Politecnico di Milano

Scuola di Ingegneria Industriale e dell’Informazione

Corso di Laurea Magistrale in Ingegneria Gestionale

“A classification framework of distribution strategies

supporting cross-border online sales of Food and

Beverage products to USA: a focus on the wine industry”

Relatore: Riccardo Mangiaracina

Correlatore: Maria Giuffrida

Tesi di laurea di:

Luca Pelliccioni (818091)

Anno accademico: 2014/2015

Summary

List of figures ... 4

List of tables ... 4

List of graphs ... 5

Abstract ... 6

Executive summary (Italian version) ... 7

Premesse ... 7Obiettivi ... 9

Metodologia ... 9

Risultati ... 10

Focus sul vino ... 14

Executive summary (English version) ... 18

Introduction ... 18Goals ... 19

Methodologies ... 20

Results ... 21

Wine export models ... 25

1 Focus of the thesis ... 29

1.1 Industry selection ... 291.2 The choice of the country of destination: the United States of America ... 29

2 Objectives and methodology ... 32

2.1 Objectives ... 322.2 Methodology ... 32

3 The strategic approach ... 34

3.1 Tactical Outsourcing ... 343.2 Strategic Outsourcing ... 34

3.3 Insourcing ... 35

3.3.1 A case study: Rana S.p.A in the U.S. ... 35

4 The trade channels ... 37

4.1 Producer’s own website ... 374.1.1 A case study: Monini.us ... 37

4.1.2 Factors discouraging own e-commerce website ... 37

4.2 Selling through third party e-commerce website/platforms ... 39

4.2.1 E-commerce landscape in US ... 39

4.2.2 Focus on food e-commerce ... 40

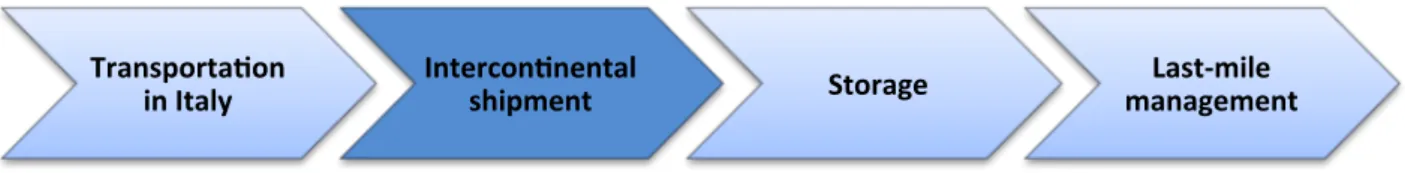

5 The logistics channels ... 48

5.1 Transportation in Italy ... 495.1.1 The road freight in Italy ... 49

5.1.2 The rail freight in Italy ... 49

5.2 Intercontinental shipment ... 50

5.2.1 Sea freight ... 50

5.2.2 Air freight ... 53

5.2.3 Value added services ... 54

5.3 Storage ... 55

5.3.1 Proprietary warehouse ... 55

5.3.2 Importer’s warehouse ... 55

5.3.3 Third-party warehousing services provider ... 55

5.4 Last mile management ... 56

5.4.1 Build your own network ... 57

5.4.2 Outsource to a 3PL operator ... 58

6 Focus on wine ... 62

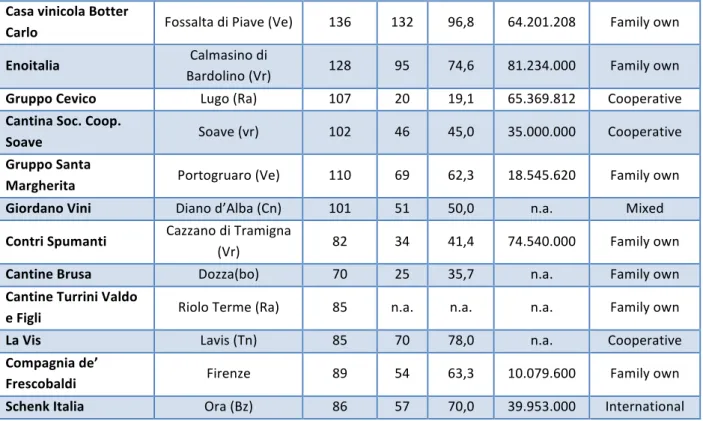

6.1 State of wine industry in Italy ... 626.2 State of wine industry in the U.S. ... 65

6.2.1 Sale channels ... 66

6.2.2 The distribution system in US ... 66

6.3 Current offline export channels ... 67

6.3.1 The importer ... 68

6.3.2 Exporting through an “unconventional” importer ... 71

6.3.3 Open your import/export company ... 72

6.3.4 Open a licensed retailer ... 74

6.4 Wine e-commerce ... 74

6.4.1 Amazon wine marketplace ... 75

6.4.2 GiordanoWines.com ... 76

6.4.3 The wine shipping law ... 77

7 Import regulation ... 80

7.1 Departments of the Federal Government ... 807.2 The American Customs Authorities ... 80

7.2.1 Customs clearance and documentation ... 81

7.2.2 Excise taxes ... 81

7.3 Import of food products ... 82

7.3.1 The anti-bioterrorism in the United States of America ... 82

7.3.2 Labelling of Food Products ... 86

7.3.3 Focus on wine regulation ... 87

8 Conclusions ... 90

8.1 Future developments ... 919 Bibliography ... 92

10 Attachments ... 94

10.1 Interview to ExportUsa ... 94List of figures

Figure 1: Il modello “tradizionale” ... 10

Figure 2: Modello con sito e-commerce proprietario ... 12

Figure 3: Vendita tramite marketplace con evasion ordini dall’Italia ... 12

Figure 4: Amazon FBA Global Selling ... 13

Figure 5: Esportare tramite ExportUsa ... 14

Figure 6: Modello di export “tradizionale” per il vino ... 14

Figure 7: Aperture società d’importazione/distribuzione negli Stati Uniti ... 15

Figure 8: Sito e-commerce proprietario (vino) ... 16

Figure 9: Vendita tramite Amazon ... 17

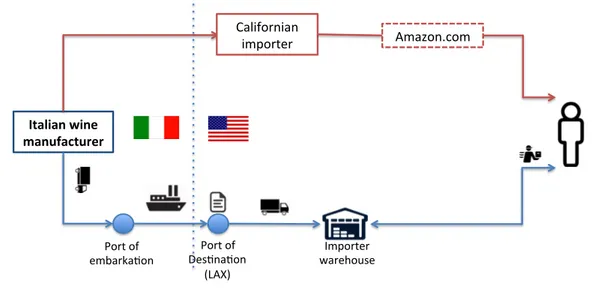

Figure 10: The “traditional” model ... 21

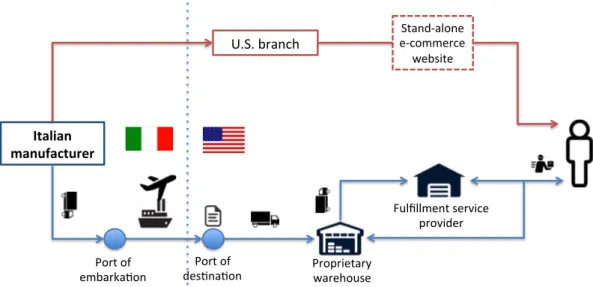

Figure 11: Proprietary website model ... 23

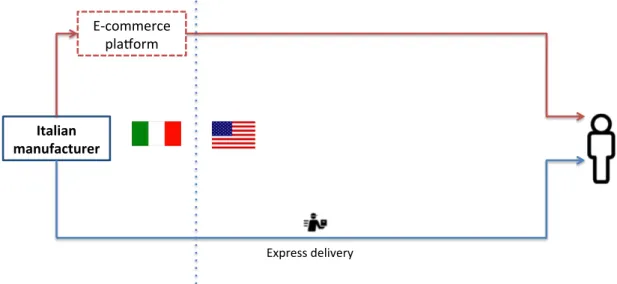

Figure 12: Sale thorugh e-commerce platform with shipment from Italy ... 23

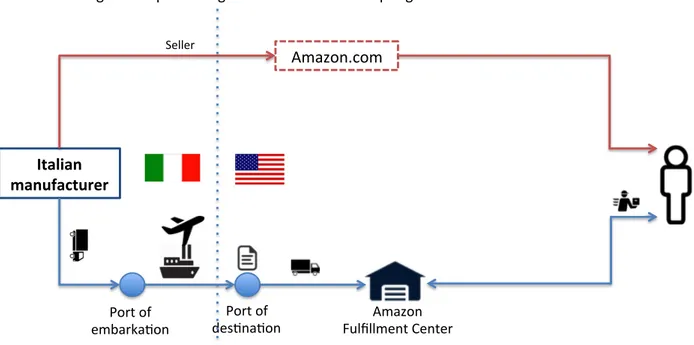

Figure 13: Amazon FBA Global Selling ... 24

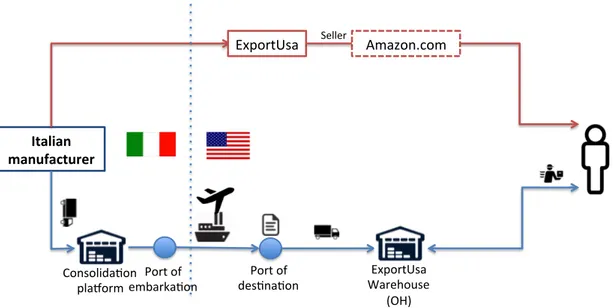

Figure 14: ExportUsa model ... 24

Figure 15: “Traditional” model ... 25

Figure 16: Start an import/distribution business in the U.S. ... 26

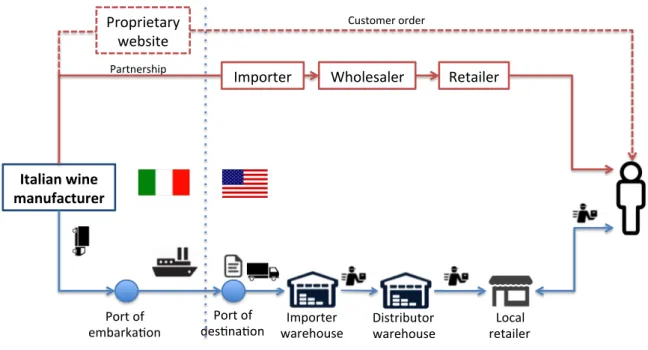

Figure 17: Proprietary e-commerce website (wine) ... 26

Figure 18: Amazon wine marketplace ... 27

Figure 19: Amazon marketplaces ... 41

Figure 20: The logistics process ... 48

Figure 21: Transportation in Italy ... 49

Figure 22: Intercontinental shipment ... 50

Figure 23: Storage ... 55

Figure 24: Last mile management ... 57

Figure 25: Three-Tier System ... 67

Figure 26: Government warning sample ... 88

List of tables

Table 1: Classifica primi 10 esportatori mondiali (ICE report 2014/2105) ... 7

