allows a throughout investigation of the phenomenon of offshoring of business services. In some chapters, the ORN database has been integrated also with other datasets. The next few lines provide a general overview of each paper.

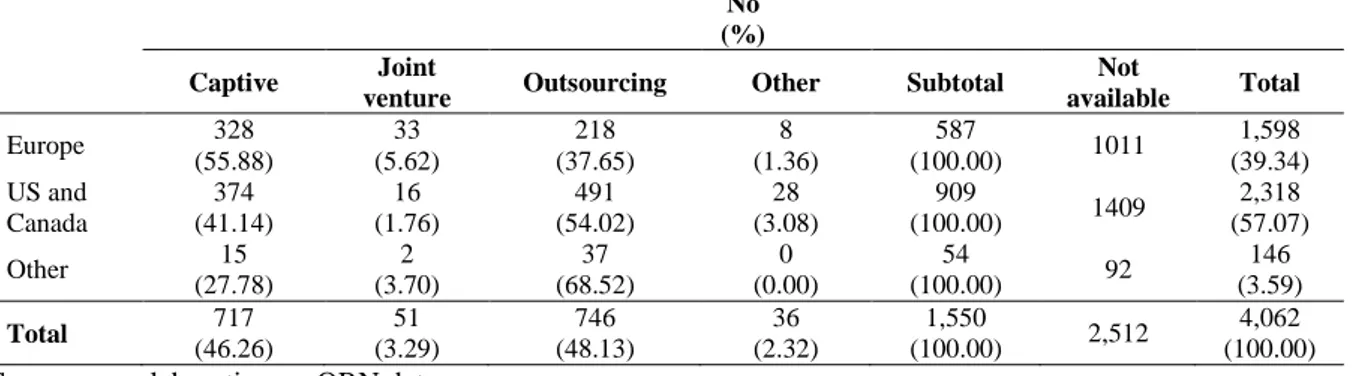

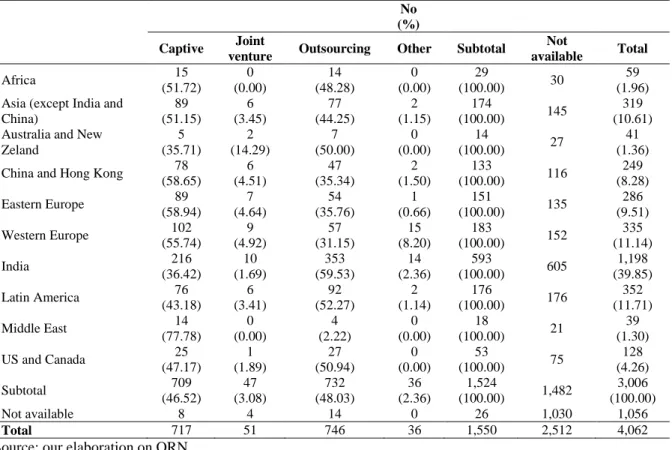

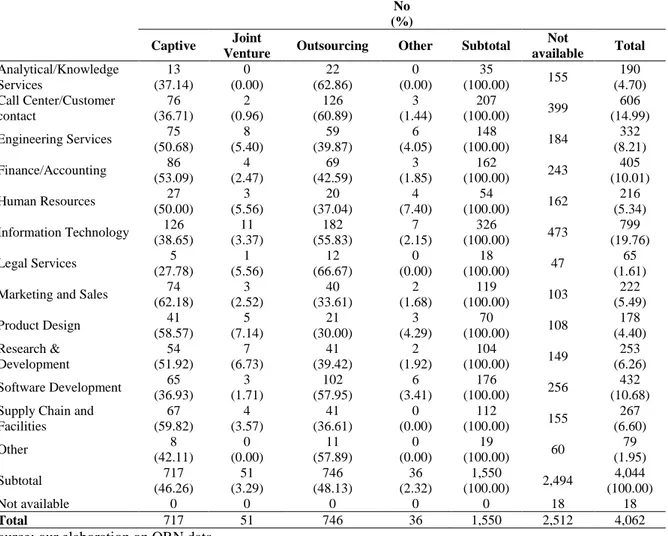

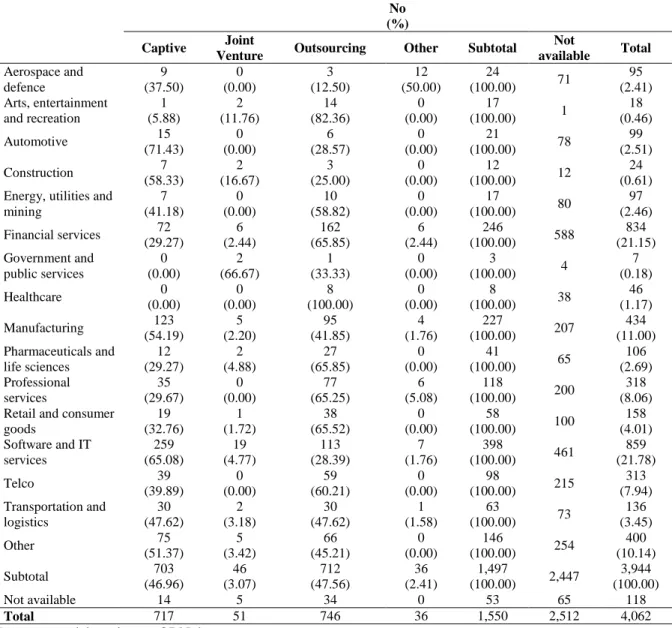

II

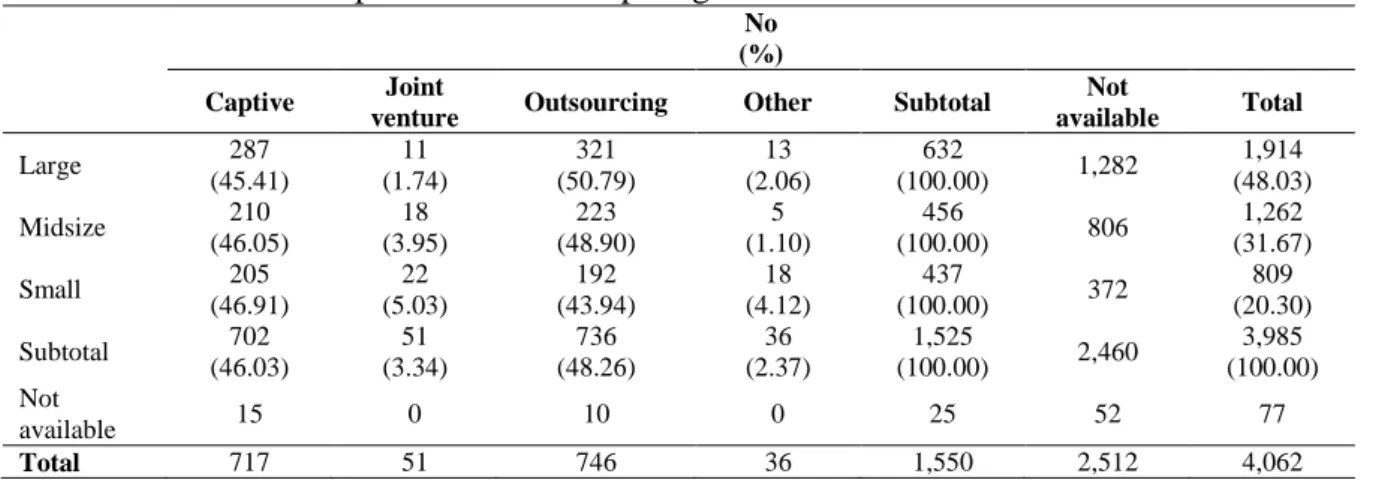

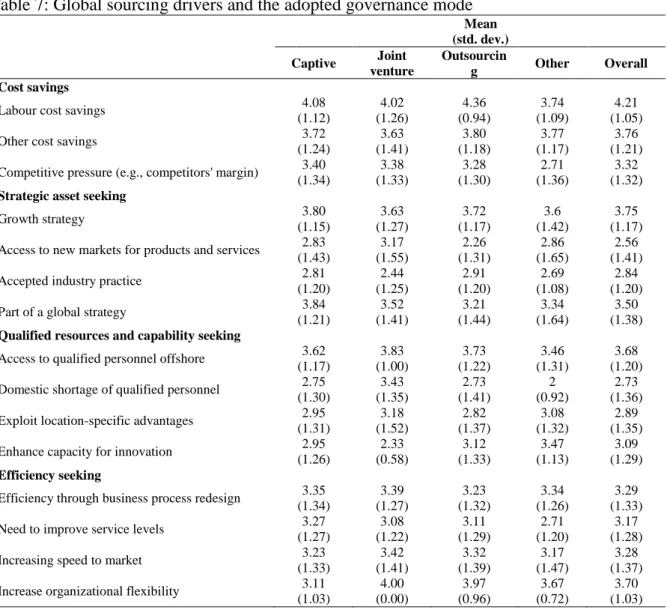

The second chapter describes the offshoring of business services using some descriptive statistics and it shows how high value-added business services are increasingly offshored. For these activities, companies prefer captive rather than outsourcing entry modes, probably in order to guarantee adequate protection of knowledge. Moreover, data show that European companies show a slight preference for wholly owned solutions, while US and Canadian companies are more likely to adopt outsourcing solutions. India is the main recipient of offshoring initiatives, probably because it offers not only low cost skilled labour, but also qualified service providers. The main drivers of the offshoring of business services are the need to attain cost-savings and to access to qualified personnel. In this context, wholly owned entry mode seems to be more performing than outsourcing in achieving both savings and high quality standards.