Table 2: Global exporters (goods and services) ranking (ICE report 2014/2015) ... 18

Table 3: A comparison of Food and Beverage sectors different countries (Arkios Italy, 2012) ... 38

Table 4: Major Food and Beverage e-commerce in the U.S. (Top 500 guide, 2014) ... 41

Table 5: Comparison of Amazon Vendor Central and Amazon Seller Central ... 43

Table 6: Container standard features ... 52

Table 7: Self-fulfillment vs. Outsourced fulfillment ... 60

Table 8: Top 20 Italian wine companies (Mediobanca, 2015) ... 64

Table 9: List of U.S. wine importers ... 69

Table 10: Analysis of wine price/cost structure (Impact Databank, Spanish Chamber of

Commerce NY) ... 70

Table 11: Top 10 U.S. wine wholesalers (Impact Newsletter, 2013) ... 71

Table 12: Average number of days to completely process Original Applications to operate (TTB,

2015) ... 87

List of graphs

Graph 1: Export/GDP (rielaborazione dati Istat, 2014) ... 8

Graph 2: Fatturato e-commerce globale (eMarketer, 2014) ... 8

Graph 3: Export/GDP rate (elaboration on Istat data, 2014) ... 19

Graph 5: Major online retailers in the U.S. (Euromonitor International, 2014) ... 39

Graph 6: Top 10 Ocean Carriers (Alphaliner.com) ... 51

Graph 7: Air freight volumes (IATA, 2015) ... 53

Graph 8: Top 10 air cargo carriers (IATA, 2015) ... 54

Graph 9: Top 25 American 3PL (Armstrong and Associates, 2015) ... 59

Graph 10: Italian export value share by country of destination (Mediobanca, 2015) ... 62

Graph 11: 2014 wine production by country (Statista, 2015) ... 63

Graph 12: Wine consumption CAGR by country (IWSR, 2015) ... 65

Graph 13: U.S. Wine market by sale channels ... 66

Graph 14: Composition of end price of a bottle of wine (Impact Databank, 2009) ... 70

Abstract

Italian version

Gli Stati Uniti rappresentano storicamente uno dei principali mercati di sbocco per l’export

Agroalimentare Italiano. La congiuntura macroeconomica attuale che vede una moneta

Europea debole rispetto al Dollaro e una crescita dei consumi nel paese a stelle e strisce

significativa rafforza ulteriormente le opportunità derivanti da tale mercato.

I consumi crescono sopratutto del segmento e-commerce B2c; infatti, nonostante le abitudini

del consumatore digitale Americano siano consolidate, alcuni settori, in particolare quello del

Food and Beverage, sono carattarizati da una notevole dinamacità. L’opportunità di sfruttare il

canale online per esportare è quindi importante e attuale ma spesso le nostre imprese non

sono dotate della dimensione o del know-how necessario per affrontare un mercato altamente

regolamentato ed esigente come quello Americano.

Sulla scia di queste osservazioni, questa tesi si pone l’obiettivo di fornire un supporto

informativo alle imprese Italiane interessate a esportare negli Stati Uniti attraverso l’utilizzo di

tecnologie e-commerce.

In particolare, esploreremo le strategie commerciali e logistiche che tali imprese possono

implementare a supporto dell’esportazione dei loro prodotti tramite e-commerce B2c, con

accenni necessari alle implicazioni normative e burocratiche che tali “modelli di export”

comportano.

English version

The United States is historically one of the main destination markets for the export of Food and

Beverage prodcuts. The current macroeconomic situation is carachterized by a weak euro

against dollar and by a significative growth of the internal demand in the US; factors that

further strenghten the opportunities offered by this market.

In particular, consumption is driven by e-commerce B2c segment. In fact, despite the habits of

the American digital consumer are consolidated, some industries, especially the Food and

Beverage, are carachterized by high growth rates. Therefore, the opportunity to take advantage

of the online channel for exporting is real and relevant but, often, Italian companies do not

have the proper size or the know-how to deal with a highly regulated and demanding market

and such as the US.

In the wake of these considerations, this thesis aims to provide an informative support to

Italian companies interested in exporting to the United States through the use of e-commerce

technologies.

In particular, we will explore the commercial and logistics strategies that these firms can

implement to support the export of their products through e-commerce B2C, with necessary

hints to bureaucratic and regulatory implications that these "expot models" carry with them.

Executive summary (Italian version)

Questo lavoro di tesi si inserisce all’interno del progetto di ricerca che l’Osservatorio Export del Politecnico di Milano sta portando avanti al fine di fornire un supporto, soprattutto in termini informativi, alle imprese Italiane che vogliono esportare i loro prodotti tramite l’utilizzo di canali E-commerce B2C.