The third chapter sheds light on the re-shoring of business functions. Indeed, policy makers and scholars are increasingly interested in the relocation of once offshored activities; however, the empirical evidence is mostly focussed on manufacturing activities, while very little is known about business functions that assist manufacturing activities. Therefore, this chapter provides some empirical evidence regarding the plans to re-shore administrative and technical work. In particular, the chapter analyses the entry-mode, the home and the host country context, the business functions, the industries, the size and the performance of once offshored activities that are planned to be re-shored.

Despite the abundance of studies on offshoring and entry mode choices, it is still not clear whether relying on former entry-specific experience allows enhancing the outcome of the offshoring venture. Thus, the fourth chapter, while confirming that several companies adopt the same entry mode of the past, finds that the repetition of previous entry modes increases the focal initiative performance, but only when the company internalizes previous outcomes.

III

Conversely, the inertial repetition of routines associated to previous entries does not lead to an increase of the outcome.

Although empirical evidence shows that offshoring companies tend to be persistent in their entry mode choices (as stated above), the current global scenario is demanding greater strategic flexibility to companies. In this context, real options are studied as a feasible solution to attain the required flexibility and to switch from one entry mode to another over time. By use of a risk tolerance simulation model in the context of an international joint venture, the fifth chapter demonstrates how a real option exchange appears as a win-win strategy for two business parties with asymmetrical risk profiles. The chapter exemplifies and discusses also the reciprocal use of Real Options in the context of other types of interfirm collaboration such as franchising and outsourcing.

Offshoring companies attain flexibility relying not only on contractual clauses, but also on the possibility to relocate their activities over time. Indeed, companies are increasingly re-shoring their activities. The sixth chapter provides a picture of what we know regarding the companies returning from offshore and what are the main open research issues in the field. The seventh chapter finds that the reshoring of business services is the result both of company response to performance shortcomings of the initiative offshored and of the persistence with original offshoring strategy (disintegration advantages, accessing new markets and cost-saving).

Further understanding of the offshoring phenomenon provides meaningful insights not only for research, but also for managers and policy makers, challenged by the threats and opportunities of global markets. Thus, each chapter of the thesis provide throughout investigation and detailed answers to the relevant research issues.

V Table of contents

Summary ... I

1. Introduction ... 9

1.1 Introductory section and the context ... 9

1.2 The research gaps in the literature ... 11

1.2.1 The entry mode choice in the offshoring context ... 11

1.2.2 Entry switches through real options: dealing with uncertainty in offshoring ... 13

1.2.3 Location and re-location decisions ... 17

1.3 Research questions and purpose of the thesis: the dynamics over time in offshoring ... 18

1.4 Research methodology ... 22

1.5 Organization of the work and brief overview of the contributions ... 24

1.6 The dissemination strategy of the work ... 26

1.6.1 Academic dissemination ... 26

1.6.2 Practitioner dissemination ... 30

1.7 Concluding remarks and future steps ... 31

1.8 References ... 33

2. The Global Sourcing of Business Services: Evidence from the Offshoring Research Network Survey ... 43

2.1 Introduction ... 44

2.2 The global sourcing of services in the ORN database ... 45

2.3 Concluding remarks ... 55

VI

2.5 Appendix ... 59

3. Complementing the Reshoring of Manufacturing Activities: the Relocation of Business Functions ... 61

3.1 Introduction ... 62

3.2 The re-shoring drivers, opportunities and challenges ... 64

3.3 Methodology: evidence from the ORN survey ... 67

3.4 Concluding remarks ... 80

3.5 References ... 84

4. When Do Offshoring Companies Learn From The Repetition of Former Entry Modes? ... 89

4.1 Introduction ... 90

4.2 Conceptual framework ... 93

4.2.1 Inertial vs. Mindful Repetition in Firms’ Entry Mode Decision ... 96

4.3 Empirical study ... 99

4.3.1 The Context and the Sample ... 99

4.3.2 Methodology ... 101 4.3.3 Variables of Step (1) ... 104 4.3.4 Variables of Step (2) ... 108 4.4 Results ... 110 4.4.1 Findings ... 110 4.4.2 Robustness check ... 112

4.5 Discussion and concluding remarks ... 113

VII

4.7 Tables... 124

4.8 Figures ... 131

4.9 Appendix ... 132

5. Does Reciprocal Use of Real Options Qualify as Cooperative Strategy? ... 135

5.1 Introduction ... 136

5.2 Antecedents of RO reciprocity ... 137

5.3 A risk tolerance simulation model ... 141

5.4 RO reciprocity in different types of interfirm collaboration ... 145

5.5 Conclusions ... 152

5.6 References ... 155

5.7 Appendix ... 159

6. Returning from Offshore: What Do We Know? ... 161

6.1 Introduction ... 161

6.2 What do we know? Evidence on the reshoring phenomenon ... 163

6.3 Implications for managers, policy makers and researchers ... 167

6.4 References ... 170

7. The Reshoring of Business Services: Reaction to Failure or Persistent Strategy? ... 175

7.1 Introduction ... 176

7.2 The reshoring of business services: Failure vs. Coherent offshoring strategy ... 179

7.2.1 The DLE framework and reshoring decisions ... 180

7.2.2 Performance assessment and reshoring decisions ... 183

VIII

7.3.1 Descriptive statistics ... 187

7.3.2 Regression analysis ... 191

7.4 Discussion and concluding remarks ... 204

7.4.1 Managerial Relevance ... 205 7.4.2 Policy implications ... 206 7.4.3 Future research ... 207 7.5 References ... 208 7.6 Appendix A... 216 7.7 Appendix B ... 217 Acknowledgments ... 221

9

1. Introduction

1.1 Introductory section and the context

Companies break-up their value chains and increasingly delocalize some business activities to emerging economies. In particular, firms started to move production activities towards developing countries in the sixties in order to take advantage of lower labour costs. This phenomenon is known with the term offshoring and it refers to the fragmentation of business activities along the value chain and to their delocalization in different countries (Bunyaratavej et al., 2008; Dossani & Kenney, 2006; Manning et al., 2008; Kedia & Mukherjee, 2009). Knowledge-intensive activities have been typically located in advanced countries, while manufacturing and production activities have been offshored to emerging economies in order to exploit cost advantages (Contractor et al., 2010; Mudambi, 2007). However, nowadays, companies are increasingly relocating from advanced to developing countries not only manufacturing activities, but also business services and this phenomenon is considered a pivotal element of the third industrial revolution (Blinder, 2006). The standardization of complex tasks, the improvement of the capabilities in emerging economies and the advances in ICT led also knowledge-intensive functions to be increasingly sourced from emerging economies (Baaij et al., 2015; Blinder, 2006; Jahns et al. 2006; Lewin et al., 2009 Manning et al., 2008). The fact that high value-added activities, such as Research & Development (R&D), Product Design and Engineering Services are increasingly offshored requires further understanding in order to help decision makers to effectively implement global sourcing ventures in the increasingly competitive international markets.