Nel dettaglio, la tesi ha come obiettivo quello di analizzare i canali commerciali e logistici che le imprese operanti nel settore Agroalimentare possono utilizzare per esportare i loro prodotti negli Stati Uniti d’America.

Premesse

I principali trend del contesto macroeconomico attuale che fanno sì che il presente lavoro di analisi abbia una forte significatività come supporto strategico e decisionale per le imprese sono due:

• La crescente rilevanza dell’export per l’economia Italiana; • La continua crescita dell’e-commerce B2C nel mercato globale.

Nel 2014 le esportazioni italiane di beni, a prezzi correnti, sono aumentate del 2,1 per cento, raggiungendo un totale di €387 miliardi (ICE report, 2014). Con questo risultato l’Italia si conferma all’ottavo posto della classifica dei maggiori esportatori mondiali guadagnando ben tre posizioni rispetto al 2013.

Ranking

Country Value (€ billion) % Var. Share

2013 2014 2013 2014 2013-14 2014 1 1 China 2.209 2.343 6,1 12,4 2 2 United States 1.580 1.623 2,8 8,6 3 3 Germany 1.452 1.511 4,1 8,0 4 4 Japan 715 684 -4,4 3,6 5 5 Netherlands 672 672 0,1 3,6 6 6 France 581 583 0,4 3,1 7 7 South Korea 560 573 2,3 3,0 11 8 Italy 518 529 2,0 2,8 9 9 Hong Kong 535 524 -2,1 2,8 8 10 United Kindgom 541 507 -6,3 2,7 Table 1: Classifica primi dieci esportatori mondiali (ICE report 2014/2105)

Quest’andamento è stato il risultato di una variazione di segno positivo delle vendite destinate all’Unione europea (+3,7%), le cui economie sono state caratterizzate da una domanda in crescita, soprattutto nel Regno Unito, e di una leggera diminuzione di quelle dirette verso i paesi extraeuropei (-0,1 %), sintesi degli effetti contrapposti indotti dalla ripresa dell’economia statunitense, da un lato, e dal rallentamento delle importazioni delle economie emergenti, dall’altro.

Graph 1: Export/GDP (rielaborazione dati Istat, 2014) Con il PIL del paese che è in decrescita dal 2011, sono le esportazioni che riescono ancora una volta a sostenere l’economia Italiana durante questa recessione. Come evidenziano i dati Istat, rielaborati nel Grafico 1, la quota percentuale dell’export sul Prodotto Interno Lordo del paese è in continuo aumento, arrivando a toccare quota 25% nell’ anno 2014. Per quanto riguarda lo scenario riguardante l’e-commerce, negli ultimi anni si è assistito a una diffusione rapidissima e costante di dispostivi mobili e una altrettanto significativa crescita dell’accesso a internet a livello globale. Questo ha portato di conseguenza a un incremento delle vendite online su scala globale che nel 2014, secondo stime eMarketer (2014), hanno raggiunto la quota record di $1,47 miliardi. Numeri che, sempre secondo lo stesso istituto, sono destinati ad aumentare notevolmente nei prossimi anni, grazie soprattutto all’azione trainante dei mercati in via di sviluppo.

Graph 2: Fatturato e-commerce globale (eMarketer, 2014) È evidente come questi due trend combinati potranno generare numerose opportunità di crescita nel futuro più prossimo. Opportunità che le imprese Italiane dovranno saper cogliere al momento opportune. 23.04% 24.06% 24.29% 24.90% 22.0% 22.5% 23.0% 23.5% 24.0% 24.5% 25.0% 25.5% 2011 2012 2013 2014 Export of goods/GDP 1.233 1.471 1.700 1.922 2.143 2.356 0.0 0.5 1.0 1.5 2.0 2.5 2013 2014 2015 2016 2017 2018 B 2 C e-co m m er ce ( $ tr il li on ) Year

Obiettivi

L’obiettivo di questa tesi è quello analizzare e proporre modelli di export che le aziende Italiane possono utilizzare per supportare la vendita tramite e-commerce negli Stati Uniti. Un modello di export è composto dai seguenti cinque blocchi: • Canale commerciale. È costituito dalle scelte legate alla tipologia di piattaforma, online e non, utilizzata per raggiungere il cliente finale. • Canale logistico. Comprende le scelte legate al mezzo di trasporto per la spedizione delle merci, magazzino e politiche di distribuzione. • Canale di comunicazione. Riguarda le scelte di advertising e promozione. • Sistemi di pagamento. Riguarda le differenti possibilità di pagamento concesse ai clienti. • Quadro normativo. Insieme di norme che regolano l’importazione in un determinato paese. Nello specifico, nella nostra analisi ci siamo occupati dei primi due blocchi, il canale commerciale e quello logistico, con accenni necessari alle normative più importanti, che, specialmente nel settore in considerazione, influenzano profondamente il quadro di riferimento. Nella pratica, le domande di ricerca cui abbiamo cercato di dare risposta sono queste: 1) Quali alternative commerciali ha un produttore Italiano che intende vendere i suoi prodotti negli Stati Uniti d’America? È consigliabile operare tramite un sito e-commerce proprio o è preferibile una piattaforma esterna? Analizzeremo il contesto e-commerce B2C Statunitense e identificare i principali e-tailer e piattaforme e-commerce che permettono la vendita di generi alimentari negli Stati Uniti e cercheremo di identificare le soluzioni più appropriate per i produttori Italiani.

2) Quali sono le alternative logistiche che un produttore ha a disposizione per consegnare fisicamente il prodotto al consumatore Americano?

Anche tramite un’analisi del settore logistico Statunitense, cercheremo di identificare le possibili strategie che le imprese Italiane possono implementare per consegnare la merce al consumatore Americano. Sono incluse le scelte riguardanti la spedizione intercontinentale, la gestione del magazzino e dell’“ultimo miglio”.

3) Quali sono le principali norme previste dal codice Americano che regolano le importazioni di generi alimentari?

Analizzeremo la normativa vigente in tema di import di generi alimentari per capire in che modo quest’ultima può impattare sulle scelte commerciali e logistiche di un’impresa che vuole esportare negli U.S.A.

Metodologia

Nel rispondere alle domande di ricerca non si è proceduti strettamente in logica sequenziale ma in maniera piuttosto organica, molto spesso, infatti, i tre filoni risultano intrecciarsi. In generale, il presente lavoro si pone obiettivi analitici di tipo qualitativo, non è presente un vero e proprio modello o parte numerica a supporto e validazione delle considerazioni fatte.

La metodologia utilizzata per raggiungere gli obiettivi posti si è basata sui seguenti passi: 1. Analisi fonti secondarie

La ricerca delle fonti secondarie si è avvalsa di siti internet specializzati, blog, i siti di imprese esportatrici, tesi, analisi di mercato e report di società di consulenza. Tramite l’analisi di fonti secondarie siamo riusciti a identificare i principali trend e player che caratterizzano il commercio online negli Stati Uniti, con particolare riferimento al settore Food and Beverage.

L’analisi delle fonti primarie si è basata soprattutto sulla realizzazione d’interviste.

Sono state condotte numerose interviste con i principali attori coinvolti nel processo di esportazione come importatori, aziende esportatrici, società di consulenza per internazionalizzazione delle imprese e operatori logistici.

3. Individuazione framework distributivi

Tramite un lavoro sia di sintesi sia di teorizzazione sono stati infine identificati principali modelli distributivi che possono essere utilizzati dalle imprese Italiane per supportare la strategia di e-commerce negli Stati Uniti. Per ogni framework dsitrbutivo riporteremo le seguenti informazioni: • Aziende che utilizzano tale modello • Flusso logistico e commerciale (dal produttore al consumatore Americano) • Descrizione attori coinvolti e principali attività • Pro e contro • Principali implicazioni normative

Risultati

In questa sezione presentiamo i risultati del nostro lavoro di ricerca; cercheremo quindi di dare una risposta alle domande di ricerca che ci siamo posti e che hanno guidato la nostra analisi.