Regarding the drivers of the offshoring phenomenon, the offshoring of production and manufacturing activities was primarily driven by lower labor costs in emerging and developing

10

countries. Starting from the nineties, the advancement in ICT has allowed to offshore also some business activities with similar purposes (e.g. the call centers). Nowadays, cost savings are not the only driver of the sourcing of business services from the global market across geopolitical boundaries. Indeed, the access to new resources and knowledge are increasingly recognized as an important driver for the delocalization of high value-added activities. The shortage of technical talents in advanced countries induces the shift of labor competition from national to global level for high value-added activities (Manning et al., 2008; Lewin et. Al., 2009). Jensen and Pedersen (2012) argue that the drivers of offshoring are different for less advanced and more advanced tasks: for the formers, the main purpose is cost-reduction; for the latters, the primary objective is cross-border knowledge sharing. Thus, the phenomenon is widening its boundaries and it is now often defined “global sourcing” rather than “offshoring”1. Research on global sourcing now encompasses business activities along the entire value-added contribution spectrum and considering not only cost-saving drivers, but also value-enhancement ones. Furthermore, some companies that have already experienced offshoring, in the last few years decided to return to their home countries or to near-by regions or to other offshore locations; while the study of the offshoring is well established in the literature, little is known about the reshoring phenomenon. The aim of this research is to further investigate both the offshoring and reshoring phenomena analyzing their many facets.

The main goal of this cover essay is to provide an overview regarding the dynamics and performances related with the fragmentation of the global value chain. Therefore, after section 1.2 that contextualizes the main topics of the thesis, section 1.3 provides an explanation regarding the purpose of the thesis and the main research questions. Section 1.4 illustrates the research methodology adopted. Section 1.5 presents the organization of the work and it

1 Although the term “Global Sourcing” is more appropriate to define the offshoring justified by resource-seeking purposes (rather than cost saving ones), some streams of literature still prefer the term “Offshoring”. Therefore, some of the chapters of this thesis adopt the term “Offshoring” (and not “Global Sourcing”) in order to comply with the reference literature and to correctly position the paper.

11

provides a brief overview of the contributions. Section 1.6 shows an overview of the dissemination strategy of the work. Finally, section 1.7 concludes.

1.2 The research gaps in the literature

Since Hymer’s seminal work2, International Business main research streams have mostly focused on the underlying determinants of FDIs3. Although these studies are extremely important to understand the globalization process, they failed to clarify the relationship between strategic decisions and their performance implications. Indeed, further understanding on how to improve the performance is probably the contribution with the highest potential not only for management studies, but also outside the academic world. Therefore, after analyzing the extant literature, this section inquires the open and most debated issues in the field. In particular, the first two sections (1.2.1 and 1.2.2) deal with the choice of the entry mode in the offshoring context (and, more generally, in international business activities), while the third section (1.2.3) discusses relocation decision in the offshoring context (i.e. reshoring).

1.2.1 The entry mode choice in the offshoring context

The literature on entry mode4 in international business mostly focused on make-or-buy and make-or-ally choices (Brouthers & Hennart, 2007). In particular, several studies focused on what are the main entry determinants and a consistent stream of literature argues that the

2 Stephen Herbert Hymer presented his PhD thesis entitled “The International Operations of National Firms: A Study of Direct Foreign Investment” in 1960; however, his work has been published only posthumously in 1976. 3 For further support about this argument, see the discussion of the literature in chapters 3 and 6.

4 The term entry (or governance) mode refers to the firms’ degree of control and commitment towards a business venture in a foreign market. The term “entry mode” is preferred in the International Business literature, while the term “governance” is more adopted in the Strategy literature.

12

entry mode is affected by transaction costs5. In particular, high transaction costs induce companies to opt for wholly owned solutions rather than for arm’s length contracts (Anderson & Gatignon, 1986). However, the entry mode is not driven by transaction costs only; Kogut and Singh (1988) suggest that also the cultural dimension is extremely relevant. Brouthers (2002) and Meyer (2001) complement the TCE with some institutional dimensions, thus suggesting an extended transaction cost model. Other theoretical contributions argue that the entry choice is connected with the resource endowment and the resource requirements for the focal activity of the company; in particular, the lack of internal resources might drive a company to seek alliances in order to appropriate the missing assets (Castañer et al., 2013). According with Madhok (1997), the entry should be studied not only considering the impact of costs, but also considering the value-enhancement stemming from the foreign venture; companies should take into account not only the possibility to exploit but also to strengthen their competitive advantage. Furthermore, the literature recognizes the role of previous experiences in international business processes and the temporal interdependence of entry choices (Chan & Makino, 2007; Chang & Rosenzweig, 2001; Gao & Pan, 2010; Guillen, 2003; Lu, 2002; Padmanabhan & Cho, 1999; Swoboda et al., 2015; Yiu & Makino, 2002). However,

5 Several scholars applied the Transaction Cost Economics (TCE) to MNCs, and in particular, in chronological order: McManus (1972), Buckley & Casson (1976), Teece (1977), Rugman (1981), Caves (1982) and Hennart (1982). The TCE was originally invented by Coase (1937), and further developed by Williamson (1985). According to the TCE, perfect markets do not exist, indeed, the exchange of goods between firms and consumers cannot happen without frictions or costs. In particular, the TCE is based on three pillars leading to the existence of some transaction costs: bounded rationality, opportunism and asset specificity. The concept of bounded rationality refers to the fact that economic agents are not able to forecast all the states of nature and, even if it were possible to forecast all the states of nature, economic agents do not know the algorithm that enables to find the optimal solution. The concept of opportunism regards the fact that economic agents pursue their own utility and interest and they cheat in order to maximize their utility. The concept of asset specificity concerns the fact that certain investments are valuable only within a specific business relationship and they cannot be easily redeployed in other relationships. Due to these assumptions, contracts are incomplete: (i) the parties of a contract have and can exert a certain degree of discretion over the fulfilment of contractual clauses; (ii) the parties can behave opportunistically to appropriate of some rents; and (iii) the parties bear costs if they cannot use the investment in other relationships. Therefore, difficulties to negotiate and include in the contract different contingencies leads to some Transaction Costs connected with making any economic exchange. In particular, transaction costs can be divided into three categories: search costs to identify the right partner; negotiating costs due to the bargaining for fair prices and for other contractual terms, facing information asymmetries; and monitoring costs due to the distance, to communication issues, and to the difficulties to include some specific contingencies in the contract. These costs increase in the international context; therefore, companies have the incentive to internalize activities rather than go through (expensive) market transactions.

13

although studies on entry determinants abounds (Agarwal & Ramaswami, 1992; Anderson & Gatignon, 1986; Brouthers, 2002; Castañer et al., 2013; Kogut & Singh, 1988; Lu, 2002; Madhok, 1997; Meyer, 2001; Mutinelli & Piscitello, 1998; Shaver, 1998; Yiu & Makino, 2002), empirical results regarding the relationship between entry and performance are still quite controversial (Brouthers, 2002; Castañer et al., 2013; Shaver, 1998). Therefore, further inquiry is needed to understand the relationship among entry determinants, entry choices and the outcome of the foreign venture.

This thesis departs from the attempt to answer some of the questions raised during the most recent debate on entry mode studies. The selection of the entry mode is one of the key concerns for managers of companies investing abroad; despite the large number of contributions on this topic, “we still lack clear tools to help managers to make their choices” (Brouthers, 2013, p. 14). In addition, following the question posed by Shaver (2013) on whether we need further entry mode studies, Hennart and Slangen (2015, p.117) argue that there is a disjunction between “what companies do” and “what companies should be doing”. In other terms, it is necessary to identify the entry mode that enables and fosters firms’ competitiveness (Hennart & Slangen, 2015; Martin, 2013).

1.2.2 Entry switches through real options: dealing with uncertainty in offshoring

Companies approaching foreign markets have the opportunity to decide simultaneously their equity stake and/or the presence of real option clauses in the negotiation with a business partner6 (Tong & Li, 2013). Indeed, companies deciding to expand their activities into foreign

6 A real option is the right -but not the obligation- to undertake some business decisions, typically, the option to make, or abandon a capital investment. For example, the opportunity to invest in the expansion of a factory, or, alternatively, to sell the factory, is a real option. In contrast to a financial option, a real option is not often tradable (e.g. the factory owner cannot sell the right to extend his or her factory to another party, only s/he can make this decision). However, some real options can be sold, (e.g., ownership of a vacant lot of land is a real option to develop that land in the future).