Legenda

Modello 0 - Il modello “tradizionale”

Questo modello rappresenta il modo tradizionale che le aziende utilizzano per esportare negli Stati Uniti.Le operation possono essere gestate in loco attraverso una filiale commerciale negli Stati Uniti o dall’Italia, facendo leva su una rete esistente di importatori e distributori locali.

Figure 1: Il modello “tradizionale” Italian manufacturer E-tailer Port of

embarka0on des0na0on Port of Proprietary/importer warehouse Fulfillment Center E-tailer Importer Broker U.S. branch Importer e-commerce website Amazon Vendor • Ex-work • Partnership • M&A

I principali attori commerciali sono:

• Importatori. Sono i soggetti dotati di licenza e incaricati all’importazione dei prodotti nel territorio Statunitense. I produttori italiani hanno tre diversi modalità di interfaccia con un importatore: o Franco Fabbrica: produttore vende i propri prodotti agli importatori; § i.e: Piccoli produttori; o Partnership: i produttori sfruttano la rete logistica e la struttura legale dell’importatore; § i.e .: Parmareggio; o M&A: il produttore acquisisce la società di importazione; § i.e .: Auricchio;

• Filiale Americana: le più maggiori aziende italiane hanno scelto di aprire una sede negli Stati Uniti al fine di avere un maggiore controllo del mercato;

§ i.e .: Barilla, Ferrero, De Cecco;

• Brokers. Rappresentano le aziende nelle negoziazioni con i grandi retailer;

• E-tailer. Permettono ai consumatori di acquistare prodotti alimentari online tra una vasta selezione di prodotti.

I principali attori logistici sono:

• Vettore marittimo/areo. Si occupa della spedizione intercontinentale;

• Agente doganale. Si occupa di aiutare la società importatrice nelle procedure doganali nel rispetto delle disposizioni emanate dalla FDA;

• Operatore logistico americano. È responsabile della spedizione della merce dal magazzino del produttore a quello dell'e-tailer Americano;

• Magazzino produttore/importatore. In questo caso avere un magazzino negli Stati Uniti è cruciale, in quanto tali intermediari comprare solo beni FOB USA.

• E-tailer fulfillment center. Si occupa del ricevimento della merce dal produttore, delle operazioni di stoccaggio e gestione degli ordini. • Corriere espresso. È responsabile della consegna finale al consumatore americano. I principali vantaggi di questa alternativa sono: − Grande base di utenti − Fiducia dei consumatori − Tempi di consegna veloci − Outsourcing di attività"non-core" Gli svantaggi: − Bassi margini

− Basso controllo sulle strategie di comunicazione e prezzi

Modello 1 – Sito e-commerce proprietario

L'azienda che implementa questo modello è Monini, che è presente negli Stati Uniti con una filiale commerciale e uno store online (Monini.us), ed opera attraverso due magazzini situati su entrambe le coste del paese. Questo modello di esportazione è caratterizzato da un elevato grado di integrazione verticale, data la necessità della società di operare, da un punto di vista logistico, attraverso un magazzino in loco e, da un punto di vista commerciale, attraverso un sito web e-commerce dedicato in lingua Inglese. Il flusso commerciale non vede la presenza di intermediari e questo permette all'azienda di presentare al consumatore americano un prodotto dal prezzo competitivo.

Figure 2: Modello con sito e-commerce proprietario

I pro di questo modello sono:

− Elevato controllo sulle strategie di comunicazione e prezzi;

− Alti margini;

− Facilità di integrazione con i sistemi informativi aziendali.

I contro:

− Elevati investimenti; − Base utenti limitata;

− Alto costo della spedizione negli Stati Uniti;

− Insourcing dell’“ultimo miglio".

Modello 2 – Vendita tramite piattaforme e-commerce con evasione ordini dall’Italia

Questa soluzione è in particolare adottata dai piccoli produttori che utilizzano piattaforme, eBay in particolare, per vendere i loro prodotti in tutto il mondo.

Figure 3: Vendita tramite marketplace con evasione ordini dall’Italia

La spedizione avviene tramite corriere espresso, specialmente per quanto riguarda i prodotti deperibili, con operatori logistici internazionali come UPS o DHL che prendono in carico la spedizione con una logica “point to point”.

Italian manufacturer

Port of

embarka,on des,na,on Port of Proprietary warehouse U.S. branch Fulfillment service provider Stand-alone e-commerce website Italian manufacturer E-commerce pla,orm Express delivery

I principali vantaggi di questa soluzione sono legati al fatto di non dovere avere una struttura commercial negli Stati Uniti. Tuttavia, le incertezze riguardanti le procedure doganali, la gestione dei dazi e gli alti costi di spedizione rappresentano ostacoli importanti alla buona riuscita di una transazione.

Modello 3 – Amazon FBA Global Selling

Quest’opzione innovativa, introdotta recentemente dal colosso online di Seattle, è studiata per le aziende che vogliono espandersi globalmente ma non dispongono della scala necessaria.

Figure 4: Amazon FBA Global Selling

Secondo tale modello, l’azienda Italiana deve solo occuparsi di spedire la merce che desidera mettere in vendita sul marketplace a un Amazon Fulfillment Center negli Stati Uniti. Amazon si occupa poi della ricezione della merce e della gestione ed evasione degli ordini.

In questo caso le aziende operano come seller, ovvero hanno completo potere sulle scelte di pricing e

listing. I principali vantaggi di tale opzione sono, similarmente al modello 2, il fatto di non doversi

integrare verticalmente e quindi di non avere la necessità di effettuare alti investimenti iniziali.

Inoltre, al contrario del modello precedente, l’evasione dell’ordine avviene in loco, con tempi certi e rapidi, poiché Amazon rappresenta un interlocutore molto affidabile per il consumatore Americano. Tuttavia, le fees applicate da Amazon per il servizio di order fulfillment sono molto elevate e numerose sono anche le problematiche legate alla gestione di prodotti soggetti a deperibilità. A oggi, non abbiamo riscontri di aziende del Food Italiane operanti tramite tale modello.

Modello 4 – Intermediario Italiano

Questo modello è quello implementato dall’azienda Italiana ExportUsa. ExportUsa è una società di consulenza che si occupa di supportare le imprese Italiane nel processo di export verso gli Stati Uniti dal punto di vista logistico e legale. La società ha sede a Rimini e New York. Secondo questo modello l’azienda Italiana interessata a esportare negli Stati Uniti può usufruire della struttura logistica e legale di cui ExportUsa dispone per vendere i propri prodotti tramite lo store TasteIt aperto su Amazon dalla società stessa. Italian manufacturer Amazon.com Port of embarka1on Port ofdes1na1on Fulfillment Center Amazon

Figure 5: Esportare tramite ExportUsa

Vi è comunque una selezione preventiva dei prodotti da parte dell’azienda: le imprese interessate contattano ExportUsa, presentano la propria specialità, inviano sei cartoni alla sede di Rimini della società e aspettano un feedback. Quando scatta il parere postivo, l’articolo fa la sua comparsa nello store di Amazon gestito da ExportUsa. Per quanto riguarda la parte contrattuale, ExportUsa opera sia in conto vendita sia acquistando direttamente la merce.

Focus sul vino

La normativa sull’importazione e la vendita di bevande alcoliche negli Stati Uniti influenza significativamente le modalità con cui le aziende Italiane si approcciano all’esportazione di tali prodotti. Per questo i framework di riferimento legati a tale prodotto meritano di essere analizzati separatamente.