14

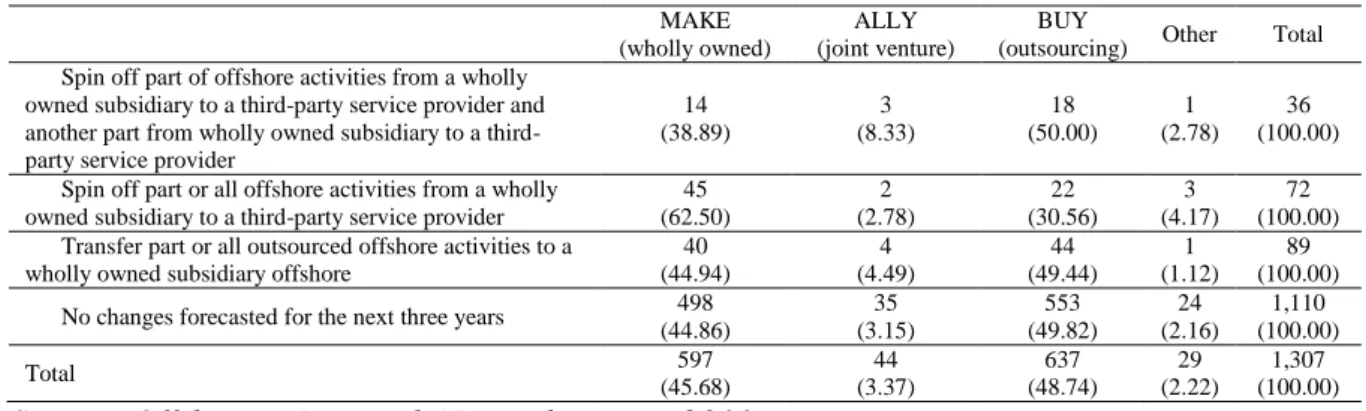

markets have much more degrees of freedom regarding the structure of their foreign contracts than the traditional make-or-buy or make-or-ally choice (Benito et al., 2009; Reuer & Tong, 2005)7. Furthermore, entry choices have been studied statically, while they are a choice that evolve dynamically. For example, table 1 shows the different typologies of contracts identified in the Offshoring Research Network Survey and how, over time, companies decide to change the mode of entry for some of the tasks performed abroad. In particular, respondents answered regarding their plans for a specific offshoring implementation in the next three years. Although we do not know whether real option clauses underlie these choices, it is worth noting that entry choices evolve over time.

Table 1: Evidence in the ORN survey regarding the actual entry mode and plans regarding the entry mode in the next three years

MAKE (wholly owned)

ALLY (joint venture)

BUY

(outsourcing) Other Total Spin off part of offshore activities from a wholly

owned subsidiary to a third-party service provider and another part from wholly owned subsidiary to a third-party service provider

14 (38.89) 3 (8.33) 18 (50.00) 1 (2.78) 36 (100.00) Spin off part or all offshore activities from a wholly

owned subsidiary to a third-party service provider

45 (62.50) 2 (2.78) 22 (30.56) 3 (4.17) 72 (100.00) Transfer part or all outsourced offshore activities to a

wholly owned subsidiary offshore

40 (44.94) 4 (4.49) 44 (49.44) 1 (1.12) 89 (100.00) No changes forecasted for the next three years 498

(44.86) 35 (3.15) 553 (49.82) 24 (2.16) 1,110 (100.00) Total 597 (45.68) 44 (3.37) 637 (48.74) 29 (2.22) 1,307 (100.00)

Source: Offshoring Research Network survey, 2011

Real options are an essential and integrating part of contractual agreements; however, the alliance and, more generally, the entry mode literature has overlooked its importance so far; indeed, entry choices are often constant over time, but sometime they are not. The study of

7 Although most of the studies rely on the traditional make-or-ally or make-or-buy dilemma, according with Mudambi and Tallman (2010), a dichotomous characterization does not fit well with decisions regarding the offshoring of knowledge processes where the entire spectrum of business activities -from low value-added to high value-added- should be described as a make-or-ally-or-buy decision.

15

the possibility to switch from one entry to another is extremely relevant in the context of strategic management as long as it allows dealing with uncertainty.

It is worth highlighting that several kinds of real options exist in order to enhance operational flexibility. Real options can be explicit (i.e. the contract specifies the party who holds the right to acquire and the strike price) or implicit (i.e. both the parties can negotiate the right to acquire and the share price during the joint venture or the collaboration) (Cuypers & Martin, 2007; 2010; Reuer & Tong, 2005). Even though several works are based on the assumption that joint ventures are implicit real options (Kogut, 1991; Reuer, 2000; Reuer & Leiblein, 2000) and although the percentage of explicit real options in international joint ventures is limited (Reuer, 2002; Reuer & Tong, 2005), real options can be defined as such only when contractual clauses explicitly specify the timing, the pricing, the terms and the conditions of the right to make, or abandon a capital investment. Only works on explicit real options help to better understand the ex-ante economic rationales of real option clauses (Chi, 2000; Chi & McGuire, 1996; Reuer & Tong, 2005). Indeed, the studies conceiving any joint venture as an implicit real option account only for the ex-post economic rationale to acquire or dismantle the joint venture, but they are unable to explain: (i) why explicit real option are included and (ii) why one of the two parties should be keen to concede the option to the other party. As long as most of the studies are on implicit real options, the option embedded in a joint venture is akin to a call option8, while little is known regarding put options, and further understanding is needed on the possibility to simultaneously exploit upside and downside opportunities (thus jointly studying call and put options) (Reuer, 2002; Reuer & Tong, 2005). In the fifth chapter of this work, the reciprocal adoption of call and put options is investigated in order to understand whether it qualifies as a cooperative strategy for the two parties involved

8 Call options confer the right to buy certain assets at a given price after a defined period, while put options confer the right to sell them.

16

in the transaction. Indeed, the underlying economic rationales for the two parties involved in the contract (i.e. the acquirer and the seller) can be quite different. In call options, the acquirer is the “strong” party (as long as it has the right, but not the obligation to buy the assets), and the seller the “weak” one (as long as it has to accept the other party’s decision). Vice versa, in put options, the acquirer is the “weak” party and the seller is the “strong” party. However, recently, the literature mostly highlighted how the mix of both call and put options allows adopting a sequential investment and disinvestment logic enabling upscaling and downscaling flexibility, where firms commit resources only if outcomes aligned with their goals emerge (Klingebiel & Adner, 2015; Tong & Reuer, 2007). Indeed, real options allow to reduce different kinds of risk and therefore to meet the needs of different contractual parties.

The literature referring to the transaction costs economics (TCE) considers real options as an instrument to safeguard intended specific investments against partners’ inclination to expropriate the quasi-rent resulting from the specific investments (Chi & McGuire, 1996; Chi, 2000; Reuer, 2002)9. Therefore, real options can be considered as an alternative to wholly owned solutions to prevent from hold-up risks (Williamson, 1985). By pre-specifying the price of anticipated specific assets, the party undertaking the investments in these specific assets is guaranteed against partial or complete expropriation of the quasi-rent by the joint venture partners. Furthermore, real options are a tool to mitigate not only market-demand uncertainty (Campa, 1993; Goldberg & Kolstad, 1995; Kumar, 2005), but also institutional risk (Chung et al., 2010; Grewal and Tansuhaj, 2001).

9 Another widely adopted tool to protect information and to mitigate the endogenous uncertainty is the fine slicing of the global value chain. Indeed, fine slicing allow reducing misappropriation hazard at the level of the single fragment (Gooris & Peeters, 2016).

17

Therefore, in the offshoring context where different kinds of uncertainty are present, real options can guarantee a certain degree of flexibility over entry choices. Once a firm acquires a real option on a future opportunity, it can strike the option and take full opportunity if the uncertainty is resolved favorably over time, or just let the opportunity pass at no further cost if the uncertainty is resolved unfavorably. Therefore, by obtaining an option, firms minimize risk exposure by deferring part of the investment until uncertainty is reduced and the value of the investment can be more accurately predicted (Dixit & Pindyck, 1994; Kogut, 1991). Thus, real options confine uncertainty to determinate scenarios guaranteeing strategic flexibility (Bowman & Hurry, 1993; Reur & Leiblein, 2000). The literature has extensively studied why firms adopt real options (Brouthers et al., 2008; Cuypers & Martin, 2010; Dalziel, 2009; Folta & Miller, 2002; Hult et al. 2010; Jiang et al. 2008; Reuer & Tong, 2005; Xu et al., 2010). However, very little is known regarding what might prevent the achievement of a real option when both the parties tend to minimize uncertainty on their side. Therefore, the fifth chapter of this thesis investigates risk asymmetries between the parties in different forms of alliance and how these asymmetries can lead to the reciprocal exchange of call and put options between the parties.

1.2.3 Location and re-location decisions

Another important strategic decision of the internationalization process is the choice of the location. Indeed, strategic flexibility is enhanced not only by entry mode switches, but also by location changes.

As already mentioned, companies from advanced countries have strategically chosen the location of production activities for several decades, mostly to take advantage of lower

18

labor costs in emerging countries. Typically, manufacturing and production activities have been offshored to emerging economies in order to exploit cost advantages, while value-adding, knowledge-intensive activities have been located in advanced countries (Contractor et al., 2010). However, over time, production activities have become increasingly technology intensive, implying a shift in the specialization of firms in emerging economies towards more knowledge-intensive production systems. At the same time, the improvement of technical capabilities in emerging economies and the advances in ICT have also facilitated the relocation of high value added activities (such as R&D, engineering services and product development) to emerging economies (Baaij et al., 2015; Blinder, 2006; Bunyaratavej et al., 2008; Lewin et al., 2009). After several decades of offshoring of both production and services, some companies have decided to relocate their offshore activities either back home or to other offshore locations. Indeed, as entry choices evolve over time, also location decisions change. In particular, the term re-shoring defines the location changes of formerly offshored business activities. Even though the re-shoring is not new, the existing literature traditionally focused on the relocation of manufacturing operations (Arlbjørn & Mikkelsen, 2014; Ellram, 2013; Ellram et al. 2013; Fratocchi et al., 2014; Gylling et al, 2015; Kinkel & Maloca, 2009; Martinez-Mora & Merino, 2014; Tate et al., 2014), and very little is known regarding the re-shoring and back shoring of business functions and their drivers. Therefore, the sixth and seventh chapters of this thesis inquire the reshoring of business services.

1.3 Research questions and purpose of the thesis: the dynamics over time in

offshoring

In the offshoring context, strategic decisions are extremely relevant in order to succeed on the market. In particular, as highlighted in the former section, offshoring companies are

19

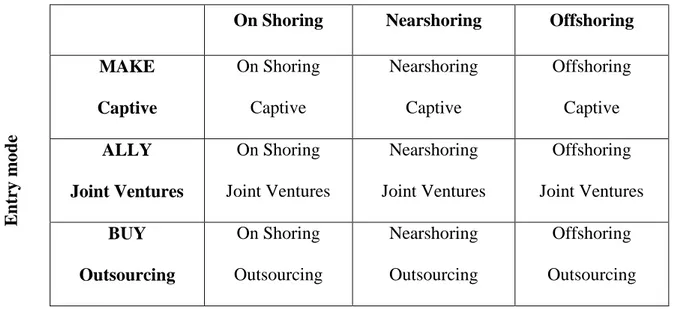

essentially involved in two main strategic decisions: the mode of entry and the location for their offshoring initiative. Table 2 synthetizes the set of strategic opportunities offshoring companies face. In particular, companies can approach new countries through: (i) wholly owned subsidiaries (i.e. captive); (i) strategic alliances (i.e. joint venture); (iii) or external suppliers (i.e. outsourcing). Moreover, companies can locate their activities: (i) in the home country (i.e. on shoring); (ii) in a close by country (i.e. nearshoring); (iii) or in faraway region (i.e. offshoring). The combination of different entry mode and location choices leads to several international configurations.

Table 2: Location and entry mode in offshoring

Location

On Shoring Nearshoring Offshoring

E n tr y m od e MAKE Captive On Shoring Captive Nearshoring Captive Offshoring Captive ALLY Joint Ventures On Shoring Joint Ventures Nearshoring Joint Ventures Offshoring Joint Ventures BUY Outsourcing On Shoring Outsourcing Nearshoring Outsourcing Offshoring Outsourcing

Source: adapted and translated from Albertoni & Elia, 2014

Although the literature has widely investigated the offshoring of business service, little is known about their dynamics over time. In particular, the literature deeply investigated the drivers and the underlying determinants related with the offshoring of business services, which are shifting from cost-reduction towards cross-border knowledge sharing (Baaij et al., 2015; Jensen & Pedersen, 2012; Lewin et al., 2009; Manning et al., 2008; Youngdahl et al., 2010).

20

Conversely, little is known regarding the evolution of the phenomenon over time and the performance implications for offshoring firms. Specifically, (i) some companies are persistent in their entry choices and heavily rely on previous experiences; (ii) some others try to keep a certain degree of flexibility in their entry choices in order to mitigate uncertainty; (iii) and some change the location over time. Therefore, this thesis tries to address the following research questions: when do companies learn from their former strategic entry decisions over time? How do companies maintain contractual flexibility to switch from one entry to another over time? Why do companies change the location of their offshoring initiatives over time?

Regarding the first research question, the selection of the entry mode is still one of the key concerns for the managers of companies investing abroad. Indeed, despite the large number of papers on this topic, scholars have been unable to identify managerial tools enabling greater performance (Brouthers, 2013). Furthermore, following the question posed by Shaver (2013) on whether we need to investigate further entry issues, Hennart and Slangen (2015) argue that entry mode studies require an evolutionary approach accounting for the role of previous experience. The most promising research in this field regards how to choose the entry mode fostering firms’ performance (Hennart & Slangen, 2015; Martin, 2013). In particular, the iteration of previous choices can arise from two main contingencies: (i) firms imitate their choices ritualistically; (ii) or firms learn from previous experiences by taking into account the ex-post outcome of prior choices (Hennart & Slangen, 2015). In the first situation, it is likely that the inertial blind self-imitation of previous choices gradually reduces the uncertainty related with the initiatives at hand, but it leads to lock-in effects, organizational inertia and ultimately problems of over-confidence and learning myopia (Petersen et al., 2008). The second scenario considers not only the need to adopt established organizational routines, but also the possibility to enhance the organizational capabilities as theorized by the Resource-Based View and Dynamic Capabilities approaches (Barney, 1991; Castañer et al., 2013;

21

Madhok, 1997; Meyer et al., 2009; Teece, 2014; Teece et al., 1997). In this context, the repetition of previous entries stemming from organizational inertia and the repetition of previous entries stemming from the selection of successful organizational routines need to be studied. It is not clear whether firms “merely consider the frequency with which specific modes were chosen previously”, or “take into account the ex post performance of prior choices and hence learn from them”, and, if they learn from prior experience, “from which types of experiences do they learn more” (Hennart & Slangen, 2015: 118). Thus, the first goal of this thesis is to inquire how different types of entry-specific experience lead to different types of learning and, hence, different outcomes for the offshoring present initiative.

Concerning the second research question, it is worth highlighting that the design and the structure of offshoring contracts deeply depends on the existence of specific clauses. In other words, the degree of control over foreign ventures: (i) varies along the continuum and it is not dichotomous (despite the fact that the literature on entry mode focussed mostly on make-or-ally decisions); and (ii) is strongly affected by the dynamics over time. Therefore, the fifth chapter focuses on real options (ROs) as a tool to enhance contractual flexibility and it investigates why companies engage in this kind of contracts. In particular, the chapter studies reciprocal uses of real options (ROs), meaning the exchange of call and put options between two business parties, and how this exchange can enable the cooperation between the parties. The main assumptions underlying the model presented in the chapter are that RO reciprocity can make sense (i) when sizeable irrevocable investments are needed upfront, and (ii) when the risk tolerance of the two parties differs to a non-negligible extent. The main finding is that the more risk-willing party will be allotted a call option in exchange of granting the risk-averse party a put option. Although the study was originally conceived in the context of business service offshoring, the same findings are applicable also to different contexts. In particular, the chapter discusses the applicability to horizontal alliances (such as R&D collaborations, license

22

agreements or franchising), and vertical alliances (such as outsourcing and, in particular, Build-Operate-Transfer contracts).

Last but not least, after several decades of offshoring of both production and services (with the latter still growing), some companies have decided to relocate their offshore activities either back home or to other offshore locations. However, little research has investigated these “backshoring” and “reshoring” activities, in particular of business services. Therefore, the sixth chapter of this thesis investigate what we already know about the reshoring of business service and what we still need to understand. The seventh chapter tries to address some of the research perspectives emerged in the sixth chapter. In particular, it studies the post-performance implications of offshoring decisions on relocation choice and the main drivers leading to the reshoring of business services. The findings are not only important to fill the extant gap in the literature on the reshoring phenomenon, but also to identify the most important implications for managers and policy makers. On the one hand, the co-location of business activities might have benefits exceeding the cost savings attainable through offshoring. On the other hand, the reshoring of business activities towards advanced countries can be one of the tools to restore the competitiveness of these areas.