Modello 5 – Modello di export “tradizionale” per il vino

La maggior parte del vino che entra negli Stati Uniti è importato tramite questo modello.Figure 6: Modello di export “tradizionale” per il vino Italian manufacturer Amazon.com Port of

embarka1on des1na1on Port of Consolida1on pla8orm ExportUsa ExportUsa Warehouse (OH) Seller Italian wine manufacturer Wholesaler Port of embarka0on Port of des0na0on Importer Importer

warehouse Wholesaler warehouse

Retailer Retailer Restaurant Restaurant Delivery app Website Pick-up Delivery On-premise Consolida0on pla@orm • Ex-cellar • Parntnership • M&A

In accordo al sistema distributivo Statunitense, caratterizzato dal cosiddetto Three-Tier System, una bottiglia di vino prima di arrivare sulle tavole di un consumatore Americano deve seguire obbligatoriamente i passaggi riportati in Figura 6.

I principali attori del canale commerciale sono:

• Azienda produttrice. Rappresenta il primo dei tre tier.

• Importatore/distributore. Questi due operatori fanno parte del secondo tier. Spesso, almeno a livello locale, l’importatore svolge anche il ruolo di distributor, non limitandosi quindi all’importazione del vino in territorio Statunitense ma occupandosi anche della vendita a ristoranti e negozi.

• Negozio/Ristorante. Sono le entità che, autorizzati da una licenza statale, vendono il prodotto al consumatore finale.

L’importatore acquista la merce direttamente dall’azienda produttrice ex-celar o, meno frequentemente, stipula un contratto di conto vendita. È anche colui che si occupa dell’organizzazione della spedizione intercontinentale, delle procedure doganali e dello stoccaggio in un magazzino fornito di licenza negli Stati Uniti. L’importatore può anche operare tramite una piattaforma di consolidamento in Italia dove stoccare I prodotti in attesa di raggiungere un volume sufficiente di bottiglie da spedire. La spedizione avviene comunemente via nave tramite container, che possono essere refrigerati nei mesi più caldi dell’anno. Dal punto di vista del produttore, la transazione inizia e termina in Italia, senza la necessità di avere una struttura commercial e logistica negli Stati Uniti. I principali svantaggi di questo modello sono: • Alti ricarichi per il consumatore Americano • Contatto tra azienda produttrice e mercato minimo

Modello 6 – Apertura società d’importazione/distribuzione negli Stati Uniti

Se l’azienda produttrice Italiana desidera fare un passo in più in termini d’integrazione verticale può aprire la propria società d’importazione negli Stati Uniti. Questo, in aggiunta all’ottenimento di una licenza di distribuzione locale, può permettere all’azienda di saltare le intermediazioni di importatore e distributore, permettendole di vendere direttamente a ristoranti e retailer stabilendo un rapporto più stretto con il mercato.

Figure 7: Aperture società d’importazione/distribuzione negli Stati Uniti Italian wine manufacturer Port of

embarka,on des,na,on Port of Proprietary warehouse

Retailer Retailer Restaurant Restaurant Delivery app Website Pick-up Delivery On-premise U.S. branch (Import/distribu,on license)

Le implicazioni dal punto di vista logistico sono: la necessità di organizzare in prima persona la spedizione intercontinentale e quella di occuparsi del successivo stoccaggio negli Stati Uniti. Il magazzino in loco diventa quindi fondamentale.

Rispetto alla soluzione precedente i principali vantaggi di questa soluzione sono legati alla possibilità di portare sul mercato un prodotto dal prezzo più competitivo e di avere margini più alti sulla vendita. D’altra parte, questa soluzione richiede investimenti iniziali più elevati, una licenza d’importazione a livello federale e una di distribuzione a livello federale. La regolamentazione stringente è, infatti, spesso considerata come uno dei maggiori ostacoli dalle aziende.

Modello 7 – Sito e-commerce proprietario (vino)

Questo modello, totalmente innovativo nel panorama della vendita del vino negli USA, è quello implementato dall’azienda Giordano Vini, primo e unico produttore di vino quotata in Italia.

Figure 8: Sito e-commerce proprietario (vino) L’azienda opera vende i suoi prodotti negli Stati Uniti tramite l’utilizzo di un sito e-commerce proprio, i cui server sono locati in Italia.

Dal punto di vista del consumatore finale, il canale commerciale non presenta intermediari: il cliente acquista direttamente dal sito dell’azienda (GiordanoWines.com). L’azienda è, infatti, riuscita a implementare un sistema di vendite dirette grazie alla costruzione di un network di accordi con retailer dotati di licenza in diversi stati degli Stati Uniti. Dal punto di vista logistico e contrattuale invece tutti i tre livelli distributivi devono essere rispettati.

I vantaggi di un sistema di questo tipo sono: − Prezzi finali competitivi;

− Totale controllo del pricing e delle strategie di comunicazione.

Gli svantaggi:

− Ingenti investimenti di comunicazione per la sviluppo del marchio e del portale e-commerce;

− Consulenza legale specifica per ogni stato in cui si vende.

Modello 8 – Vendita tramite Amazon

Amazon ha lanciato il suo a lungo chiacchierato marketplace del vino nel 2012, dopo un paio di tentativi falliti nel corso degli anni precedenti. Il gigante online da Seattle ha iniziato con una selezione di circa Italian wine manufacturer Proprietary website Port of embarka1on Port ofdes1na1on warehouse Importer warehouse Distributor retailer Local Importer Wholesaler Retailer Partnership

1.000 vini provenienti da cantine locali statunitensi. Al momento la piattaforma conta più di 8.500 vini per lo più dalla California, New York e Oregon.

Figure 9: Vendita tramite Amazon

Secondo i requisiti di Amazon e della legge federale Statunitense l'unico modo possibile per vendere vino su Amazon per i produttori italiani è quello di avviare un business d’importazione nello stato della California.

In aggiunta a ciò, per essere venditore di vino su Amazon è necessario avere: • Un magazzino con licenza in California;

• Una licenza di vendita all'ingrosso con specifici privilegi di vendita retail.

Amazon non si occupa in questo caso della spedizione che è di responsabilità diretta dell’azienda importatrice, la quale ha anche il compito di determinare personalmente quali sono gli stati in cui è autorizzata a vendere il suo prodotto. Anche in questo caso è necessario utilizzare per la spedizione un operatore logistico dotato di licenza.

I principali vantaggi sono: • Grande base utenti;

• Possibilità di fare leva sulla customer

experience di Amazon; • No listing fees. I principali ostacoli: • Necessità di approvazione del venditore da parte di Amazon; • 15% selling fees; • Investimenti iniziali elevati; • Complicazioni burocratiche.

Concludendo, questi sono i principali modelli distributive e commerciali che possono essere implementati da un’azienda Italiana per esportare i propri prodotti tramite e-commerce B2c. Credo che il principale limite di questo lavoro è che non è presente un’approfondita analisi di costi legati ad ogni singolo modello. Sarebbe interessante effettuare una comparazione tra i diversi modelli in termini di investimenti richiesti da ciascun modello, costi logistici e tempi di spedizione con un approccio numerico più dettagliato. Inoltre, data l’ampiezza della categoria in esame in termini di tipologie di prodotti differenti, sarebbe utile capire quale sia il modello più appropriato per specifiche categorie di prodotti. Un’idea potrebbe essere quella di effettuare delle simulazioni numeriche su prodotti e quantità specifiche per capire quali sono le implicazioni dal punto di vista degli investimenti necessari, dei costi logistici e dei prezzi finali al consumatore Americano che ogni modello porta con sé.

Italian wine manufacturer Amazon.com Port of embarka1on Port of Des1na1on (LAX) Californian importer Importer warehouse

Executive summary (English version)

This thesis is part of the research project that the Observatory of Export of Politecnico di Milano started this year with the goal of providing support, especially in terms of information, to the Italian companies wishing to export their products through the use of B2C e-commerce channels. Specifically, the thesis aims to analyze the commercial and logistic channels that companies operating in the Food and Beverage industry can use to sell their products in the United States of America.Introduction

The main trends characterizing the present macroeconomic context, and making the content of the thesis significant, are two:

• The increasing importance of export for Italian economy; • The continuous growth of B2C e-commerce in the global trade.