1.4 Research methodology

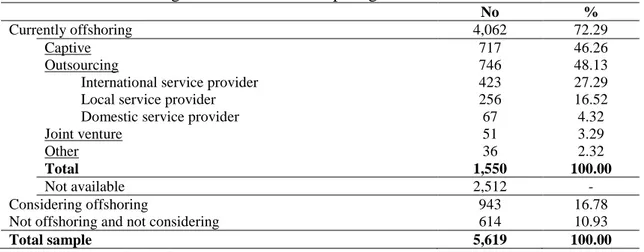

This thesis is one of the outcomes stemming from an international research project called Offshoring Research Network (ORN) involving the contribution of several researchers from all over the world. The research is mostly based on the data stemming from the ORN database10; the only exception is the fifth chapter, that is a theoretical and not an empirical contribution. The dataset is used both to provide a description of the phenomenon and to test

23

theoretical hypothesis. Indeed, most of the contributions of this thesis departs from an in-depth inquiry of the extant literature and from a throughout analysis of the data, and they then test whether theoretical hypothesis are confirmed by empirical findings. In particular, descriptive statistics and econometric regressions are used in order to analyse ORN data.

The ORN database is probably the most representative source of data for studying offshoring of business services by companies of varied size, in a wide range of industries and countries (Elia et al., 2014; Gooris & Peeters, 2016; Lewin & Peeters, 2006; Lewin et al., 2009; Larsen et al. 2013). This dataset builds on repeated surveys, which started in 2005. The most recent survey was issued in 2011, with a total of more than 5,000 observations; however, due to missing data in some of the variables, our analysis is often based on fewer observations. In the second chapter, we provide detailed descriptive analyses of the data to better understand the nature of offshoring and the characteristics and context of the firms making these decisions. ORN data are collected through a detailed online questionnaire delivered to organizations engaged in or considering sourcing administrative and technical work from abroad. The home countries reflect the geographic areas covered by ORN partners; therefore, the headquarters mostly belong to the European and US areas. The offshoring flows are directed towards advanced and developing countries (primarily India and China). The main goal of the network is to study, monitor and collect data focusing on issues such as the functions, the drivers, the geographic dynamics, the risks, the entry choices and the performance implications11.

11 Specific limitations of the ORN dataset are acknowledged in each chapter, in accordance with the specific research question.

24

1.5 Organization of the work and brief overview of the contributions

As already stated, the thesis is a collection of six papers, each one corresponding to one chapter of the thesis, and the following lines show the overall structure of the work.

After this cover essay, the second chapter is entitled “The Global Sourcing of Business Services: Evidence from the Offshoring Research Network Survey” and it provides a statistical investigation aimed at gaining further understanding of the growing phenomenon of global sourcing of business services. As mentioned above, R&D, engineering and product design business functions are increasingly offshored, and offshoring firms prefer wholly owned rather than outsourcing entry modes when involving these business functions. US and Canadian companies are more likely to adopt arm’s length contracts, while European companies show a slight preference for wholly owned solutions. The host country most widely represented is India, with almost 40 percent of all the offshoring initiatives in the dataset. The underlying reason might be that India is extremely attractive as long as it is able to offer not only low cost talents but also qualified suppliers. The main drivers appear to be cost-savings and access to skilled personnel. Wholly owned solutions seem to be more performing than outsourcing in achieving both savings and high quality standards.

The third chapter is entitled “Complementing the Reshoring of Manufacturing Activities: the Relocation of Business Functions. This chapter provides some preliminary statistics regarding the re-shoring of business functions. Indeed, policy makers and scholars are increasingly interested in the relocation of once offshored activities; however, the empirical evidence is mostly focussed on manufacturing activities, while very little is known about business functions that assist manufacturing activities. Using data from the Offshoring Research Network survey, this chapter provides some empirical evidence regarding the plans to re-shore administrative and technical work. In particular, the chapter analyses the

entry-25

mode, the home and the host country context, the business functions, the industries, the size and the performance of once offshored activities that are now planned to be re-shored.

The fourth chapter is entitled “The Role of Previous Experience on MNCs’ Repeated Entry Mode in Foreign Markets: Mindful or Inertial Learning?” and it investigates the relationship between entry-specific experience, entry choices and the ultimate outcome of the offshoring initiative. In particular, the extant literature considers experience as a predictor of firms’ entry choices because it allows reducing uncertainty associated to the foreign country. However, the repetition of the same action does not necessarily increase the likelihood of a successful outcome, depending on the type of learning stemming from previous experiences. Specifically, the repetition of previous entry modes increases the focal initiative performance only when the company internalizes previous outcomes. Conversely, the inertial repetition of routines associated to previous entries does not lead to an increase of the outcome. The empirical analysis confirm the hypotheses.

The fifth chapter is entitled “Does Reciprocal Use of Real Options Qualify as Cooperative Strategy?” and it studies the reciprocal uses of real options (i.e. the exchange of call and put options between two business parties). Most real option studies focus on one-sided uses of real options. Real option reciprocity can make sense when sizeable irrevocable investments are needed upfront, and the risk tolerance of the two parties differs to a non-negligible extent. In this case, the more risk-willing party is allotted a call option in exchange of granting the risk-averse party a put option. By use of a risk tolerance simulation model in the context of an international joint venture the paper demonstrates how a real option exchange appears as a win-win strategy for two business parties with asymmetrical risk profiles. Moreover, the paper exemplifies and discusses reciprocal use of real options in the context of other types of interfirm collaboration such as franchising and outsourcing.

26

The sixth chapter is entitled “Returning from Offshore: What Do We Know?” and it inquires the state of the art regarding the back shoring of both production and service activities. In particular, the contribution relies on the data of the Uni-CLUB MoRe and of the ORN database. The article concludes with some implications for managers, policy makers and researchers.

The seventh chapter is entitled “The Reshoring of Business Services: Reaction to Failure or Persistent Strategy?” and it analyses post-performance considerations after offshoring, thus addressing strategies and industrial policies in the international context. In particular, despite the increasing trend of service offshoring, some companies are assessing their post-implementation performance and are considering relocating their offshoring initiatives. However, so far, the investigation on the relocation of once offshored activities (i.e. the reshoring phenomenon) has been mostly confined to manufacturing activities, while this paper investigates the relocation of business services, following the former chapter of this thesis. In particular, the findings suggest that the reshoring of business services is the result both of company response to performance shortcomings of the initiative offshored and of the persistence with original offshoring strategy (disintegration advantages, accessing new markets and cost-saving).

1.6 The dissemination strategy of the work

1.6.1 Academic dissemination

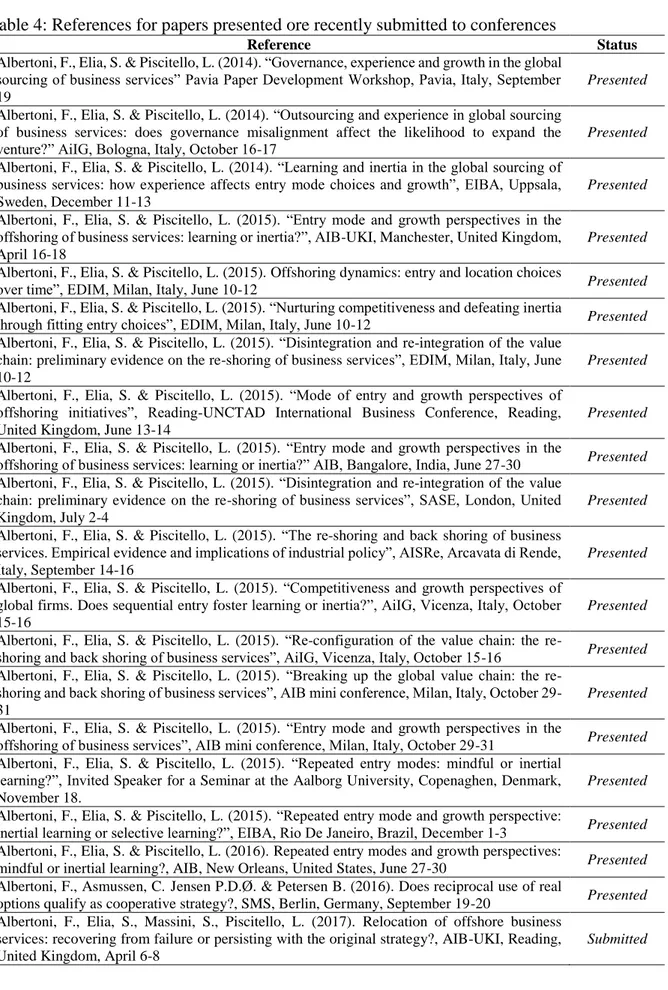

In order to disseminate the work within the academic community, one article was published on the Journal of Industrial and Business Economics and another one on the AIB

27

order of stage of development: one entitled “The Reshoring of Business Services: Reaction to Failure or Persistent Strategy?” (Journal of World Business as target journal, second round Revise & Resubmit); one entitled “Complementing the Reshoring of Manufacturing Activities: the Relocation of Business Functions” (submitted in response to the call for papers “Reshoring of Manufacturing - Drivers, Opportunities, and Challenges” of the Springer series addressing Operations Management, MEOP - Measuring Operations Performance); one entitled “When do Offshoring Companies Learn from the Repetition of Former Entry Modes?” (Journal of

Business Research as target journal); and one entitled “Does Reciprocal use of Real Options

Qualify as Cooperative Strategy?” (Managerial Decision and Economics as target journal)12. Moreover, several works have been presented to national and international conferences (see table 4 for further details). In order to strengthen the dissemination strategy, one track of the Associazione italiana Ingegneria Gestionale conference 2015 was organized; the title of the track was “Offshoring, Re-shoring and Back-shoring: Reconfiguring the Global Value Chain of Transnational Firms”. Moreover, in partnership with Bocconi University and the Academy of International Business, a special conference entitled “Breaking Up the Global Value Chain: Possibilities and Consequences” was organized (see the following link for further details: http://valuechain.unibocconi.eu/).

12 As indicated in table 3, the papers of the thesis are going to be submitted, or are under review, or are published in international journals, therefore, the reference style has been adjusted according to the editorial requests.

28 Table 3: Work progress of the papers

Chapter Title Co-author Target journal /

volume Status

2

The global sourcing of business services: evidence from the Offshoring Research Network survey Stefano Elia (Politecnico di Milano) Journal of Industrial and Business Economics Published 2014, 14(2) 3 Complementing the reshoring of manufacturing activities: the relocation

of business functions Stefano Elia (Politecnico di Milano) Lucia Piscitello (Politecnico di Milano) Reshoring of Manufacturing - Drivers, Opportunities, and Challenges Submitted 4

The role of previous experience and learning

in explaining MNCs’ repeated entry mode

Stefano Elia (Politecnico di Milano) Lucia Piscitello (Politecnico di Milano) Journal of Business Research Working paper 5

Does reciprocal use of real options qualify as cooperative strategy?

Christian Geisler Asmussen (Copenhagen Business School)

Bent Petersen

(Copenhagen Business School)

Managerial Decision & Economics Working paper 6 Returning from offshore: What do we know? Stefano Elia (Politecnico di Milano) Luciano Fratocchi (Università dell’Aquila) Lucia Piscitello (Politecnico di Milano)

AIB Insights Published

2015, 15(4) 7 The Reshoring of Business Services: Reaction to Failure or Persistent Strategy? Stefano Elia (Politecnico di Milano) Silvia Massini (University of Manchester) Lucia Piscitello (Politecnico di Milano) Journal of World Business Second Round Revise & Resubmit

29

Table 4: References for papers presented ore recently submitted to conferences

Reference Status

Albertoni, F., Elia, S. & Piscitello, L. (2014). “Governance, experience and growth in the global sourcing of business services” Pavia Paper Development Workshop, Pavia, Italy, September 19

Presented Albertoni, F., Elia, S. & Piscitello, L. (2014). “Outsourcing and experience in global sourcing

of business services: does governance misalignment affect the likelihood to expand the venture?” AiIG, Bologna, Italy, October 16-17

Presented Albertoni, F., Elia, S. & Piscitello, L. (2014). “Learning and inertia in the global sourcing of

business services: how experience affects entry mode choices and growth”, EIBA, Uppsala, Sweden, December 11-13

Presented Albertoni, F., Elia, S. & Piscitello, L. (2015). “Entry mode and growth perspectives in the

offshoring of business services: learning or inertia?”, AIB-UKI, Manchester, United Kingdom, April 16-18

Presented Albertoni, F., Elia, S. & Piscitello, L. (2015). Offshoring dynamics: entry and location choices

over time”, EDIM, Milan, Italy, June 10-12 Presented

Albertoni, F., Elia, S. & Piscitello, L. (2015). “Nurturing competitiveness and defeating inertia

through fitting entry choices”, EDIM, Milan, Italy, June 10-12 Presented Albertoni, F., Elia, S. & Piscitello, L. (2015). “Disintegration and re-integration of the value

chain: preliminary evidence on the re-shoring of business services”, EDIM, Milan, Italy, June 10-12

Presented Albertoni, F., Elia, S. & Piscitello, L. (2015). “Mode of entry and growth perspectives of

offshoring initiatives”, Reading-UNCTAD International Business Conference, Reading, United Kingdom, June 13-14

Presented Albertoni, F., Elia, S. & Piscitello, L. (2015). “Entry mode and growth perspectives in the

offshoring of business services: learning or inertia?” AIB, Bangalore, India, June 27-30 Presented Albertoni, F., Elia, S. & Piscitello, L. (2015). “Disintegration and re-integration of the value

chain: preliminary evidence on the re-shoring of business services”, SASE, London, United Kingdom, July 2-4

Presented Albertoni, F., Elia, S. & Piscitello, L. (2015). “The re-shoring and back shoring of business

services. Empirical evidence and implications of industrial policy”, AISRe, Arcavata di Rende, Italy, September 14-16

Presented Albertoni, F., Elia, S. & Piscitello, L. (2015). “Competitiveness and growth perspectives of

global firms. Does sequential entry foster learning or inertia?”, AiIG, Vicenza, Italy, October 15-16

Presented Albertoni, F., Elia, S. & Piscitello, L. (2015). “Re-configuration of the value chain: the

re-shoring and back re-shoring of business services”, AiIG, Vicenza, Italy, October 15-16 Presented Albertoni, F., Elia, S. & Piscitello, L. (2015). “Breaking up the global value chain: the

re-shoring and back re-shoring of business services”, AIB mini conference, Milan, Italy, October 29-31

Presented Albertoni, F., Elia, S. & Piscitello, L. (2015). “Entry mode and growth perspectives in the

offshoring of business services”, AIB mini conference, Milan, Italy, October 29-31 Presented Albertoni, F., Elia, S. & Piscitello, L. (2015). “Repeated entry modes: mindful or inertial

learning?”, Invited Speaker for a Seminar at the Aalborg University, Copenaghen, Denmark, November 18.

Presented Albertoni, F., Elia, S. & Piscitello, L. (2015). “Repeated entry mode and growth perspective:

inertial learning or selective learning?”, EIBA, Rio De Janeiro, Brazil, December 1-3 Presented Albertoni, F., Elia, S. & Piscitello, L. (2016). Repeated entry modes and growth perspectives:

mindful or inertial learning?, AIB, New Orleans, United States, June 27-30 Presented Albertoni, F., Asmussen, C. Jensen P.D.Ø. & Petersen B. (2016). Does reciprocal use of real

options qualify as cooperative strategy?, SMS, Berlin, Germany, September 19-20 Presented Albertoni, F., Elia, S., Massini, S., Piscitello, L. (2017). Relocation of offshore business

services: recovering from failure or persisting with the original strategy?, AIB-UKI, Reading, United Kingdom, April 6-8

30

1.6.2 Practitioner dissemination

This research work has allowed also several synergies with practitioners and managerial implications. The first part of the research allowed frequent interactions with managers in order to collect data for the ORN survey project13. These interactions led to the organization of one

round table and the organization of an elective MBA course at the School of Management of Politecnico di Milano (MIP) entitled “Global Sourcing & Procurement of Services” beyond several other teaching activities at Master level within the same university. The publication (together with Stefano Elia) entitled “Rischio e strategia nel global sourcing” (in La gestione dei fornitori dominanti, 2014: http://tinyurl.com/njsa8gk) was born within the collaboration with these practitioners.

During the second part of the PhD, the interest towards the localization of the companies and in particular the ones belonging to the Made-in-Italy led to the increasing involvement to the activities of the observatory “eCommerce-export”. The main mission of this observatory (belonging to the observatories on the digital innovation: www.osservatori.net) is to provide knowledge and support to Italian companies in the promotion of the export of Italian goods and services through the use of new technologies. The main activities of the observatory are related with companies’ engagement, fund-raising, workshop organization, data collection and data analysis.

13 It is worth noting that, although the thesis uses data stemming from the latest ORN release in 2011, data collection continued until 2014.