The Italian export in 2014, at market price, increased by a 2,1% to a total value of €387 billion (ICE report, 2014). With this result Italy proves once again to be one of the largest global exporter: it now ranks in eighth place, gaining three positions since 2013.

Ranking

Country Value (€ billion) % Var. Share

2013 2014 2013 2014 2013-14 2014 1 1 China 2.209 2.343 6,1 12,4 2 2 United States 1.580 1.623 2,8 8,6 3 3 Germany 1.452 1.511 4,1 8,0 4 4 Japan 715 684 -4,4 3,6 5 5 Netherlands 672 672 0,1 3,6 6 6 France 581 583 0,4 3,1 7 7 South Korea 560 573 2,3 3,0 11 8 Italy 518 529 2,0 2,8 9 9 Hong Kong 535 524 -2,1 2,8 8 10 United Kingdom 541 507 -6,3 2,7 Table 2: Global exporters (goods and services) ranking (ICE report 2014/2015)

This trend was the result of a positive sale performance in the countries of European Union (+3,7%), which have shown a significant increase of internal demand, especially in the United Kingdom, in addition to a slightly negative trend (-0,1%) regarding extra-EU economies. The negative performance of export to extra-EU countries was caused by the significant decrease of developing countries’ import.

Graph 3: Export/GDP rate (elaboration on Istat data, 2014)

Export is once again the pillar for Italian economy during this recession, with the GDP continuously decreasing since 2011.

As Istat numbers, rielaborated in Graph 3, highlights, the share of export on Italian Gross Domestic Product keeps growing, reaching the record value of almost 25% in 2014.

As well as regards e-commerce, there was an epidemic and constant diffusion of mobile devices during the past years as well as a significant growth of access to the Internet all over the world. As a consequence, this led to a massive increase of online sales on global scale, which have reached the record value of $1,47 trillion in 2014 (remarketer, 2014).

E-commerce growth absolutely represents a significant trend, especially aware of the fact that these numbers are going to grow in the next years, mainly caused by developing economies, eMarketer goes on to say.

Graph 4: Global B2c e-commerce sales (eMarketer, 2014)

It is clear how these two different trends combined could generate a lot of growth opportunities for companies in the very next future. Italian firms need to be ready.

Goals

As we have previously stated, the final goal of this thesis is to provide information as a support for Italian ventures interested in exporting their products in the U.S., in particular through the use of e-commerce technologies. We will try to analyze different "export models” that producers can implement to sell their products in the U.S. and make suggestion about some “best practices” that can be brought as examples to follow. 23.04% 24.06% 24.29% 24.90% 22.0% 23.0% 24.0% 25.0% 26.0% 2011 2012 2013 2014 Export of goods/GDP

1.233

1.471

1.700

1.922

2.143

2.356

0.0

0.5

1.0

1.5

2.0

2.5

2013

2014

2015

2016

2017

2018

B2C

e

-c

om

m

er

ce

($

tr

illion)

Year

An export model is the result of these five “blocks”:

• Trade channel. It includes all the different alternative platform, online and offline, through which producers can sell their products to end customers.

• Logistic channel. It takes into consideration the choices related to which kind of freight transportation must be used, warehouses and distribution policies.

• Communication channel. It includes the different possible way to advertise and promote a product.

• Payment method. Different possible way through which consumers can pay for the items desired.

• Regulation. It is represented by the set of laws that regulate the import process in a specific country as well as product restrictions.

Specifically, our analysis takes into account the first two blocks, the ones related to trade and logistic channels, even though during our work we needed to point out some specificity regarding the import regulation, which has a large impact on the environment.

Basically, we tried to answer the following research question:

• Which commercial alternatives does an Italian manufacturer wishing to sell its products in the U.S. have? Is it better to operate through a proprietary e-commerce website or through a third-party platform? We will analyze the context of e-commerce B2C in the U.S. and identify the major e-tailers and e-commerce platforms that allow the sale of food in the United States and will try to identify the most appropriate solutions for the Italian manufacturer. • What are the different logistic strategies a producer can implement to physically deliver a product to end consumers in U.S.?

Analyzing the logistics sector American, we will try to identify possible strategies that Italian companies can implement to deliver goods to the American consumer, including choices regarding the intercontinental shipment, warehouse and "last mile" management. • How does the regulation affect the import of Food and Beverage products into the U.S.? We will analyze the regulation in force regarding import of food to understand how it can impact on business and logistic decisions of a company that wants to export to the U.S.A.

Methodologies

In answering the research questions awe did not proceed strictly in sequential logic but quite organically, very often in fact the three blocks are intertwined.

In general, the following thesis has qualitative analytical objectives, no scientific model has been developed to support and validate considerations done. In particular, given the "practical" nature of the issue in consideration, and the lack of a real specific literature on the topics of e-commerce and exports, the approach in collecting information and answering the research questions has been rather "practical".

The methodologies used to achieve the objectives of the thesis are: 1. Secondary sources

The research on secondary sources was done through the use of specialized websites, blogs, workshops with companies, websites of exporting companies, theses and market analysis.

Through the analysis of secondary sources we were able to identify the main trends and players that characterize online commerce in the United States, with particular reference to the Food and Beverage industry.

We conducted several interviews with key players involved in the export process such as importers, exporting companies, consulting firms supporting firms in internationalization and logistics operators. This allowed us to define what are the existing approaches Italian companies are using to export to the USA. We also developed some case studies in order to identify possible best practices Italian companies can implement.

3. Identification of distribution frameworks

The final step consisted in the identification of the main distribution frameworks that can be used by Italian companies to support the strategy of e-commerce in the United States. For each distribution framework following information will be reported: • Companies using this model; • Logistics and commercial flows (from manufacturer to US consumer); • Description of main actors and activities; • Pros and cons; • Main regulatory implications.

Results

In this section we present the results of our work trying to answer the research questions we have set and which have guided our analysis. LegendModel 0 – The “traditional” model

This model represents the traditional way companies export into the U.SFigure 10: The “traditional” model Operations might be run through an on-site commercial branch in the U.S. or from Italy, leveraging an existing network of local importers and distributors. Italian manufacturer E-tailer Port of

embarka0on des0na0on Port of Proprietary/importer warehouse Fulfillment Center E-tailer Importer Broker U.S. branch Importer e-commerce website Amazon Vendor • Ex-work • Partnership • M&A

The main commercial actors are:

• Importers. They are licensed entity in charge of import products into the U.S. territory. Italian manufacturers have three main approach in order to deal with them:

a. Ex-work: manufacturer sells their products to importers; § i.e: small size firms

b. Partnership: manufacturers leverage the importer logistic and legal structure of importers; § i.e.: Parmareggio c. M&A: manufacturer acquires the importer. § i.e.: Auricchio • U.S branch: the largest Italian companies have chosen to open an headquarter in the U.S. in order to have a deeper control of the market; § i.e.: Barilla, Ferrero, De Cecco • Brokers: They push the products, negotiate purchasing agreements and ensure that everything is in stock; • E-tailers. They allow consumers to buy food online among a large selection of products. E-tailers can operate through different business models that have been studied in the next chapters of the thesis. The main logistical actors are: • Ocean/Air Carrier. It deals with the intercontinental shipment that, especially as regards the goods not subject to perishability, is arranged by an ocean carrier. • Customs Agent. He deals with helping the importing company in customs procedures in compliance with the regulations issued by the FDA

• American logistic operator. He is in charge of the shipment of goods from the manufacturer's warehouse to the e-tailer. The organization and expenses related to such shipment are directly related to the type of sales contract between manufacturer and retailer, ruled by the so-called Incoterms.

• Proprietary/importer warehouse: In this case having a warehouse in the United States is crucial, as these intermediaries only buy goods FOB USA.