31

1.7 Concluding remarks and future steps

The main aim of this research was to investigate the fragmentation of the global value chain and, in particular, it analysed the dynamics and performance implications related with the offshoring of business services. The study is divided in three main parts: one providing an overall statistical overview of the offshoring of business services (chapters 2 and 3); one dealing with the persistency and the evolution over time of the mode of entry (chapters 4 and 5) and another one covering the emerging phenomenon of reshoring (chapters 6 and 7).

After an overview of the main dimensions of the offshoring of business services, the first part of this thesis inquires the evolution of the contractual agreements in the offshoring context, and it studies how companies’ strategic decisions evolve over time and how organizations can enhance their flexibility and reduce uncertainty. Although this study started to investigate the contractual complexity underlying international agreements between different companies, the mode of entry should be further disentangled empirically considering that between outsourcing and wholly owned solutions there are many other contractual forms (see Mudambi & Tallman, 2010); also the adoption of particular contractual clauses (such as real options) require further empirical testing. In addition, the variables considered to measure the offshoring performance probably need a refinement in order to improve their reliability. Moreover, causality issues can be resolved only using panel data, therefore future data collection on offshoring should consider to follow the evolution of the companies over time, also to understand what might lead to the closure of an offshoring initiative. Indeed, while we know a lot about companies that are active abroad, we know very little about the companies ceasing their foreign activities. Furthermore, we still know very little regarding the synergies between MNCs’ activity and their home and host locations; it is often difficult to measure not only the impact on unemployment of the decision to relocate some business activities, but also

32

the degree of embeddedness with the academic and research ecosystem. Therefore, the offshoring and reshoring phenomena still deserve attention and further research.

33

1.8 References

Agarwal, S. & Ramaswami, S.N. 1992. Choice of foreign market entry mode: impact of ownership, location and internalization. Journal of International Business Studies, Vol. 23, No. 1, pp. 1-27.

Albertoni, F. & Elia, S. 2014. Rischio e strategia nel global sourcing. In Albertini, G. et al. (Eds), La gestione dei fornitori dominanti. http://tinyurl.com/njsa8gk

Anderson, E. & Gatignon, H. 1986. Modes of foreign entry: a transaction cost analysis and propositions. Journal of International Business Studies, Vol. 17, pp. 1-26.

Arlbjørn, J.S. & Mikkelsen, O.S. 2014. Backshoring manufacturing: notes on an important but under-researched theme. Journal of Purchasing and Supply Management. Vol. 20, pp. 60-62.

Baaij, M.G., Mom, T.J.M., Van den Bosch, F.A.J. & Volberda, H.W. 2015. Why do multinational corporations relocate core parts of their corporate headquarters abroad?

Long Range Planning, Vol. 48, pp. 46-58.

Barney, J. 1991. Firm resources and sustained competitive advantage. Journal of Management. Vol. 17, No. 1, pp. 99-120

Benito, G.R.G., Petersen, B. Welch, L.S. 2009. Towards more realistic conceptualisations of foreign operation modes. Journal of International Business Studies. Vol. 40, No. 9, pp. 1455-1470.

Blinder, A.S. 2006. Offshoring: the next industrial revolution? Foreign Affairs, Vol. 85, No. 2, pp. 113-128.

Bowman E.H. & Hurry D. 1993. Strategy through the option lens: an integrated view of resource investments and the incremental-choice process. The Academy of

34

Brouthers, K. D. 2002. Institutional, cultural and transaction cost influences on entry mode choice and performance. Journal of International Business Studies, Vol. 33, No. 2, pp. 203-221.

Brouthers, K. D. 2013. Retrospective on entry mode and performance. Journal of International

Business Studies. Vol. 44, pp. 14-22.

Brouthers, K.D. & Brouthers, L.E. & Werner. S. 2008. Real options, international entry mode choice and performance. Journal of Management Studies, Vol. 45, No. 5, pp. 936-960.

Brouthers, K.D. & Hennart, J.-F. 2007. Boundaries of the firm: insights from international entry mode research. Journal of Management, Vol. 22, No.3, pp. 395-425.

Buckley, P. J., & Casson, M. C. 1976. The future of the multinational enterprise. London: Macmillan.

Bunyaratavej, K., Hahn, E.D. & Doh, J.P. 2008. Multinational investment and host country development: location efficiencies for service offshoring. Journal of World Business, Vol. 43, pp. 227-242.

Campa, J.M. 1993. Entry by foreign firms in the United States under exchange rate uncertainty.

The Review of Economics and Statistics, Vol. 75, No. 4, pp. 614-622.

Castañer, X., Mulotte, L., Garrette, B., & Dussauge, P. 2013. Governance mode vs. governance fit: performance implications of make-or-ally choices for product innovation in the world wide airacraft industry 1942-2000. Strategic Management Journal, Vol. 35, No. 9, pp. 1386-1397.

Caves, R. E. 1982. Multinational enterprises and economic analysis. Cambridge: Cambridge University Press.

35

Chan, C. M., & Makino, S. 2007. Legitimacy and multi-level institutional environments: implications for foreign subsidiary ownership structure. Journal of International

Business Studies, Vol. 38, No. 4, pp. 621-638.

Chang, S. J., & Rosenzweig, P. M. 2001. The choice of entry mode in foreign direct investment.

Strategic Management Journal, Vol. 22, pp. 747-776.

Chi, T.L. & McGuire, D.J. 1996. Collaborative ventures and the value of learning: integrating the transaction cost and strategic option perspectives on the choice of market entry modes. Journal of International Business Studies, Vol. 27, pp. 285-307.

Chi, T.L. 2000. Option to acquire or divest a joint venture. Strategic Management Journal, Vol. 21, pp. 665-687.

Chung, C.C., Lee, S. H., Beamish, P., & Isobe, T. 2010. Subsidiary expansion/contraction during times of economic crisis. Journal of International Business Studies, Vol. 41, No. 3, pp. 500-516.

Contractor, F., Kumar, V., Kundu, S. & Pedersen T. 2010. Reconceptualising the firm in a world of outsourcing and offshoring: The organizational and geographical relocation of high-value company functions. Journal of Management Studies, Vol. 47, No. 8, pp. 1417-1433.

Cuypers, I.R.P. & Martin, X. 2007. Joint ventures and real options: an integrated perspective.

Advances in Strategic Management. Vol. 24, pp. 103-144.

Cuypers, I.R.P. & Martin, X. 2010. What makes and what does not make a real option? A study of equity shares in international joint ventures. Journal of International Business

Studies, Vol. 41, pp. 47-69.

Dalziel, M. 2009. Forgoing the flexibility of real options: when and why firms commit to investment decisions. British Journal of Management, Vol. 20, No. 3, pp. 401–412.

36

Dixit, A.K. & Pindyck, R., S. 1994. Investment under uncertainty. Princeton University Press; Princeton, NJ.

Dossani, R., & Kenney, M. 2006. Reflections upon “Sizing the Emerging Global Labor Market”. Academy of Management Perspectives, Vol. 20, No. 4, pp. 35–41.

Elia, S., Caniato, F., Luzzini, D., & Piscitello, L. 2014. Governance and performance in global sourcing of services: does a mistake always hurt performance? Global Strategy

Journal, Vol. 4, No. 3, pp. 181-199.

Ellram, L. M. 2013. Offshoring, reshoring and the manufacturing location decision. Journal of

Supply Chain Management. Vol. 49, No. 2, pp. 3-5.

Ellram, L. M., Tate, W. L. & Petersen, K. J. 2013. Offshoring and reshoring: an update on the manufacturing location decision. Journal of Supply Chain Management. Vol. 49, No. 2, pp. 14-22.

Fichman, R.G., Keil, M. & Tiwana, A., 2005, Beyond Valuation: “Options Thinking” in IT Project Management. California Management Review, Vol. 47, pp. 74-96.

Folta, T.B. & Miller, K.D. 2002. Real options in equity partnerships. Strategic Management

Journal, Vol. 23, pp. 77-88.

Fratocchi, L., Di Mauro, C., Barbieri, P., Nassimbeni, G. & Zanoni, A. 2014. When manufacturing moves back: concepts and questions. Journal of Purchasing and

Supply Management, Vol. 20, pp. 54-59.

Gao, G.Y. & Pan, Y. 2010. The pace of MNEs’ sequential entries: cumulative entry experience and the dynamic process. Journal of International Business Studies, Vol. 41, pp. 1572-1580.

Goldberg, L. & Kolstad, C. 1995. Foreign direct investment, exchange rate variability and demand uncertainty. International Economic Review. Vol. 36, No. 4, pp. 855-873.