• E-tailers fulfillment center. It deals with the receiving of the goods from the manufacturer, the storage operations and order management. • Express courier. He is in charge of the final delivery to the American consumer. The main advantages of this alternative are: − Great user base; − Consumer confidence; − Low delivery time; − Outsourcing of "non-core" activities. The disadvantages: − Low margins;

− Low control on communication and pricing.

Model 1 – Proprietary website

This model of export is characterized by a high degree of vertical integration, given the need of the company to operate, from a logistic point of view, through a on site warehouse and, from a commercial point of view, through a dedicated e-commerce website in English language. The company that implements this model is Monini S.p.A., which is present in the United States with a commercial branch and an online shop (Monini.us) and operates through two warehouses located on both coasts of the country.

Figure 11: Proprietary website model

It is useful to note that large logistics operators such as UPS, DHL or FedEx offer all the services listed and therefore may represent the only interface for a company in the entire logistic process. The transportation of goods from the manufacturer’s warehouse to the port of embarkation can be realized with proprietary trucks, if the firm is provided, or via logistic operator.

The pros of this model are:

− High control over communication strategies and pricing

− High margins

− Easy integration with enterprise information systems The cons: − High investments − Low size user base − High cost of shipping in the U.S. − Insourcing of ''last mile” management

Model 2 - E-commerce platform with shipment from Italy with express courier

E-commerce B2c/C2c platforms, eBay in particular, can represent an opportunity for small producers to sell their products all over the world.Figure 12: Sale through e-commerce platform with shipment from Italy The model is rather simple: products are listed online on the marketplace, when an order is placed the manufacturer will take care of the shipment, which is realized by an express courier. These are logistics operators such as UPS or DHL who take charge of the expedition with a logical "point to point".

The main advantages of this solution are related to the fact of not having to have a commercial structure in the United States. However, there are two main obstacles:

− Uncertainties regarding the customs procedures and duties Italian

manufacturer

Port of

embarka,on des,na,on Port of Proprietary warehouse U.S. branch Fulfillment service provider Stand-alone e-commerce website Italian manufacturer E-commerce pla,orm Express delivery

− High delivery cost

Model 3 - Amazon FBA Global Selling

This innovative option introduced recently by Amazon is specifically designed for companies looking to expand globally but that do not have the scale required.Figure 13: Amazon FBA Global Selling According to this model, the manufacturer only has to list its inventory on the American marketplace and then ship it to an Amazon Fulfillment Center in the United States. Amazon will then deals with the order management and fulfillment. At present, we have no evidence of companies working through this model.

Model 4 – Italian intermediary

This framework has been implemented by ExportUsa. ExportUsa is a consulting firm that supports Italian companies logistically and legally in the process of exports to the United States. The company is headquartered in Rimini and New York.Figure 14: ExportUsa model

According to this model the Italian company interested in exporting to the United States can take advantage of logistics and legal structure of ExportUsa, which sell its products through its own TasteIt store on Amazon marketplace.

However, ExportUsa runs a prior selection of the products will list on its online store: the manufacturer contacts ExportUsa, presents its specialties sending samples at the Rimini branch and waits for a

Italian manufacturer Amazon.com Port of embarka1on Port of

des1na1on Fulfillment Center Amazon

Seller

Italian manufacturer

Amazon.com

Port of

embarka1on des1na1on Port of Consolida1on pla8orm ExportUsa ExportUsa Warehouse (OH) Seller

feedback. If the response is positive, the item will appear in the store run by Exports on Amazon in the U.S. ExportUsa will take care of the whole logistics and legal issues. As regards the purchasing agreement between the parts, Exports operates both in consignment both directly purchasing the goods.

Wine export models

The regulation of import and sale of alcoholic beverages in the United States heavily influences the modalities with which the Italian companies will approach export. This is why export models related to such product deserve to be analyzed separately.

Model 5 – “Traditional” model (wine)

The majority of the wine that enters the United States is imported through this model. According to the distribution system in force in the U.S., the so-called Three-Tier System, a bottle of wine before getting to the end consumer must necessarily follow the steps in the figure.Figure 15: “Traditional” model The main actors of the trade channel are: 1. Manufacturer/Grower. It is the first of the three tiers; 2. Importer/Distributor. These two operators are part of the second tier. Often, at least locally, the importer also plays the role of distributor, taking care of the import of wine in the U.S. territory and its distribution to restaurants and retailers;

3. Retailer / restaurant. They are authorized by a state license to sell alcoholic beverages to end consumers.

The importer purchases wine by the manufacturer ex-cellar or, less frequently, enters into a contract of consignment stock. It is also the actor that deals with the arrangement intercontinental shipment, customs procedures and storage in a licensed facility in the United States. The importer may also operate through a consolidation platform in Italy where to store products until they reach a sufficient volume in order to fill an entire container. Intercontinental shipment is almost always done via sea freight. Who arranges such shipment may vary according to the type of agreement between the manufacturer and the importer. The main cons of this model are: − High mark-ups for the American end consumer; − No control over distribution; − No contact between the Italian manufacturer and market. Italian wine manufacturer Wholesaler Port of

embarka0on des0na0on Port of Importer

Importer

warehouse Wholesaler warehouse

Retailer Retailer Restaurant Restaurant Delivery app Website Pick-up Delivery On-premise Consolida0on pla@orm • Ex-cellar • Parntnership • M&A

Model 6 – Start an import/distribution business in the U.S.

If the Italian manufacturer is willing to make a step further in terms of vertical integration, he can set up his own import company in the United States.

This, in addition to a local distribution license, may allow the company to skip the intermediation of importers and distributors, allowing it to sell directly to restaurants and retailers by establishing a closer contact with the market. The logistics implications for a manufacturer are: • Arrangement of intercontinental shipment; • Having a licensed warehouse in the U.S. territory.

Figure 16: Start an import/distribution business in the U.S. The main advantages of this solution, compared to the previous ones, are related to the possibility of bringing to the market a more competitive product in terms of price and of having higher margins on the sale. On the other hand, this solution requires higher initial investment, an import permit at the Federal level and a distribution at the State level. Companies often see the strict regulation as a major obstacle.

Model 7 – Proprietary e-commerce website (wine)

This model, totally innovative in the panorama of online wine sales in the US, is implemented by the company Giordano Vini, the first, and only, Italian wine company that went public.Figure 17: Proprietary e-commerce website (wine) Italian wine manufacturer Port of embarka,on Port of

des,na,on Proprietary warehouse

Retailer Retailer Restaurant Restaurant Delivery app Website Pick-up Delivery On-premise U.S. branch (Import/distribu,on license) Italian wine manufacturer Proprietary website Port of embarka1on Port of

des1na1on warehouse Importer warehouse Distributor retailer Local

Importer Wholesaler Retailer

Partnership

From the customer point of view, the trade channel the trade channel presents no intermediaries contrary to what we have affirmed about the previous models. The company is able to implement a system of direct sales by building a network of agreements with local wholesalers and retailers that are licensed in several U.S. states.

Here the main steps of the order fulfillment:

1. Giordano Vine receives the order through e-commerce website 2. The company contacts the importer (wine is already storage in U.S.)

3. Importer ships wines to the distributor located in the country where the wine has to be delivered 4. The distributor ships the wine to the local retailer 5. The retailer hires a licensed express courier (FedEx or Ups) for the final delivery The payment is subject to the opposite path; every intermediary is responsible of paying taxes and will held a fee for the service provided. The advantages of this type of system are: − Competitive final prices; − Higher margins;

− Total control over pricing and communication strategies. On the other hand this solution requires: − High investments in communication for the promotion of the brand and the e-commerce portal; − Specific legal consulting.

Model 8 – Amazon wine marketplace

Amazon launched its long-rumored marketplace of wine in 2012, after a couple of failed attempts in previous years.

Figure 18: Amazon wine marketplace According to the requirements of Amazon and the U.S. federal law the only possible way to sell wine on Amazon for Italian producers is to start an import business in the state of California. In addition to that, to be wine seller on Amazon you must have: • A warehouse located in California; • A license to sell with specific privileges for retail sale. Amazon does not take care of the delivery, which is responsibility of the seller. The main advantages of this model are: − Large user base;

− Ability to leverage Amazon's customer experience; − There are no listing fees. The main obstacle to this option is: − Seller approval by Amazon − 15% selling fees − Uncertainty over legal issues Italian wine manufacturer Amazon.com Port of embarka1on Port of Des1na1on (LAX) Californian importer Importer warehouse

To conclude, the result of this thesis consisted in identifying distribution frameworks that Italian companies can use in order to support cross-border online sales in the US; the main limit of this work is that it does not take into account the specific costs of each distribution framework. It would be useful to develop, with a higher level of detail, each export model and compare these models according to drivers such as investment required, efficiency, delivery times. Besides, it would be interested to understand which framework is more appropriate for different categories of products.

In order to do this, simulations on specific items could be run in order to understand investments, logistics costs, legal requirement and end prices of products that characterize each distribution framework.

1 Focus of the thesis

1.1 Industry selection

Why did we choose the Food and Beverage industry as a focus for our analysis?

First of all, because Food and Beverage perfectly represents the Made in Italy brand in the world. Besides, this industry has a further element of interest, which is represented by the fact that the e-commerce did not make it big here yet; online sales only represent 1% of the total B2C e-e-commerce sales in Italy (Netcom, 2014). Also the online presence of food retailers is quite low, only 10% of these retailers operates through an active e-commerce website (Netcomm-Mip, 2015). This is mainly due to specific features characterizing Food industry such as the average size of firms and the difficulty in managing logistic processes for some product categories. Graph 4: Breakdown of Italian B2C e-commerce sales by category (Netcomm-Mip, 2015)

Despite this, the growth rates are important, considering that the food sales online rose from €150 Millions in 2013 to €200 Millions in 2014 (+ 25%) according to data provided by Netcomm. There are also other signals that the Food e-commerce will be a very interesting and potentially profitable market in the coming years. Not least the entry into this market of big players such as Amazon and the proliferation of innovative apps that extend the ecosystem of the sale of alimentary products online.

1.2 The choice of the country of destination: the United States of America

The target market for this thesis work has been identified in the United States of America. Also in this case, the reasons that have led us to this choice are manifold.

According to calculations of Sace on Un Comtrade data, the U.S. is the world's leading importers of alimentary genders and drinks with a share of 11% on 'Export/ Import world, almost twice the runner-up Germany.

Which is the portion relating to the import of Italian products? As we can see from the chart above, the portion regarding the total imports of Italian food in the US is 3.32% (USDA, 2014) for a total value of $3,95 Billions. Although Italy is in the top 10, it is interesting to note that it is less powerful in terms of volume compared to a country such as Chile, or slightly higher than Australia, that certainly do not have the same importance in terms of tradition and quality of the Food sector. As for the wine, Italy is the first exporter in the United States with 31.8% of market share. As a consequence, there are both opportunities for growth of market share for what regards the food sector, both to maintain a market share already relevant in a sector such as wine, which in the United States is seeing significant growth. Opportunities are also driven by U.S. macroeconomic context (Sace Export Report 2015) that will see in the next four years an increase in employment rate and, consequently, the growth of disposable income of American consumers by 4% until 2018. This, combined with an expected depreciation of the Euro of -7.3% in 2015 and by a further 1.2% in the period 2016/2018, will lead to an increase in imports from Italy estimated in 5.4%. Another element that makes the American market interesting is related to estimate increase of online grocery. Currently in fact, with $600 billion in revenues, the food industry is by far the largest in the United States (BI Intelligence, 2014). Nevertheless, it is also the sector where e-commerce has not taken root; less than 1% of all sales of Food and Beverage are realized through the online channel, according to reports from BI Intelligence.

This mainly due to problem related to the freshness of the products, damages and margins rather low compared to other consumer products.

But consumers’ habits are changing, and the online grocery sector, especially with his actors to specialize, is gaining ground. This is caused in part to by entry of giants like Amazon, who are facing the major complexity in terms of logistics (Maras, 2014). According to data from BI Intelligence, forecasts are for an increase of the online channel in rate (CAGR) of 21.1% per year until 2018, compared with 3.1% of the offline channel. The positive estimations of the American Institute American is based mainly on the following factors: • Convenience and wide selection • The emergence of "concierge shopping" services and ready meals that are driving innovation in online spending and offering differentiated services by traditional supermarkets Canada, 18.48% Mexico, 16.14% China, 4.83% India, 3.49% France, 3.43% Chile, 3.42% Italy, 3.32% Brazil, 3.15% Australia, 2.93% Indonesia, 2.78% Vietnam, 2.60% Thailand, 2.49% Rest of world, 32.95% Italy, 31.8% France, 26.8% Australia, 8.2% Spain, 6.5% Argentina, 6.4% New Zealand, 6.0% Chile, 5.4% Rest of World, 8.7% Graph 4: Breakdown of import of Food (left) and wine (right) by country of origin (USDA, 2014)

• Some of the major players -Amazon, eBay and Google- are beginning to offer and promote services of "same-day delivery." More consumers become accustomed to the convenience of ordering something online and have it delivered in the same day, more than the online channel will grow. Finally, according to research carried out by the e-commerce consultant Brick Meets Click, the online channel for the sale of groceries will represent 24% of total sales by 2023. We are therefore dealing with a long term trend that will lead to a revolution in the way of "shopping", and since numbers have be proven to be really significant, it is essential for companies to be ready when the time to enter this market will come.

2 Objectives and methodology

2.1 Objectives

As we have previously stated, the final goal of this thesis is to provide information as a support for Italian ventures interested in exporting their products in the U.S., in particular through the use of e-commerce technologies.

We will try to analyze different "export models” that producers can implement to sell their products in the U.S. and make suggestion about some “best practices” that can be brought as examples to follow. An export model is the result of these five “blocks”:

• Trade channel. It includes all the different alternative platform, online and offline, through which producers can sell their products to end customers.

• Logistic channel. It takes into consideration the choices related to which kind of freight transportation must be used, warehouses and distribution policies.

• Communication channel. It includes the different possible way to advertise and promote a product.

• Payment method. Different possible way through which consumers can pay for the items desired.

• Regulation. It is represented by the set of laws that regulate the import process in a specific country as well as product restrictions.

Specifically, our analysis takes into account the first two blocks, the ones related to trade and logistic channels, even though during our work we needed to point out some specificity regarding the import regulation, which has a large impact on the environment.

Basically, we tried to answer the following research question:

• Which commercial alternatives does an Italian manufacturer wishing to sell its products in the U.S. have? Is it better to operate through a proprietary e-commerce website or through a third-party platform? We will analyze the context of e-commerce B2C in the U.S. and identify the major e-tailers and e-commerce platforms that allow the sale of food in the United States and will try to identify the most appropriate solutions for the Italian manufacturer. • What are the different logistic strategies a producer can implement to physically deliver a product to end consumers in U.S.?

Analyzing the logistics sector American, we will try to identify possible strategies that Italian companies can implement to deliver goods to the American consumer, including choices regarding the intercontinental shipment, warehouse and "last mile" management. • How does the regulation affect the import of Food and Beverage products into the U.S.? We will analyze the regulation in force regarding import of food to understand how it can impact on business and logistic decisions of a company that wants to export to the U.S.A.

2.2 Methodology

In answering the research questions awe did not proceed strictly in sequential logic but quite organically, very often in fact the three blocks are intertwined.

In general, the following thesis has qualitative analytical objectives, no scientific model has been developed to support and validate considerations done. In particular, given the "practical" nature of the issue in consideration, and the lack of a real specific literature on the topics of e-commerce and exports,